Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 12, 2025

US consumer price inflation rose to 2.9% in August, with survey data hinting at more price rises to come

US consumer prices rose more than expected in August, with further steep prices rises to come according to business survey data. However, business and consumer confidence will likely hold the key to whether the rise in inflation become more of a long-term concern.

Inflation at seven-month high

Higher-than-expected inflation was evident in August, according to official data from the Bureau of Labor Statistics, confirming worrying signs of prices from business survey data such as that compiled by S&P Global Market Intelligence.

US consumer price inflation rose to a seven-month high of 2.9% in August, up from 2.7% in September, after prices jumped 0.4% during the month.

Tariff pass-through

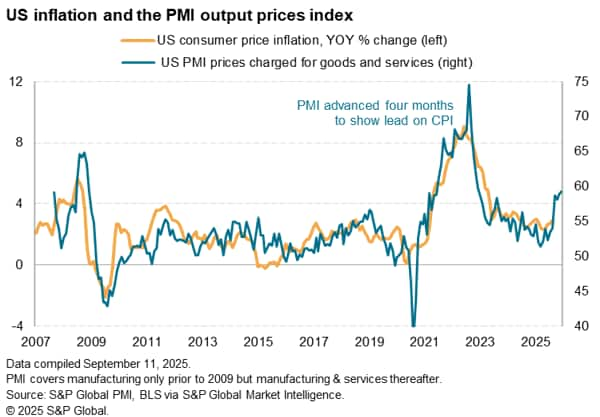

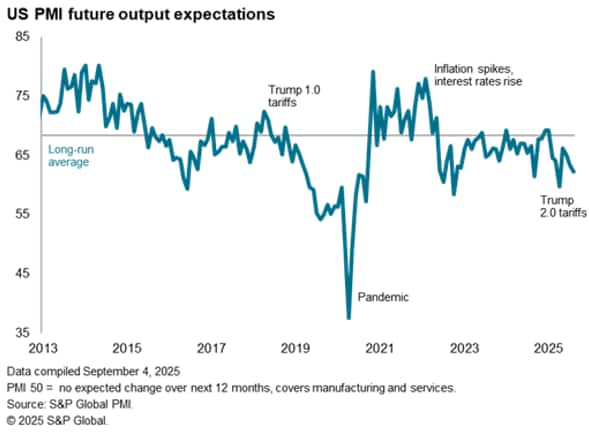

While economists had been expecting a more modest 0.3% rise, the higher-than-expected rate of inflation tallies with PMI business survey data, which have shown prices charged by companies for goods and services rising sharply in recent months. What's more, these business price hikes will likely continue to feed through to even higher consumer prices in the coming months, with historical comparisons suggesting that CPI inflation could rise to around 4% in the coming months.

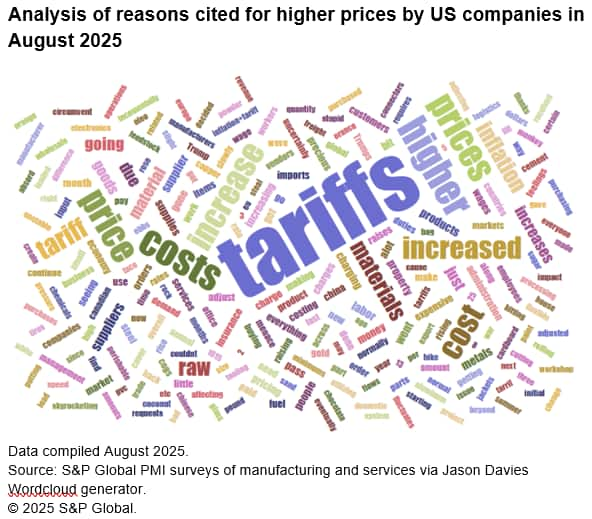

Companies have widely blamed tariffs for rising prices, with these levies on imports being increasingly passed through supply chains to households as inventories of goods bought at pre-tariff rates deplete.

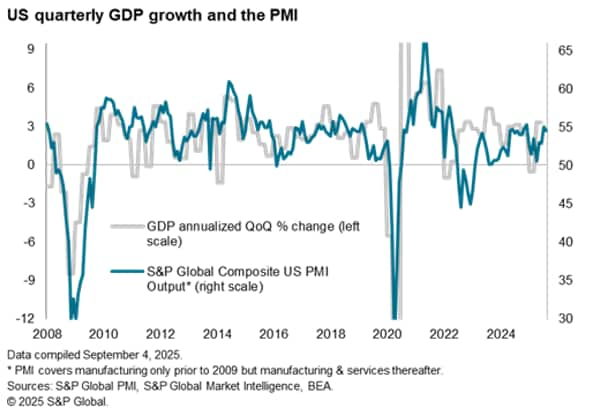

Such a rise in inflation would add to caution among policymakers in cutting interest rates. In addition to higher-than-expected inflation, some caution on policy loosening is warranted by signs that the US economy is growing strongly in the third quarter so far. S&P Global PMI survey data are consistent with GDP growing at an annualized rate of 2.4% and some nowcast models, including our own and that produced by the Atlanta Fed, currently put growth above 3%.

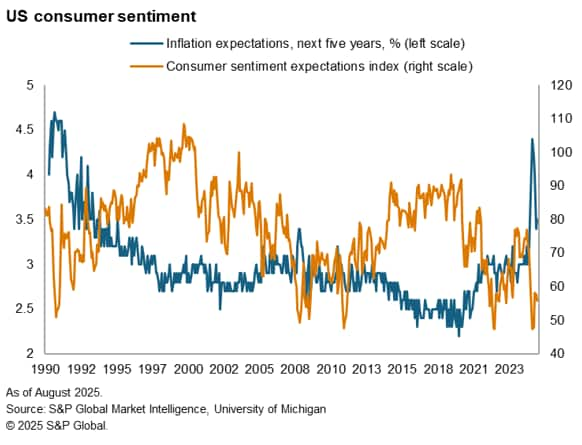

Consumer inflation expectations also remain highly elevated by historical standards, according to surveys such as those compiled by the University of Michigan.

Job market could tame inflation

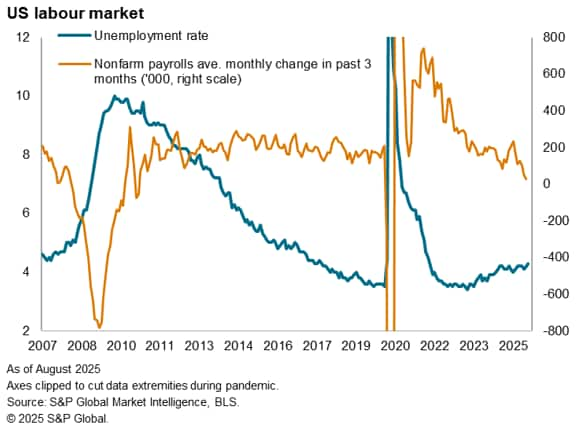

However, although sustained inflation looks to be on the way, concerns have mounted in relation to the labor market, which will likely keep the door open for the FOMC to cut rates at its policy meeting next week. Inflation doves argue that, even if prices rise sharply in the near-term, the softening labor market trends suggests little scope for inflation to endure.

Nonfarm payroll growth has slowed such that just 27,000 jobs have been added in each of the past four months. Barring the pandemic, this has been the worst spell of jobs growth since 2010. The unemployment rate has meanwhile edged up to 4.3%, its highest for nearly four years.

Not only is there little chance of a wage-price spiral taking hold in a weakening job market, but consumers will also typically have low tolerance for higher prices amid concerns over job security and incomes, limiting the pass-through of tariff-related cost increases.

Confidence is key

Looking ahead, much will depend on the degree to which current low levels of consumer and business confidence can revive in the coming months, as improved confidence generally induces higher inflation via increased spending and a reviving jobs market. In that respect, September's flash PMI data, published on 23rd September, will provide valuable insights.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-price-inflation-rose-to-2.9-in-august-with-survey-data-hinting-at-more-price-rises-to-come-sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-price-inflation-rose-to-2.9-in-august-with-survey-data-hinting-at-more-price-rises-to-come-sep25.html&text=US+consumer+price+inflation+rose+to+2.9%25+in+August%2c+with+survey+data+hinting+at+more+price+rises+to+come+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-price-inflation-rose-to-2.9-in-august-with-survey-data-hinting-at-more-price-rises-to-come-sep25.html","enabled":true},{"name":"email","url":"?subject=US consumer price inflation rose to 2.9% in August, with survey data hinting at more price rises to come | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-price-inflation-rose-to-2.9-in-august-with-survey-data-hinting-at-more-price-rises-to-come-sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+consumer+price+inflation+rose+to+2.9%25+in+August%2c+with+survey+data+hinting+at+more+price+rises+to+come+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-price-inflation-rose-to-2.9-in-august-with-survey-data-hinting-at-more-price-rises-to-come-sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}