Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 10, 2019

Weak PMI numbers take shine off Taiwanese export improvement

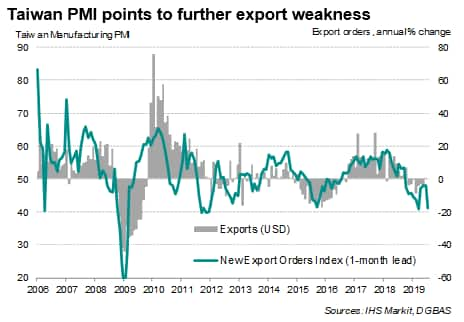

- Taiwan's exports unexpectedly increased by 0.5% in June, but the latest PMI surveys point to further export weakness

- Electronics PMI slides to lowest since November 2012

Official data showed Taiwanese exports rising in June, but the modest gain looks likely to be short-lived as the export sector continues to face significant headwinds, as indicated by PMI survey data from IHS Markit.

First export growth in eight months

Finance ministry data indicated that Taiwan's exports rose at an annual rate of 0.5% in June, the first increase in eight months. Detailed data revealed that growth in shipments to the US was the key driver of exports.

Widely regarded as a gauge for global demand, the surprise gain in Taiwan's exports naturally raised the question of whether the improvement is a harbinger of an upturn in global trade conditions in coming months, or even if Taiwan is benefitting from trade diversion as US importers shift away from China to Taiwan to avoid tariffs. Indeed, the Ministry of Finance commented that the unexpected growth in June exports was lifted by the relocation of factories from mainland China to Taiwan amid trade war tensions.

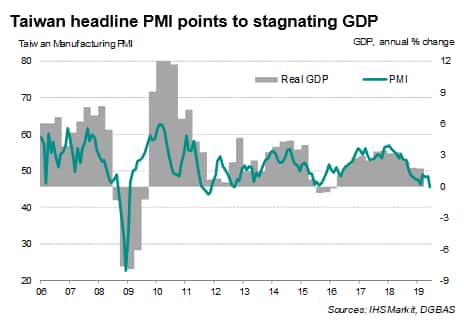

However, recent PMI data suggest the export rise in June looks likely to be short-lived. The headline Taiwan manufacturing PMI sank to its lowest for seven-and-a-half years during June, indicating another severe deterioration in manufacturing conditions. Notably, inflows of new orders contracted sharply, dragged down by a steep drop in new export sales.

The survey also found that business confidence remained negative as respondents expressed concerns over the impact of US-China trade dispute and subdued global demand on Taiwanese economic activity.

Historical comparisons suggest that the latest PMI is consistent with near zero growth in the economy.

Global slowdown

Subdued global demand also adds to the gloomy outlook for Taiwan's exports. The JPMorgan Global PMI, compiled by IHS Markit, signalled the pace of global economic growth to have stuck at a three-year low in June, with manufacturing remaining the main area of weakness.

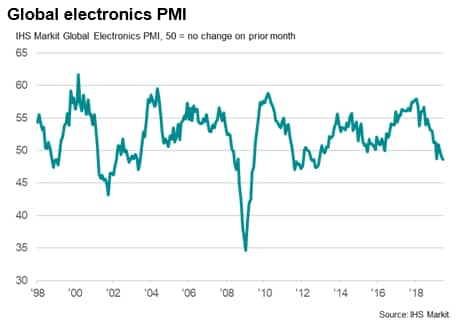

Furthermore, with Taiwan being a major electronics exporter, deteriorating worldwide business conditions for electronics producers, as indicated by the IHS Markit Global Electronics PMI, boded ill for Taiwanese economic growth. The PMI for the electronics sector fell in June to its lowest since November 2012.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-pmi-numbers-take-shine-off-taiwanese-export-improvement.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-pmi-numbers-take-shine-off-taiwanese-export-improvement.html&text=Weak+PMI+numbers+take+shine+off+Taiwanese+export+improvement+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-pmi-numbers-take-shine-off-taiwanese-export-improvement.html","enabled":true},{"name":"email","url":"?subject=Weak PMI numbers take shine off Taiwanese export improvement | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-pmi-numbers-take-shine-off-taiwanese-export-improvement.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+PMI+numbers+take+shine+off+Taiwanese+export+improvement+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-pmi-numbers-take-shine-off-taiwanese-export-improvement.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}