Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Aug 30, 2018

Trade Policy Insights: US Mexico renegotiated NAFTA - Automotive - Impact on Supply Chains

Author: Daniela Stratulativ, Associate Director, Global Trade | Maritime & Trade

This column is based on data from World Trade Service.

Implications

The agreement will pave the way for the following:

- US vehicle imports from Canada, Japan, South Korea, and Germany will be reduced

- US auto parts imports from China, India, Brazil will decrease

- Canada and Belgium will import lower volumes of vehicles from Mexico

- An increase in US parts imports from Mexico will cause a reduction of Mexico exports to Canada, Brazil, China and Japan, amongst others

- US increase in domestically produced aluminium and steel will reduce imports from Canada, Russia, and United Arab Emirates (aluminium) and Russia and Brazil (steel).

*Any future policy agreements may impact these findings*

Next steps:

The US administration is planning on sending the agreement to the US Congress on Friday. This puts pressure on Canada to make a decision.

Could Canada be left out of the new agreement? Even after being formally signed, it would have to be ratified by lawmakers in each country before entering into force.

Impact:

Following the bilateral NAFTA renegotiation, US and Mexico reached an agreement that includes the regional local content in the auto industry from the current 62.5 to 75%.

The revised trade agreement would maintain provisions from the original NAFTA accord which stated that the first five years new auto plants would only need to meet a requirement of 50 percent regional content.

In addition, the agreement establishes that 40-45% of auto content must be made by workers earning at least USD16 per hour. This could move some of the production from Mexico back to the US.

The announcement was made on Monday. The agreement will be reviewed and updated every six years and has a lifespan of 16 years.

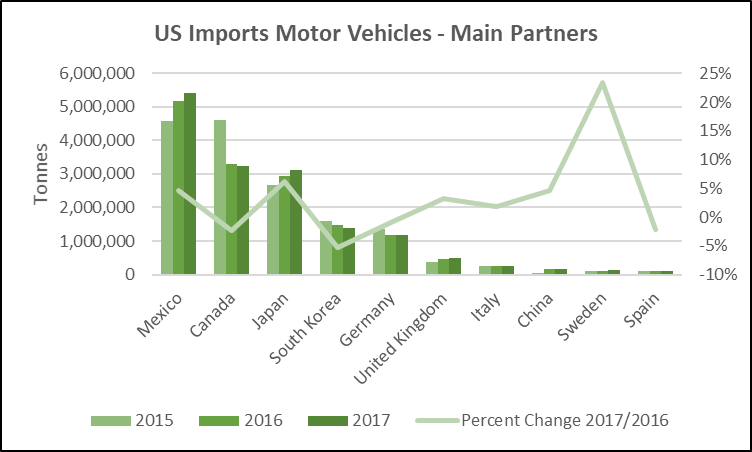

US vehicle imports from Canada, Japan, South Korea, and Germany will be reduced

If Mexico vehicles meet the new content requirements, US vehicle imports from Mexico could increase over trade with Canada, Japan, South Korea, and Germany.

Source: IHS Markit © 2018 IHS Markit

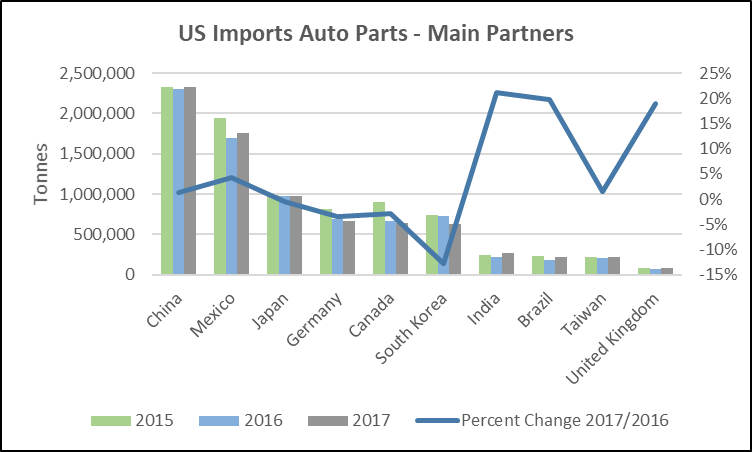

US auto parts imports from China, India, Brazil will decrease

The higher threshold of regional content will decrease auto parts imports from China who is currently providing the highest volume, reaching close to 2.3 million tonnes. Imports from India and Brazil who grew significantly in 2017 over 2016, will likely be affected.

Source: IHS Markit © 2018 IHS Markit

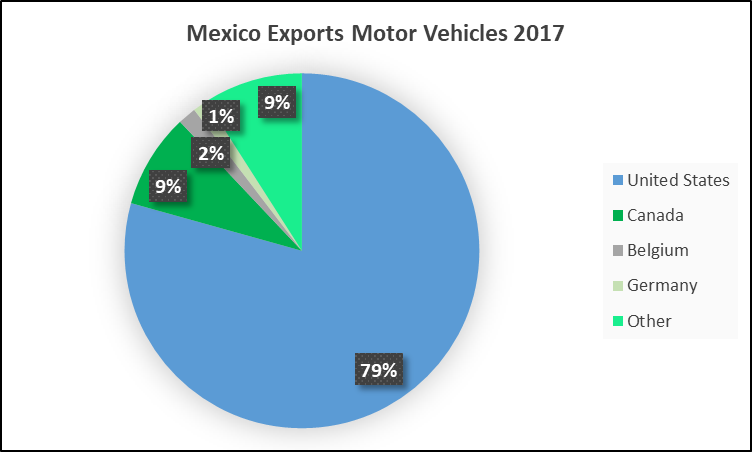

Canada and Belgium will import lower volumes of vehicles from Mexico

Mexico vehicles exports in 2017 reached over 6.8 million tonnes, going mostly to US, followed by Canada and Belgium, who will likely receive a lower supply when the deal enters into force.

Source: IHS Markit © 2018 IHS Markit

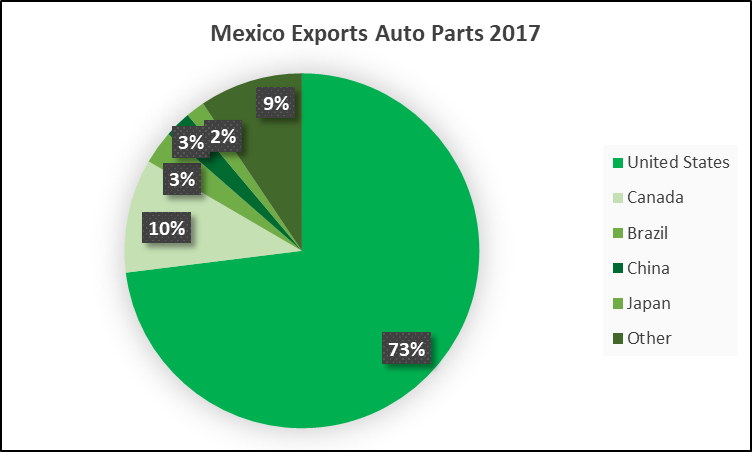

An increase in US parts imports from Mexico will cause a reduction of Mexico exports to Canada, Brazil, China and Japan, amongst others

US will import more parts from Mexico, trade volumes increasing from 2.4 million tonnes in 2017, taking trade flows away from Mexico current partners - Canada, Brazil, China, Japan, if production levels remain constant.

Source: IHS Markit © 2018 IHS Markit

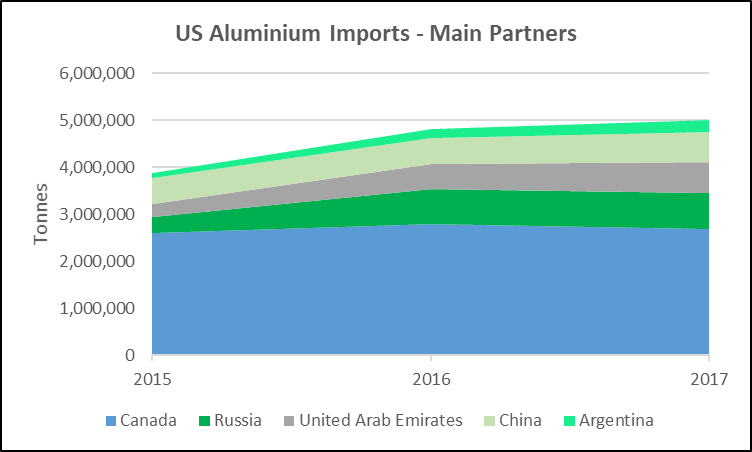

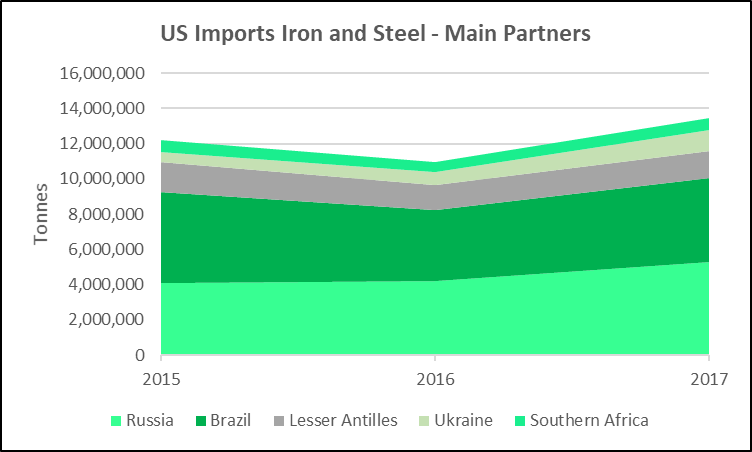

US increase in domestically produced aluminium and steel will reduce imports from Canada, Russia, and United Arab Emirates (aluminium) and Russia and Brazil (steel)

The increase in US manufacturing of vehicles and parts will require larger supplies of aluminium and steel, which could be produced locally. This will reduce aluminium imports from Canada, Russia, and United Arab Emirates, amongst others. Iron and steel imports from Russia and Brazil are likely to decrease.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-mexico-renegotiated-nafta--automotive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-mexico-renegotiated-nafta--automotive.html&text=Trade+Policy+Insights%3a+US+Mexico+renegotiated+NAFTA+-+Automotive+-+Impact+on+Supply+Chains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-mexico-renegotiated-nafta--automotive.html","enabled":true},{"name":"email","url":"?subject=Trade Policy Insights: US Mexico renegotiated NAFTA - Automotive - Impact on Supply Chains | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-mexico-renegotiated-nafta--automotive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+Policy+Insights%3a+US+Mexico+renegotiated+NAFTA+-+Automotive+-+Impact+on+Supply+Chains+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-mexico-renegotiated-nafta--automotive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}