Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 12, 2021

UK businesses forecast record growth in employment, Accenture/IHS Markit UK Business Outlook finds

- Hiring intentions among UK businesses improve to a record high, with capital expenditure and R&D plans also strengthening

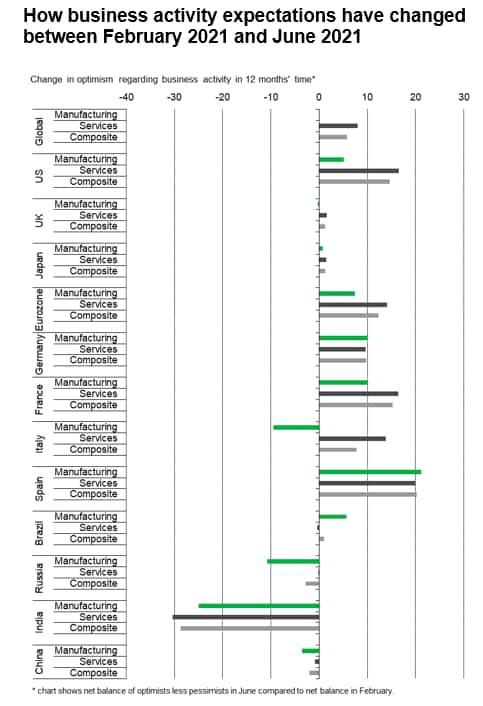

- UK business confidence continues its upward trajectory, with optimism the strongest of all globally monitored countries

- Major supply side concerns remain over workforce costs and prices of goods

UK business optimism continued to strengthen midway through the year, as expectations of a strong recovery enabled firms to plan a record increase in staffing levels over the next 12 months, according to the Accenture/IHS Markit UK Business Outlook.

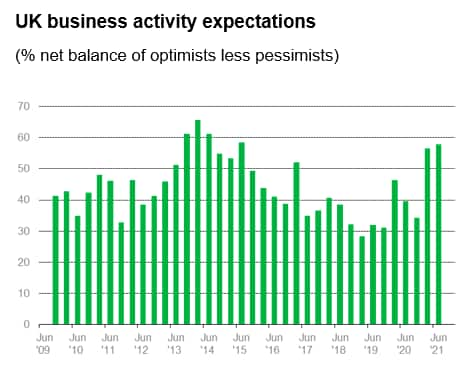

Two thirds of UK private sector firms (67%) expect an increase in business activity during the year ahead, compared to just 9% that project a reduction. At +58% in June, the resulting net balance of business expectations rose to its highest level in six years.

Improved activity expectations paved the way for another robust profits forecast, with a net balance of +37% of firms expecting profits to increase over the coming year.

As a result, UK firms increasingly made plans to boost business investment and increase employment. Staff hiring plans were particularly strong, with a record net balance of +41% of companies expecting to increase employment in the coming year.

June data indicated that most firms had seen a recovery in business activity from the COVID-19 pandemic, with approximately 51% of survey respondents stating that output was the same or higher than February 2020 levels. Notably, almost two-thirds of construction firms reported a recovery in output, compared with 62% of manufacturers and 49% of services firms.

Capital expenditure and research & development plans also strengthened, improving to the highest for six years with net balances of +20% and +11% respectively. Investment forecasts remained stronger among manufacturing firms, though service providers also saw a further marked improvement from the record lows recorded a year ago.

After topping the list for business activity in February, hotels & restaurants saw a steep drop in optimism amid expectations that the post-reopening jump in demand will cool off, while staff shortages and rising prices were also highlighted as possible risks to growth. On the manufacturing side, the transport and food sectors saw the largest improvements in output expectations, while sectors that have been severely impacted by global supply issues recorded a drop in confidence, including timber, metals and textiles producers.

Inflationary pressures - a potential sting in the tail?

Supply-side risk factors led to increasing concerns about inflation among UK businesses, as approximately 60% of surveyed firms expect non staff costs to increase, compared to just 5% that forecast a reduction. The resulting net balance of +55% was the highest on record. Staff shortages and intended hiring growth meanwhile meant that expectations for rising staff costs were also at a series-record high of +70%. This compared with an EU average of +42% with some firms commenting that Brexit contributed to a reduced pool of available workers.

With earnings stretched by the pandemic, firms are increasingly looking to pass these costs onto their customers. A record net balance of +48% of businesses plan to raise their selling prices, giving a strong indication that consumer price inflation could accelerate over the second half of the year.

David Owen, Economist, IHS Markit

Tel: +44 2070 646 237

david.owen@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-businesses-forecast-record-growth-in-employment-accentureihs-markit-uk-business-outlook-finds-July21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-businesses-forecast-record-growth-in-employment-accentureihs-markit-uk-business-outlook-finds-July21.html&text=UK+businesses+forecast+record+growth+in+employment%2c+Accenture%2fS%26P+Global+UK+Business+Outlook+finds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-businesses-forecast-record-growth-in-employment-accentureihs-markit-uk-business-outlook-finds-July21.html","enabled":true},{"name":"email","url":"?subject=UK businesses forecast record growth in employment, Accenture/S&P Global UK Business Outlook finds | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-businesses-forecast-record-growth-in-employment-accentureihs-markit-uk-business-outlook-finds-July21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+businesses+forecast+record+growth+in+employment%2c+Accenture%2fS%26P+Global+UK+Business+Outlook+finds+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-businesses-forecast-record-growth-in-employment-accentureihs-markit-uk-business-outlook-finds-July21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}