Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2023

Week Ahead Economic Preview: Week of 13 February 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US and UK inflation data to guide policy outlooks

A busy data week ahead contains inflation updates from both the US and UK. The US also releases official retail sales and industrial production data for January which, following prior soft numbers and weak PMI indications, will be closely watched. In Europe, industrial production figures from the eurozone are also lined up alongside a key UK labour market update. On central banks, Fed comments will likely be the highlights while Bank Indonesia (BI) and Bank Sentral ng Pilipinas (BSP) may raise rates. Finally in Asia, GDP from both Japan and Singapore round up fourth quarter growth conditions in the respective economies.

Another appearance by Fed chair Jerome Powell enthused markets earlier in the week as investors took away the message that the Fed is seeing inflation on the decline. This was especially so for US tech stocks, which rallied into the close on Tuesday though choppiness later ensued. As much of these risk-on views remain hinged on inflation developments, next week US CPI and PPI data will again be of high interest. As far as PMI data are concerned, price pressures regained momentum at the start of 2023, which supports the ongoing consensus for higher CPI readings to start the year. Any surprises, both on the upside or downside, may lead to market reactions in the coming week. This is alongside several other Fed appearances expected through the week.

Meanwhile in the UK, elevated inflation had encouraged the Bank of England to raise rates for a tenth meeting in a row to 4.0%, the highest since 2008. Although inflation in the UK has been trending lower, it remains sticky and concerns persist around the tightness of the labour market. Hence, although the official January CPI data will be eagerly watched in the coming week, it may be the labour market data which garner most attention, especially the wage growth numbers. Retail sales data on the other hand will meanwhile be tracked in the UK for the extent that consumption is being eroded by the current cost-of-living crisis.

Also watch out for the S&P Global Investment Manger Index (IMI) update to gain further insights into what investors see as driving the markets over the coming month.

Confidence buoyed by China's re-opening

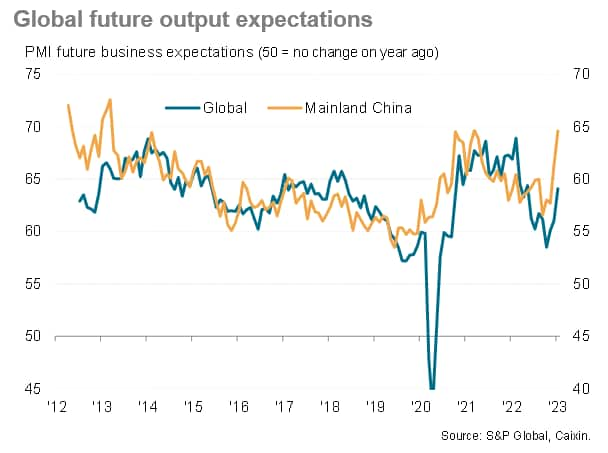

S&P Global's PMI surveys brought encouraging news of a stabilization of the global economy in January, calming recession worries in the US and, in particular, in Europe. Even better news came from the global PMI's future output index, which monitors companies' expectations of their own business activity levels in the coming year. This index jumped to an eight-month high. The improvement had the noteworthy effect of pulling confidence above its long-run average for the first time since last May and is consistent with global activity growth accelerating as we head through the first quarter.

Sentiment was lifted in the US and Europe in part by the anticipation of improved global demand and supply emanating from the relaxation of COVID-19 restrictions in mainland China, which also pushed future output expectations in mainland China itself to the joint-highest for a decade, matched by a similar high in Hong Kong SAR. Signs of a peaking of inflation also helped boost sentiment worldwide.

As for the inflation outlook, survey data in the coming months need to be watched for the impact of mainland China's re-opening. On one hand, the return to business as normal bodes well for a further alleviation of global supply chain pressures and could even lead to discounting. On the other hand, reviving demand in mainland China could fuel higher inflation, especially for commodities.

Key diary events

Monday 13 February

Singapore GDP (Q4, final)

Switzerland CPI (Jan)

India CPI (Jan)

United Kingdom Natwest Regional PMI* (Jan)

Tuesday 14 February

Japan GDP (Q4)

India WPI (Jan)

United Kingdom Labour Market Report (Jan)

Norway GDP (Q4)

Eurozone GDP (Q4)

United States CPI (Jan)

GEP Global Supply China Volatility Index* (Jan)

Wednesday 15 February

South Korea Import and Export Growth (Jan)

Indonesia Trade (Jan)

United Kingdom Inflation (Jan)

Eurozone Total Trade Balance (Dec)

Eurozone Industrial Production (Dec)

United States Retail Sales (Jan)

Canada Manufacturing Sales (Dec)

Canada Wholesale Trade (Dec)

United States Industrial Production (Jan)

United States Capacity Utilization (Jan)

United States Business Inventories (Dec)

United States NAHB Housing Market Index (Feb)

Thursday 16 February

Japan Machinery Orders (Dec)

Japan Trade Balance (Jan)

Australia Employment (Jan)

Philippines Policy Interest Rate

United States Building Permits (Jan)

United States Housing Starts (Jan)

United States Initial Jobless Claims

United States PPI (Jan)

Indonesia 7-Day Reverse Repo (Feb)

Friday 17 February

Singapore Non-Oil Domestic Exports (Jan)

United Kingdom Retail Sales (Jan)

United States Import Prices (Jan)

Canada Producer Prices (Jan)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US January CPI, PPI, retail sales and industrial production data, Fed appearances

US January inflation figures will be awaited keenly following the Federal Open Market Committee (FOMC) meeting, whereby Fed chair Powell noted that inflation has started to cool but expected 'ongoing' hikes. The consensus currently points to a forecast of 0.5% month-on-month (m/m) for the headline figure and 0.4% m/m for core CPI, which are higher than prior readings. According to the S&P Global US Composite PMI, price pressures regained momentum at the start of 2023. Several Fed appearances through the week will also be of interest to gauge central bankers' latest views towards the expected persistence of elevated inflation rates.

Meanwhile retail sales and industrial production data will also be due in the US, and the consensus has indicated expectations of better consumption and production in January. As far as the S&P Global US Sector PMI reflected, consumer goods and services activity remained in contraction in January but fell at a slower rates compared to December. Concurrently, overall US manufactured goods production also shrank in January amid muted demand, though the rate of decline likewise moderated.

Europe: UK inflation, labour market and retail sales data, Eurozone industrial production

Key releases from the United Kingdom include January inflation, employment and retail sales data. While the latest S&P Global / CIPS UK Composite PMI outlined persistent contraction, one other thing that stood out was the moderation of input cost inflation to the lowest since May 2021. Employment conditions meanwhile appeared largely unchanged at the start of the year though the KPMG and REC UK Report on Jobs outlined the dampening of recruitment activity due to an uncertain outlook and a shortage of candidates.

Asia-Pacific: BI and BSP meetings, Japan, Singapore Q4 GDP, Australia employment data

In APAC, central banks in Indonesia and the Philippines convene with further rate hikes likely to unfold.

Separately, Japan and Singapore release fourth quarter GDP. Consensus expectations point to faster growth at 0.5% quarter-on-quarter (q/q) annualised for Japan amid the easing of restrictions in Q4 supporting output, a trend we have witnessed with early PMI data.

Special reports:

Global Recession Risk Eases as PMI Climbs to Six-month High in January - Chris Williamson

Taiwan Economy Hit by Slump in Exports - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-february-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-february-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+13+February+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-february-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 13 February 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-february-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+13+February+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-february-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}