Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 22, 2024

US outperformance widens in November as output surge contrasts with decline in Europe

The flash PMI data compiled by S&P Global Market Intelligence showed the US building further on its recent outperformance among its developed market peers in terms of business activity growth in November. A strong and accelerating expansion in the US contrasted with falling or stalled output in Europe and Japan.

Improved post-election optimism about the year ahead among US businesses meanwhile contrasted with gloomier moods in Europe, suggesting the growth divergence could widen further in the coming months.

Key to the current divergence has been a substantial outperformance of the US services economy relative to other major developed economies.

It remains to be seen whether threatened US-imposed tariffs could drive a similar wedge in manufacturing performance, but at present the US goods-producing sector is reporting a steepening downturn, albeit less so than in the eurozone.

There was a more broad-based picture of brighter news on the inflation front, with PMI data showing falling selling price inflation in the US and UK and only a modest rise in the eurozone, in all cases adding scope for central banks to loosen policy further if deemed necessary.

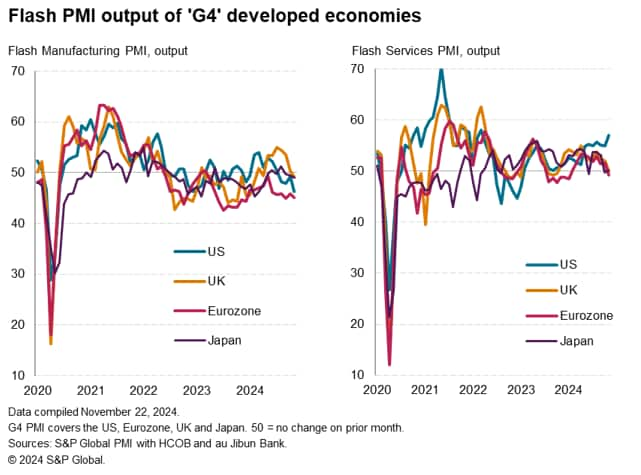

Faster services growth contrasts with manufacturing malaise

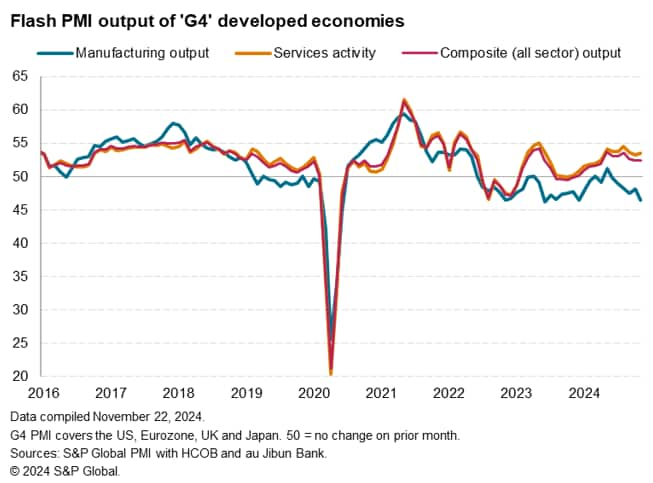

Flash PMI data from S&P Global Market Intelligence showed the group of four (G4) major developed economies continued to collectively grow in November, sustaining the expansion that has been recorded in the year to date. The G4 PMI output index held steady on October's reading of 52.4, according to the provisional data for November.

However, this unchanged reading masked some widening growth divergences beneath the surface.

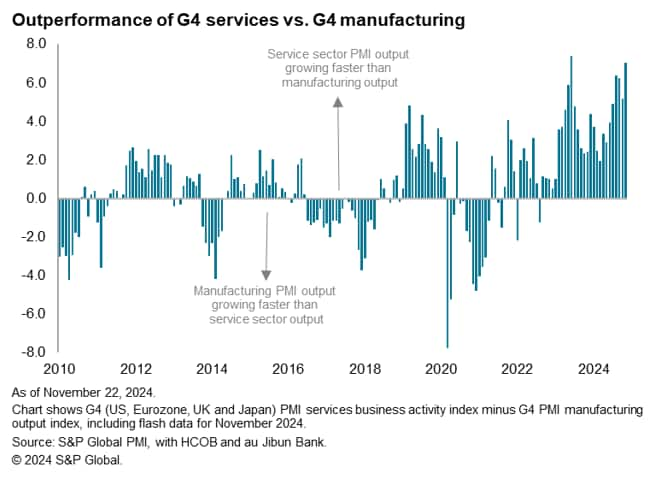

First, from a sectoral perspective across the G4, the expansion continued to be driven exclusively by the service sector, where output growth edged higher compared to October to rise further above the average seen in the year to date.

In contrast, manufacturing output fell into a steeper decline, with November's survey data showing the largest monthly contraction of production since last December. Excluding the pandemic lockdown months, the latest manufacturing downturn is among the sharpest recorded by the survey since the global financial crisis.

The divergence takes the outperformance of the services economy relative to manufacturing close to the survey high recorded back in June 2023 (comparable data are available back to late-2009), underscoring the unusual degree of sectoral divergence being reported by the survey since the pandemic.

US outperformance widens

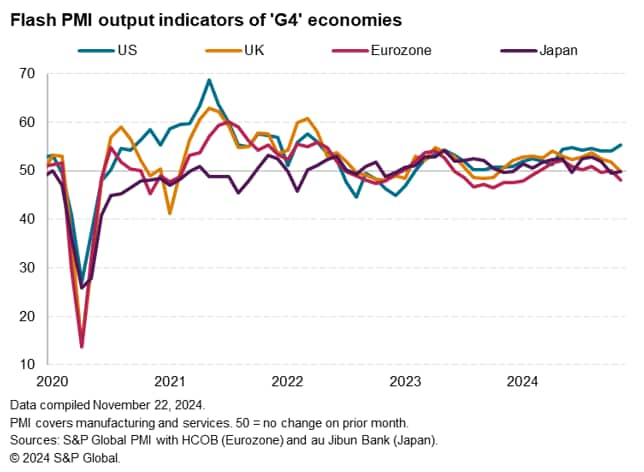

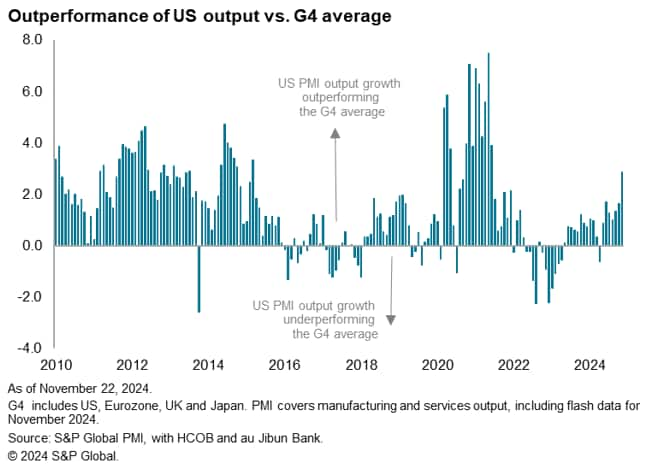

A second key area of divergence within the G4 economies is regional, with the US outperforming in terms of business activity to an increased degree in November.

While the composite PMI output index (covering goods and services) rose in the US to 55.3, its highest since April 2022 and indicating robust economic growth, the equivalent indices for the eurozone, UK and Japan were in contraction territory. At 48.1, the eurozone flash PMI signalled the steepest decline among the G4, while at 49.9 and 49.8 respectively, the PMIs for the UK and Japan signalled only marginal contractions.

The outperformance of the US economy in terms of business output growth across goods and services relative to the G4 average is now at its highest since June 2021.

Key to the US's stronger performance was again the resilience of its services economy, where robust and strengthening output growth represented a striking contrast with the other G4 economies, which saw economic malaise spread from manufacturing. Eurozone services activity was most notably affected, falling into decline, while a stalled picture was seen in the UK and only marginal growth was recorded in Japan.

A fall in manufacturing output was meanwhile common among the G4 economies, with the eurozone registering the steepest decline. However, the US notably recorded its steepest manufacturing decline for nearly two years, registering a significantly steeper pace of contraction relative to the modest declines seen in the UK and Japan.

The detailed data therefore show that the expansion of G4 output in November was in fact entirely driven by the US service sector barring a marginal rise in services output in Japan.

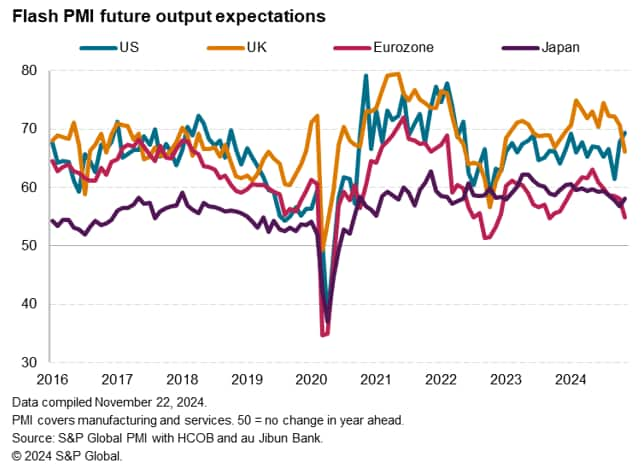

Confidence boost

The US outperformance could widen further in coming months, given changes in business views on expected output trends in the coming year. While US firms became increasingly upbeat about year-ahead prospects, in November, optimism waned in the eurozone and UK, and remained somewhat moribund in Japan. US firms are consequently now the most optimistic among the G4 peers.

While US firms reported improved prospects following the clearing of election uncertainty and hopes for a more business-friendly incoming administration, the threat of tariffs and heightened political uncertainty dogged business sentiment elsewhere, especially in Europe.

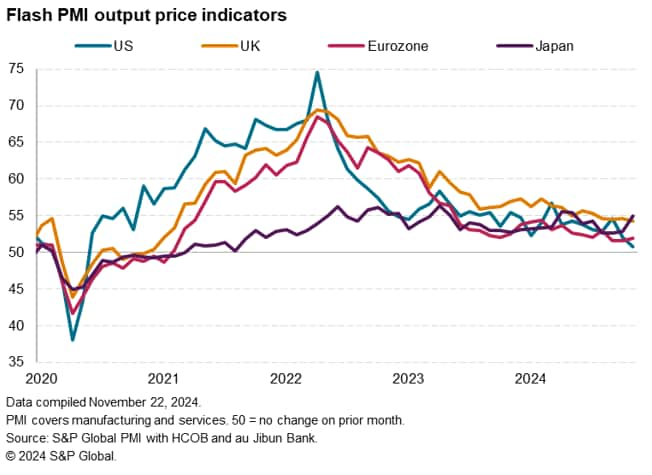

Selling price inflation cools especially sharply in the US

The good news out of the US flash PMI didn't stop with output and future expectations, as inflation pressures also cooled further. Average prices charged for US goods and services in fact barely rose in November, registering the smallest monthly increase seen by the S&P Global PMI this side of the pandemic.

However, the flash PMI surveys also continued to register modest price growth by recent standards in both the eurozone and UK, adding to scope for potential rate cuts to help offset downturns should policymakers grow concerned over recession risks. UK selling prices rose at the slowest rate since February 2021 and eurozone prices also rose at one of the weakest rates seen since the pandemic, albeit the pace ticking higher largely via increased wage effects.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-outperformance-widens-in-november-as-output-surge-contrasts-with-decline-in-europe-nov24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-outperformance-widens-in-november-as-output-surge-contrasts-with-decline-in-europe-nov24.html&text=US+outperformance+widens+in+November+as+output+surge+contrasts+with+decline+in+Europe+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-outperformance-widens-in-november-as-output-surge-contrasts-with-decline-in-europe-nov24.html","enabled":true},{"name":"email","url":"?subject=US outperformance widens in November as output surge contrasts with decline in Europe | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-outperformance-widens-in-november-as-output-surge-contrasts-with-decline-in-europe-nov24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+outperformance+widens+in+November+as+output+surge+contrasts+with+decline+in+Europe+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-outperformance-widens-in-november-as-output-surge-contrasts-with-decline-in-europe-nov24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}