Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2026

US manufacturers report surge in factory output despite subdued demand

US manufacturers reported a surge in factory output in January, according to the S&P Global PMI, though new business growth remained worryingly subdued by comparison. The gap between strong output growth and only modest order expansion suggests production could weaken in the coming months unless demand revives.

Weak sales were often linked to high prices, with factory gate selling prices rising at an increased rate at the start of the year, often blamed on tariffs. However, more encouragingly, the January survey brought signs that input cost inflation is trending lower in US factories compared to the peaks seen last year, and business confidence is also holding up well, albeit constrained by political uncertainty.

Production surges higher

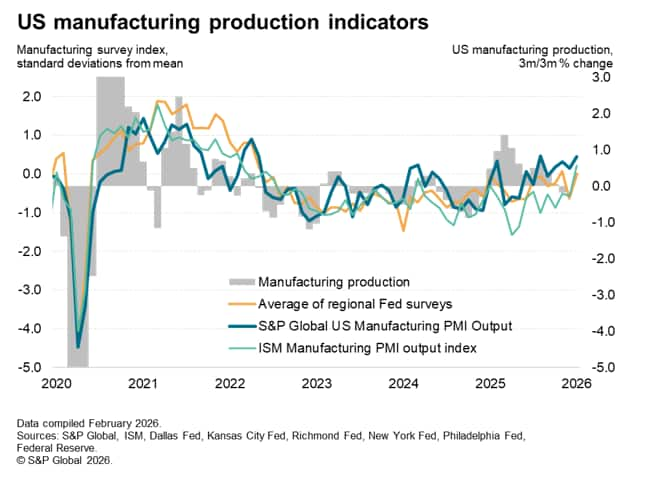

US manufacturing output growth surged higher in January. The headline S&P Global US Manufacturing Purchasing Managers' Index™ (PMI®), recorded 52.4 in January. That was up from 51.8 in December. The upturn in the PMI was driven in particular by a faster rate of output growth: factory production reportedly grew at the fastest rate since last August, which had in turn been the best performance since May 2022.

The PMI data are broadly indicative of factory output growing at a quarterly rate of approximately 1%, hinting at an improvement in the upcoming official manufacturing output data.

However, this brighter news is tainted by reports of ongoing subdued sales growth, which rebounded only modestly after a drop in orders was recorded in December. That had been the first fall in demand for US goods since December 2024.

Order book risks

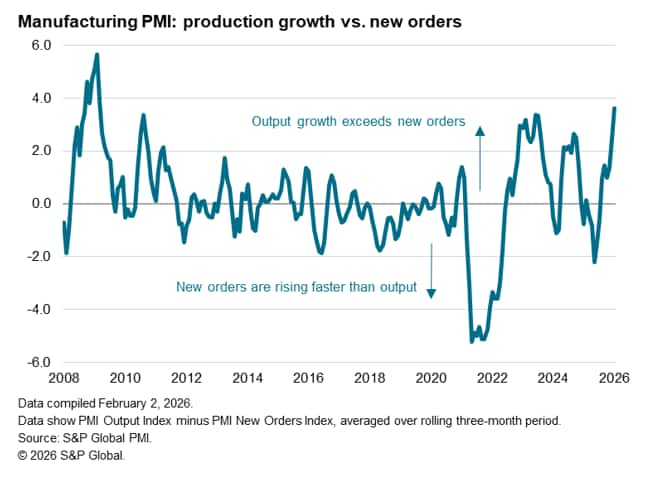

Over the latest three months, the PMI new orders index has averaged just 50.8. That compares with an average output index reading of 54.4 over this period. This indicates that production growth is significantly outpacing that of new orders to the greatest extent since the global financial crisis back in early 2009. This highly unusual situation is clearly unsustainable, hinting at risks of a production slowdown (and a potential knock-on effect on employment), unless demand improves markedly in the coming months.

Sales growth curbed by affordability

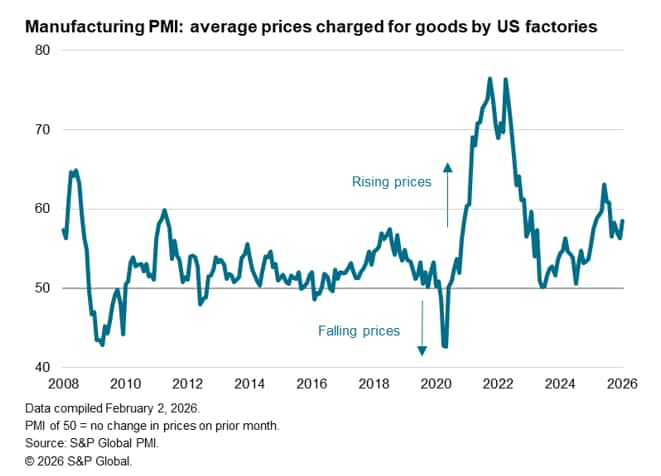

Sluggish sales and order book growth are being commonly linked to customer resistance to high prices, in turn often blamed on tariffs. Average prices charged by producers rose in January at an increased rate, registering the steepest monthly increase since last August.

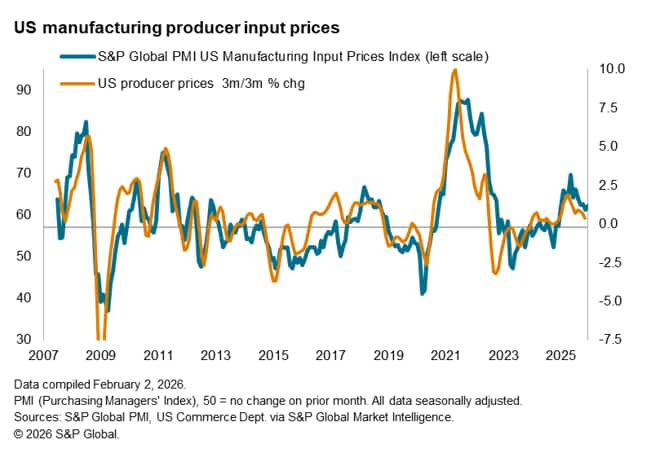

However, some better news has appeared in recent months, with input cost inflation showing a cooling trend. January's rise in manufacturing costs was the second-weakest recorded over the past 11 months, albeit up slightly on December. This slower cost growth could take some pressure off selling prices in the coming months.

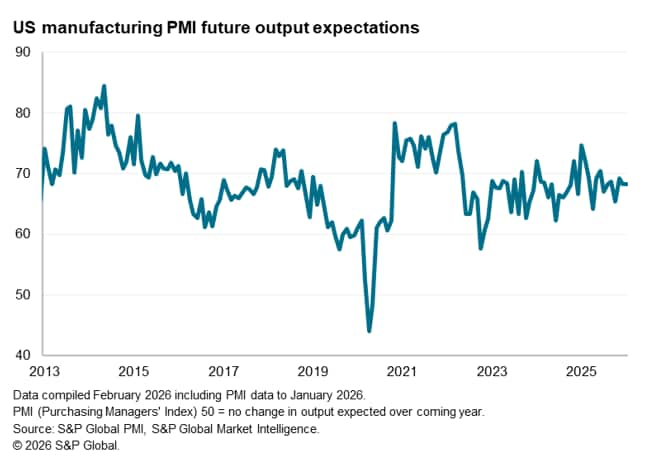

Confidence holding up

Meanwhile, although still running just below the long-run trend level, business growth expectations for the year ahead are holding up. Firms generally anticipate improving demand, thanks in part to lower interest rates, reduced import competition due to tariffs, and more government support. However, political uncertainty clearly remains a key drag on business sentiment, according to survey responses, dampening spending by both businesses and households.

The outlook for manufacturing therefore very much depends on whether the order book situation can indeed improve to match these expectations, or whether production growth will need to be adjusted lower in the face of persistent weaker-than-anticipated sales.

Access the press release here.

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-surge-in-factory-output-despite-subdued-demand-Feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-surge-in-factory-output-despite-subdued-demand-Feb26.html&text=US+manufacturers+report+surge+in+factory+output+despite+subdued+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-surge-in-factory-output-despite-subdued-demand-Feb26.html","enabled":true},{"name":"email","url":"?subject=US manufacturers report surge in factory output despite subdued demand | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-surge-in-factory-output-despite-subdued-demand-Feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturers+report+surge+in+factory+output+despite+subdued+demand+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturers-report-surge-in-factory-output-despite-subdued-demand-Feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}