Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 29, 2019

US enjoys strong first quarter, but flash PMI shows growth fading in April

- GDP grows faster than expected in first quarter

- IHS Markit PMI indicated solid growth in opening months of year, but hints at second quarter slowdown

The US economy grew faster than economists expected in the first quarter, but a robust pace of expansion had been signalled ahead by the PMI business surveys. The latter nevertheless suggest the pace of growth has weakened markedly at the start of the second quarter, according to the preliminary 'flash' estimate.

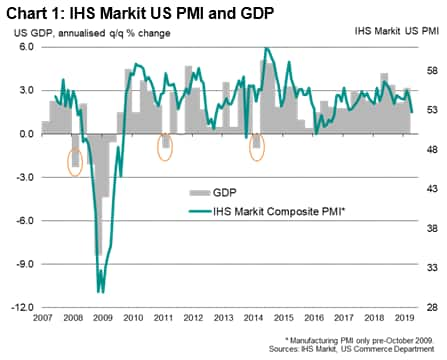

The first official estimate of gross domestic product showed the economy picking up speed in the opening three months of 2019, with GDP rising at an annualised rate of 3.2% after a 2.2% rise in the fourth quarter of 2018. Economists polled by Reuters had expected growth of just 2.0%. However, PMI survey data from IHS Markit had pointed to growth of 2.5%, warning that first quarter growth could come in higher than analysts were generally expecting.

With a few exceptions, such as residual seasonality which appears to persist in years prior to 2015 (see highlighted data in chart), the survey data have a strong track record of accurately anticipating GDP data and regularly beat the consensus.

We use a simple linear regression model to nowcast GDP, using quarterly averages of the output and new orders indices from the composite PMI (a weighted index from the manufacturing and services surveys). The regression has an adjusted r-square of 0.75 when the highlighted GDP outliers are excluded and indicates that the rate of economic growth has slowed to 1.8% at the start of the second quarter.

A slower overall increase in output in April was driven by widespread reports of softer demand conditions, with new order growth easing for the second month running in April to the weakest for two years.

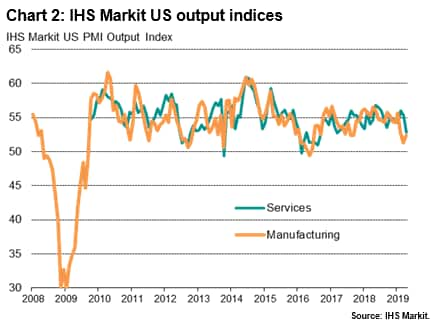

A major contrast in April to the first quarter was a marked slowing of growth in the service sector, highlighting how a factory-led slowdown has now spread. The flash services PMI business activity index fell to its lowest since March 2017.

The manufacturing PMI's output index is meanwhile indicative of a downturn in factory production continuing into April, albeit with the rate of decline moderating slightly.

Further reports:

- Analysis of the April flash US PMI surveys

- Falling US manufacturing output confirmed by official data

- IHS Markit US PMI signals greatest pressure on corporate earnings since 2016

- Using the PMI to nowcast US GDP

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-enjoys-strong-first-quarter-290419.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-enjoys-strong-first-quarter-290419.html&text=US+enjoys+strong+first+quarter%2c+but+flash+PMI+shows+growth+fading+in+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-enjoys-strong-first-quarter-290419.html","enabled":true},{"name":"email","url":"?subject=US enjoys strong first quarter, but flash PMI shows growth fading in April | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-enjoys-strong-first-quarter-290419.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+enjoys+strong+first+quarter%2c+but+flash+PMI+shows+growth+fading+in+April+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-enjoys-strong-first-quarter-290419.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}