Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 29, 2021

Week Ahead Economic Preview: Week of 1 November 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing and services PMIs will be released in the coming week for a detailed look into economic conditions into the start of Q4. Central bank meetings will meanwhile be in abundance including in the US, UK and Australia, while October's US non-farm payrolls round off the week.

A packed week is lined up ahead, kickstarted by the worldwide manufacturing and services PMIs. These have been front-run by worrying signs of persistent supply constraints from the flash figures. However, while supply issues hit manufacturing, services growth was widely reported to have accelerated amid the waning COVID-19 Delta wave impact. Sector PMI data will also be due for a finer breakdown of sector performance in October, with autos under particular scrutiny after output collapsed in September.

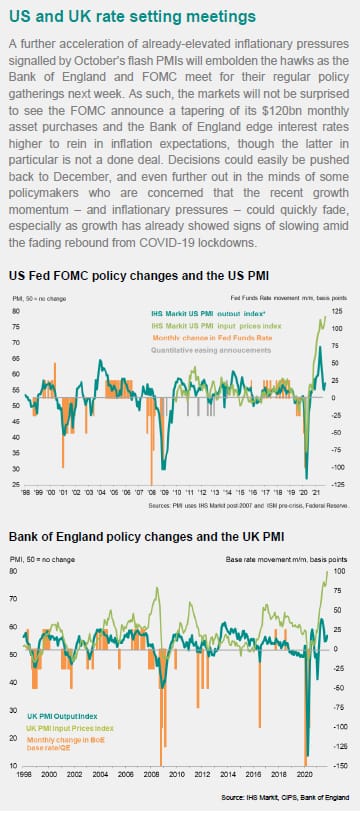

Central bank meetings will likewise fill the week. The highlight is expected to be the UK BoE meeting where expectations of a 15-basis points hike has been priced in by the market. Recent IHS Markit/CIPS UK PMI continued to point to record inflationary pressures, and accelerating growth, adding to signs that the BoE could be the first G-7 central bank to hike rates, though not all policymakers think the timing is right given uncertainties over the recovery path.

Finally, alongside tapering announcements expected at the FOMC meeting, US watchers will be scrutinising the October non-farm payrolls after last month's disappointing jobs count. Wage growth will also be eyed for second-round inflationary pressures.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-november-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+1+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-november-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 1 November 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+1+November+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}