Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 14, 2024

Heavy frontloading sets up US-Asia trade for falling rates, imports

Asia-to-US freight rates at the tail end of the peak shipping season are falling faster than is typical for this time of year given the heavy frontloading that occurred months earlier that is also expected to result in weaker-than-normal imports from Asia in November, forwarders tell the Journal of Commerce.

Retailers frontloaded holiday season imports in August to ensure they arrived before the strike by East and Gulf coast dockworkers on Oct. 1, which lasted for three days. The huge import volumes that moved across US docks in August are also muting the post-Golden Week bounce that normally occurs in mid-October when retailers ship their high-value holiday merchandise through the West Coast.

"The degree of frontloading in 2024 may have been more than some analysts realized," Paul Bingham, director of transportation consulting for S&P Global Market Intelligence said. "That might account for softness in import demand now and through the rest of the year."

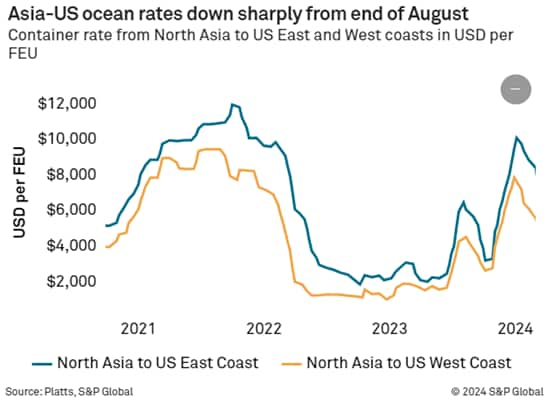

It might also account for rates that have fallen 49% to the East Coast and 25% to the West Coast since Aug. 30, according to Platts, a Journal of Commerce sister company within S&P Global.

The East Coast spot rate as of Oct. 7 was $4,300 per FEU, Platts data showed, with the West Coast rate at $4,200. The near parity of rates is unusual because the East Coast typically carries a nearly $1,000 per FEU premium to the West Coast rate.

Doubts about upcoming GRI

Sources, meanwhile, say at least two trans-Pacific carriers have announced a $600 per FEU general rate increase (GRI) to the West Coast effective Oct. 15, but there is widespread skepticism that the GRI will hold because imports are expected to diminish next month.

"[Carriers] are trying to push the market in a direction where it doesn't make sense to go, based on what we're seeing in demand," said Benton Kauffman, senior vice president/head of trans-Pacific air and sea for US logistics at DSV Global Transport and Logistics.

Furthermore, while they're trying to raise rates, most carriers are offering special ad hoc "bullet" rates that undercut the posted spot and freight-all-kinds (FAK) rates.

"While the carriers are trying to keep the rates up, they're cutting deals at the same time," Jon Monroe, who serves as an adviser to non-vessel-operating common carriers (NVOs), told the Journal of Commerce.

Carriers since late spring have been offering bullet rates that are hundreds of dollars lower than the listed spot/FAK rates, especially to the West Coast, where space on vessels is plentiful because carriers this year have launched or reinstated 10 services. It makes sense that carriers are attempting to keep their FAK rates from sinking lower because not all NVOs qualify for the bullet rates either because of the port pairs involved or because they lack the volume carriers are looking for, Monroe said.

Forwarders and logistics consultants say West Coast volumes should remain elevated through the end of the month before dropping into November. "October is still strong," said Sanjay Tejwani, CEO of 365 Logistics. "A lot of volume was [diverted] to the West Coast, so they're still enjoying a strong October."

Peak season surcharges heading lower?

In addition to FAK rates sinking lower in November, peak season surcharges (PSSs), which are applied to NVOs' fixed rates — also known as named account (NAC) rates — are expected to be under pressure next month.

Most carriers on May 1 implemented a $2,000 per FEU PSS on forwarders' NAC rates, and those charges have generally held. Some carriers are telling forwarders they are willing to lower the PSSs effective Nov. 1, said Christian Sur, executive vice president for ocean freight contract logistics at the NVO Unique Logistics International.

"They may come down to $1,200 to $1,500 after Oct. 31," Sur said. The combined NAC plus PSS rate of about $3,000 per FEU will still be lower than the listed FAK rate of about $4,200 per FEU to the West Coast, Sur said.

"By and large, November and the first half of December will be pretty quiet," said James Caradonna, executive vice president of the forwarder M&R Spedag Group.

The Lunar New Year holidays, when many factories in Asia close for a week or two, will begin on Jan. 29, so imports of spring merchandise are expected to begin moving in mid-December.

Forwarders anticipate a traditional pre-Lunar New Year spike in imports to both coasts, unless the tentative contract between the ILA and employers on the East and Gulf coasts shows signs of fraying as the Jan. 15 deadline to finalize the agreement approaches.

If tangible signs of progress in the negotiations are not being shown by about mid-December, retailers could begin to route discretionary cargo through the West Coast, said Rachel Shames, vice president of pricing and procurement at the forwarder CV International.

"The ILA deadline is the only wildcard," Shames said.

*This article was previously published by The Journal Of Commerce (JOC) in October 10, 2024

*Authors: Bill Mongelluzzo and Laura Robb from the Journal Of Commerce

Subscribe now or sign up for a free trial to the Journal of Commerce and gain

access to breaking industry news, in-depth analysis, and actionable

data for container shipping and international supply chain

professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fheavy-frontloading-sets-up-usasia-trade-for-falling-rates-impo.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fheavy-frontloading-sets-up-usasia-trade-for-falling-rates-impo.html&text=Heavy+frontloading+sets+up+US-Asia+trade+for+falling+rates%2c+imports++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fheavy-frontloading-sets-up-usasia-trade-for-falling-rates-impo.html","enabled":true},{"name":"email","url":"?subject=Heavy frontloading sets up US-Asia trade for falling rates, imports | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fheavy-frontloading-sets-up-usasia-trade-for-falling-rates-impo.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Heavy+frontloading+sets+up+US-Asia+trade+for+falling+rates%2c+imports++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fheavy-frontloading-sets-up-usasia-trade-for-falling-rates-impo.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}