Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 14, 2023

Week Ahead Economic Preview: Week of 17 July 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

UK and eurozone inflation, China second quarter GDP

A busy economic calendar for the week ahead is filled with more inflation numbers, notably from the UK, eurozone and Japan. Meanwhile a series of data releases from mainland China will include eagerly awaited GDP details for the second quarter. A G20 meeting will also bring together finance ministers and central bankers, unfolding all in a week which leads up to the flash July PMI data on the 24th.

The focus this week had been on the US CPI, which came in below consensus, though as far as indications from the latest S&P Global Investment Manager Index (IMI) have shown, central bank policy is expected to be the biggest drag for equities in the near-term. More inflation updates will arrive from the UK, eurozone and Japan in the coming week, with particular focus on the UK where stubborn inflation has been observed. Final June inflation figures will also be due from the eurozone, where CPI is set to follow the PMI price indices lower but remain elevated when compared with pre-pandemic averages.

Meanwhile economic releases from the US to watch in the coming week include industrial production and retail sales. July's IMI survey, while reinforcing the view of macroeconomic environments being a drag for equities according to investors, had also showed the economy being less as much a drag when compared to June. As such, we will be tracking these official economic releases for further indications of improvements, or at least recession being averted, coming after the S&P Global US Composite PMI revealed solid private sector output growth in June.

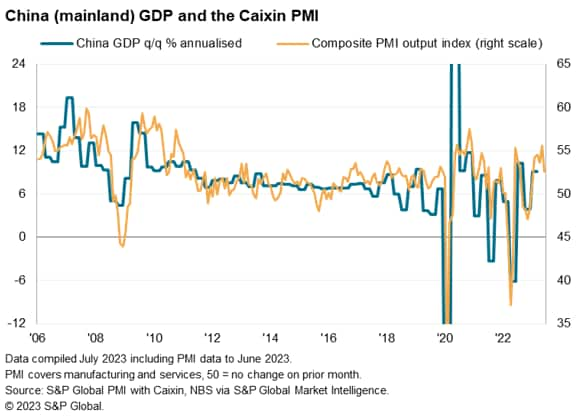

Finally, second quarter GDP figures from mainland China will be released with expectations of continued expansion. That said, it will be the higher frequency monthly data for June, such as industrial production and retail sales, that we will keep a close eye upon after PMI data signalled a stalled manufacturing sector and a weakening post-pandemic service sector rebound. While investors were bullish about the Japanese market and Asia (excluding Japan and mainland China) in our latest July IMI update, views about mainland China have turned generally bearish, so it will be important to watch where the high frequency data point us to with regards to mainland China's economic trajectory.

How fast is China's rebound fading?

The coming week brings the release of second quarter GDP data for mainland China, which is expected to show a slowdown in growth. After having expanded 2.3% (4.5% year-on-year and 9.1% annualized) in the first quarter as the economy reopened from COVID-19 containment measures, growth is expected to have weakened in the three months to June. Although base effects mean the annual rate of growth will likely lift higher, there are clear signs that the economy has lost some of its rebound momentum.

The forward-looking PMI surveys have shown a particular moderation of growth in June. Manufacturing output growth stalled and the rebounding services sector expansion slowed. The latter is a reminder not to put too much emphasis on retail sales data for a health-check on the consumer, as post-pandemic spending has switched from the goods to services - though the key message here is that even this revival is fading.

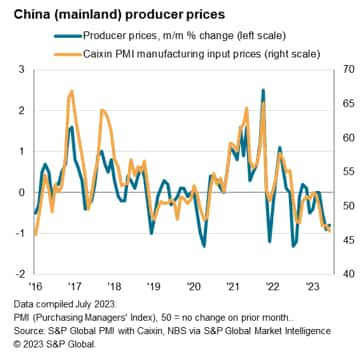

All of this of course points to weakening price pressures, especially for goods, prices for which are now falling sharply, potentially opening the door to more stimulus.

Key diary events

Monday 17 Jul

Japan Market Holiday

Singapore NODX (Jun)

South Korea Trade (Jun)

Indonesia Trade (Jun)

China (Mainland) GDP (Q2)

China (Mainland) Industrial Production (Jun)

China (Mainland) Retail Sales (Jun)

China (Mainland) Urban Fixed Asset Investment (Jun)

Tuesday 18 Jul

Australia RBA Meeting Minutes (Jul)

Hong Kong SAR Unemployment Rate (Jun)

Canada Inflation (Jun)

United States Retail Sales (Jun)

United States Industrial Production (Jun)

United States Capacity Utilisation (Jun)

G20 Finance Ministers and Central Bank Governors Meeting

Wednesday 19 Jul

Indonesia, Malaysia Market Holiday

New Zealand CPI Inflation (Q2)

United Kingdom CPI Inflation (Jun)

Eurozone CPI Inflation (Jun, final)

United Kingdom IPA Bellwether Report* (Q2)

United States Building Permits (Jun)

United States Housing Starts (Jun)

United States MBA Mortgage Rate

United States EIA Crude Oil Stocks Change

Thursday 20 Jul

Japan Trade (Jun)

China (Mainland) Loan Prime Rate (Jul)

Australia Unemployment (Jun)

Indonesia Retail Sales (May)

Malaysia Trade (Jun)

Germany PPI (Jun)

Eurozone Current Account (May)

Eurozone Consumer Confidence (Jul, flash)

Taiwan Export Orders (Jun)

Hong Kong SAR Inflation (Jun)

United States Initial Jobless Claims

United States Existing Home Sales (Jun)

United States Consumer Confidence Index (Jun)

Friday 21 Jul

South Korea PPI (Jun)

Japan Inflation (Jun)

Hong Kong SAR Business Confidence (Q3)

United Kingdom Retail Sales (Jun)

Canada Retail Sales (May)

Canada Manufacturing Sales (Jun, prelim)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US industrial production, retail sales and home sales data, Canada inflation

On the radar will be the G20 finance ministers and central bank governors meeting next week, which will be watched for any latest views and thoughts on monetary policy, especially after the latest S&P Global Investment Manager Index (IMI) revealed that US equity investors viewed central bank policy to be the biggest drag on the markets in July.

Additionally, a series of economic releases from both the US and Canada will be of importance. While US industrial production performance is expected to have deteriorated in June according to consensus, retail sales growth is set to accelerate. Additionally, home sales data will also be released in the US next Thursday.

Europe: Eurozone CPI, UK inflation and retail sales data

In Europe, inflation readings will be due from both the eurozone and UK. According to consensus, softer eurozone inflation is expected on a year-on-year basis for the final June reading and likewise for the UK. This is in line with the findings from both the HCOB Eurozone Composite PMI (compiled by S&P Global Market Intelligence) and the S&P Global / CIPS UK Composite PMI.

Separately, retail sales figures from the UK will also be due at the end of the week with likelihood of further slowdown in retail sales performance anticipated according to forecasts.

Asia-Pacific: China Q2 GDP, June industrial production and retail sales data, Japan inflation

In APAC, a series of economic releases from mainland China will be the highlight at the start of the week. Second quarter GDP will be due with continued growth expected following the easing of restrictions since the end of 2022, while industrial production, investment and retail sales may see varied paces of expansion at the midyear mark. Any disappointment will be closely watched, especially given recent paring back of bullish sentiment for Chinese equities and commodities, as indicated by the IMI survey.

Meanwhile Japan's inflation figures will be another key release in the region, though little change is expected from the still-elevated levels seen in May.

Special reports

Global Trade Falls at Fastest Rate for Five Months in June - Chris Williamson

Thailand's Economic Outlook for 2023 Boosted by Rising Tourism Inflows - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-july-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-july-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+17+July+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-july-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 17 July 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-july-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+17+July+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-july-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}