Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 20, 2025

UK labour market under pressure as demand weakens and staff costs rise

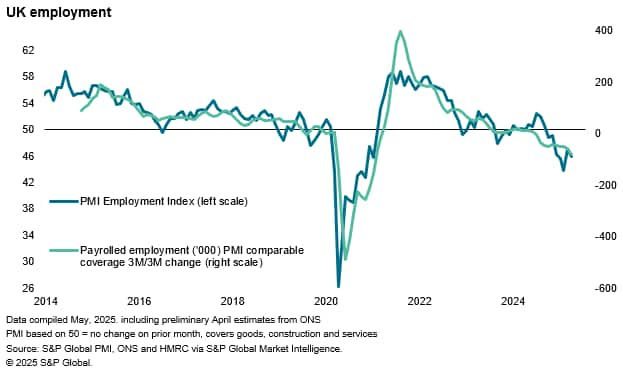

<span/><span/><span/>S&P Global PMI data showed UK employment falling for a seventh straight month in April, signalling a sustained deterioration in the country's labour market conditions. Furthermore, the UK's performance on the jobs front at the start of the second quarter wasthe weakest among all the major economies covered by PMI data, led by asteep reduction in manufacturing workforce numbers.

Rising labour costs in the UK in recent months, linked to increases in employers' National Insurance contributions and minimum wages, have been exacerbated by tariff-related concerns and uncertainty, which have weighed heavily on business confidence.

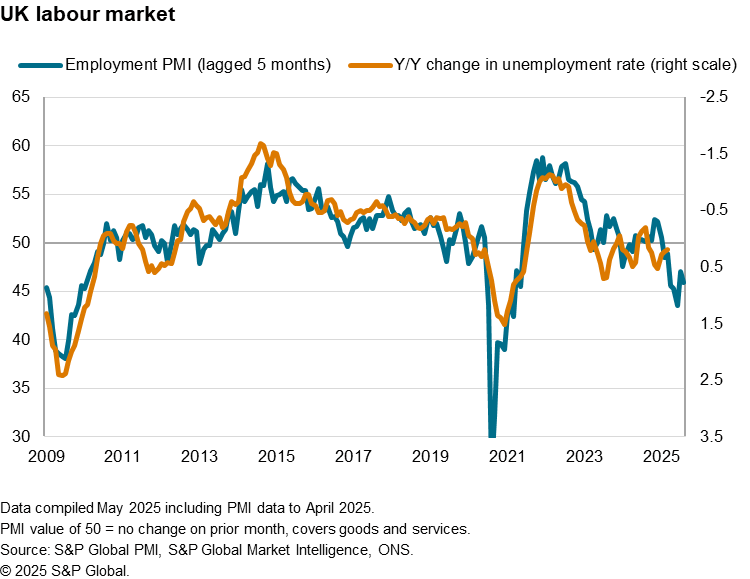

This paves the way for further job losses in the coming months unless growth expectations improve materially from the current depressed level. At its current position, the UK PMI Employment Index is consistent with the unemployment rate ticking up further from the 4.5% recorded in the three months to March, which is already the highest in more than three-and-a-half years, edging towards 5% in the second half of 2025. May's flash PMI data, published 22 May, will provide an update on business confidence and underlying demand conditions, as well as signalling the degree of stickiness in inflationary pressures following April's rise in employment costs.

Weakness in underlying demand

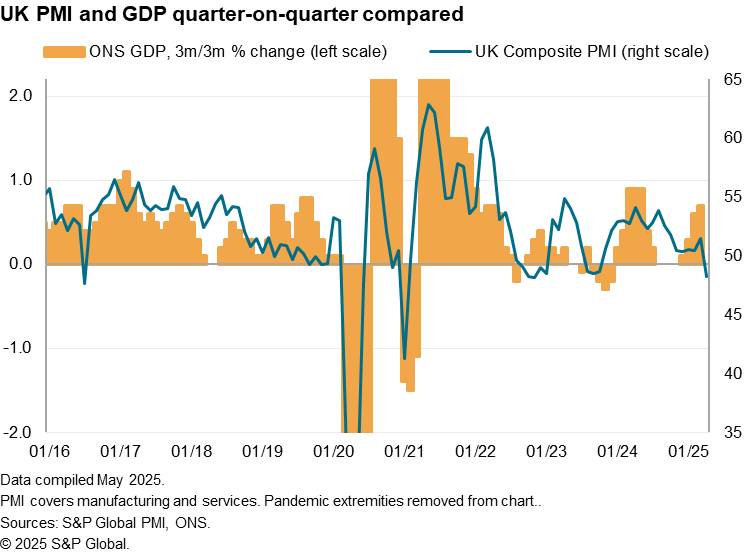

Following growth across the UK economy in the opening quarter of the year, PMI data for April showed a marked loss of momentum and renewed risks of an economic downturn. The UK PMI Composite Output Index, which covers activity across the manufacturing and services sectors, retreated sharply from a five-month high of 51.5 in March to 48.5 in April, marking the first decrease in business activity in 18 months and one of the weakest performances for almost two-and-a-half years. Notably, the index has hit the 48.5 mark on three separate occasions during this period.

The PMI data have also shown a period of persistent weakness in underlying demand conditions facing UK firms, with inflows of new business having fallen in each month since December last year amid reports of fragile consumer confidence, tighter budgets, increased scrutiny around spending, and heightened geopolitical uncertainty.

April's decrease in new business was in fact the steepest recorded since the sharp drop in demand associated with the fallout from the Liz Truss 'mini budget' in late 2022. This backdrop of weakened demand has contributed to companies adopting a more cautious approach to hiring, with PMI data showing UK employment falling for the seventh month running in April.

Jump in staff costs

Besides weak demand, another key factor driving a cutback in recruitment has been last October's Autumn Budget. Changes to employers' National Insurance contributions - a form of tax - and a higher minimum wage have led many businesses to reassess their workforce needs, according to anecdotal evidence collected in the PMI surveys.

Last October's PMI saw a decline in employment across the UK for the first time in ten months, since which staffing levels have fallen consistently on a monthly basis, thus marking the longest period of job shedding since the pandemic.

This ongoing cutback in payroll numbers is a clear shift from the strong employment growth seen in the early post-pandemic months. In fact, the reduction in workforce numbers observed in February was the most pronounced since November 2020. Ignoring the pandemic, UK staffing levels were cut at the strongest rate since the Global Financial Crisis.

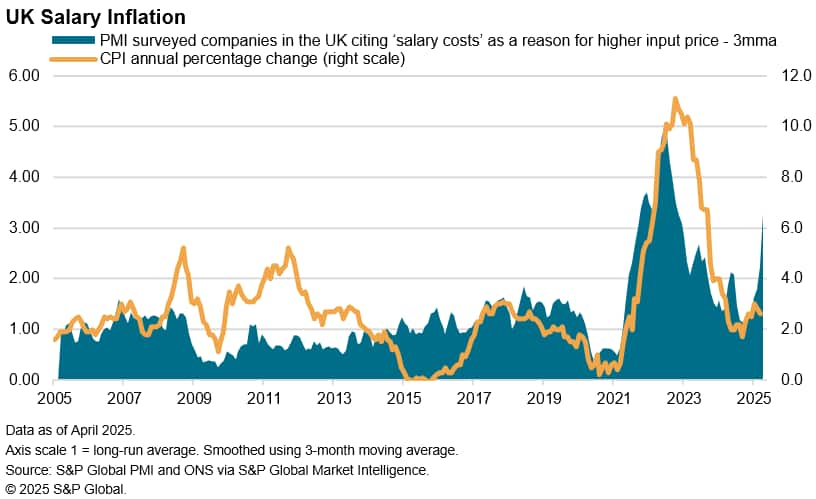

The Panel Comment Tracker (PCT) data - which utilise qualitative evidence provided by survey participants- illustrates the impacts recent policy changes have had on costs, showing a rise in the number of UK survey participants citing 'salary pressures' (or similar) as a reason for higher input prices.

While salary cost pressures have significantly diminished since their peak in 2022, they continue to run above the long-run average and have even reaccelerated, with data from October 2024 onward indicating monthly increases in these pressures. In the three months to April, they reached more than three times the long-run average. Additionally, official consumer price index (CPI) inflation rose in the latter half of last year, climbing to a ten-month high of 3% in January 2025, before ticking down slightly to 2.6% in March, showing generally high price pressures in the economy.

A concern was that the tight labour market in the UK in the years immediately after the pandemic laid the foundations for a wage-price spiral, as employees were able to demand higher wages to offset the rising cost of living. The interplay between rising salaries and ongoing cost pressures continues to shape the labour market dynamics today.

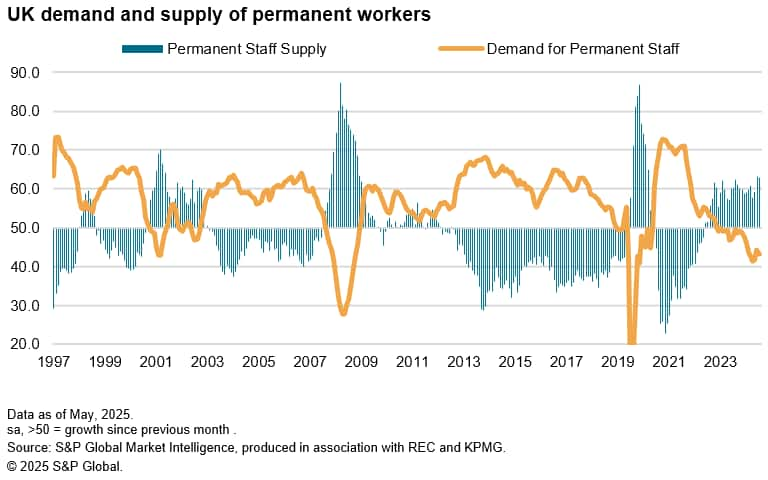

However, recent evidence from the UK Report on Jobs, which features a survey of recruitment agencies produced by S&P Global in association with REC and KPMG, shows a changing picture. With demand for staff decreasing and redundancies becoming more frequent, the previously tight labour market is starting to show signs of slack. Alongside rising temporary staff availability, the UK is currently experiencing a rapid expansion in the supply of permanent job candidates, which should restrain pay growth (absent a strong revival of demand).

Phil Smith | Economics Associate Director | S&P Global Market Intelligence

Tel: +44 149 1461 009

phil.smith@spglobal.com

Maryam Baluch, Economist, S&P Global Market Intelligence

Tel: +44 1344 327 213

maryam.baluch@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-labour-market-under-pressure-as-demand-weakens-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-labour-market-under-pressure-as-demand-weakens-may25.html&text=UK+labour+market+under+pressure+as+demand+weakens+and+staff+costs+rise+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-labour-market-under-pressure-as-demand-weakens-may25.html","enabled":true},{"name":"email","url":"?subject=UK labour market under pressure as demand weakens and staff costs rise | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-labour-market-under-pressure-as-demand-weakens-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+labour+market+under+pressure+as+demand+weakens+and+staff+costs+rise+++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-labour-market-under-pressure-as-demand-weakens-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}