Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Nov 12, 2018

Trade Policy Insights: New TPP trade agreement – ‘No’ to Protectionism

Author: Daniela Stratulativ, Head of Global Trade Analysis | IHS Markit Maritime & Trade

Key points:

- New TPP - the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) will enter into force December 30th. CPTPP has been ratified by Australia, Canada, Japan, Mexico, New Zealand, and Singapore. In process of ratifying: Chile, Malaysia, Brunei, Peru and Vietnam.

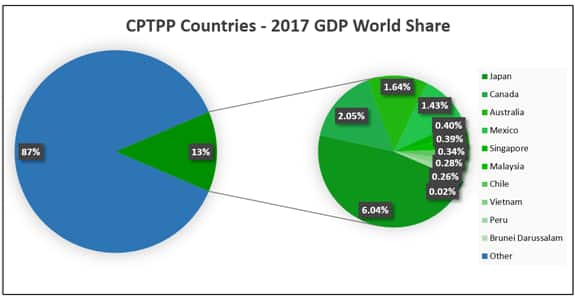

- Signatories represent 13% of world GDP and markets of close to 500 million people.

- Sends a powerful message: openness to trade leads to economic growth.

- Sectors with highest trade volumes are energy and mining, chemicals, wood and paper, vegetable products, metals and metal products. Trade is likely to shift from CPTPP countries' trade partners to CPTPP parties.

- US exports will be less competitive in CPTPP countries, with the exception of Canada and Mexico, which are part of the USMCA. China has free trade agreements with some of the CPTPP nations.

What is the CPTPP?

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) was originally called the Trans-Pacific Partnership (TPP). The original TPP was signed on February 4, 2016, by 12 parties: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam. On January 30, 2017, the United States withdrew from the TPP.

The TPP was originally conceived by the US as a rule-based countermeasure to China's growing influence in Asia. The TPP would have created an incentive for China to open its market and liberalize its policies in an effort to qualify for TPP membership.

The CPTPP incorporates, by reference, the provisions of the Trans-Pacific Partnership (TPP) agreement, with the exception of a number of provisions pertaining mainly to intellectual property and investor-state dispute settlement, whose application will be suspended once the CPTPP comes into force. These provisions will be suspended until all the parties decide otherwise.

In addition to lowering tariffs and opening markets, the agreement will also introduce new labour standards and force governments to introduce competition in sectors previously protected.

The CPTPP has been ratified by six of the 11 countries and will enter into force on Dec. 30, 2018. The agreement was ratified by Japan, Mexico, New Zealand and Singapore, Canada, and Australia. The deal also includes Chile, Malaysia, Brunei, Peru and Vietnam. Each country will join after it has ratified, but will see a delay in tariff reductions when compared to the initial six.

Market share and opportunities

The CPTPP trading bloc consists of 11 countries with a total of 495 million people and GDP of 10.4 trillion USD, representing 13% share of world GDP.

In 2017, world total GDP was 80 trillion USD. The largest economies in the CPTPP are Japan with 4.9 trillion USD, Canada with 1.6 trillion USD, Australia with 1.3 trillion USD, and Mexico with 1.1 trillion USD.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

In the current international trade environment dominated by the US-China trade war and the challenges of Brexit, the agreement sends a powerful signal to the rest of the world. It shows that a number of large economies are resisting protectionism. Openness to trade and investment remains one of the best tools to harness globalisation and create more economic growth and jobs. It is estimated the agreement will lead to increase in GDP in the 11 countries.

What is the impact on US and China?

US exports will be less competitive in CPTPP countries, with the exception of Canada and Mexico, which are part of the USMCA. China has free trade agreements with some of the CPTPP nations: Australia, New Zealand, Singapore, Chile, and Peru. In addition, Singapore, Brunei, Malaysia, and Vietnam are part of the China-ASEAN free trade agreement. However, China does not have agreements with the largest economies in CPTPP: Japan and Canada, and does not have an agreement with Mexico, which is the fourth largest.

How will tariffs be reduced?

Ten of the 11 countries apply a calendar tariff year, which means tariff reductions can only occur every January 1. Japan's tariff reductions will occur on April 1 of each year.

Upon entry into force on December 30, 2018, an initial round of tariff reductions will occur. That initial reduction will be followed by a progressive elimination schedule beginning in "Year 2", that is, the year after the year in which the agreement enters into force. For all ratifying parties except Japan, the first subsequent tariff reductions will therefore occur on January 1, 2019, only two days after the agreement enters into force. Japan's second reduction will occur on April 1, 2019. Annual tariff reductions will continue for 15 years on January 1 (and April 1 for Japan).

Value, volumes, and top sectors where trade is likely to shift from CPTPP countries' trade partners to CPTPP parties

Following is the analysis for the 6 countries that ratified the CPTPP and will implement reductions in tariffs effective December 30th.

Australia

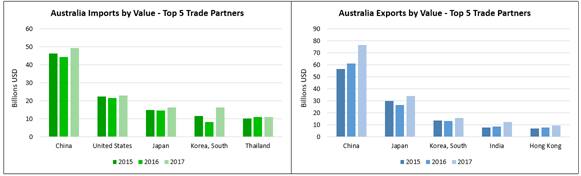

In 2017, Australia imports reached over 221 bn USD, an increase of 17% compared to the previous year. Exports totaled 231 bn USD, 20% higher than 2016 exports.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

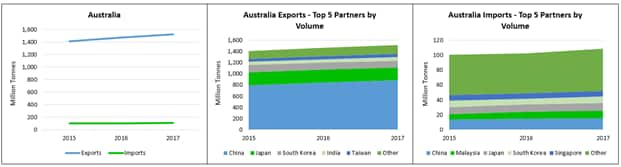

The sectors with the largest volumes of exports are energy and mining with 1.4 bn tonnes, vegetable products with 38 million tonnes, and wood and paper with 17 million tonnes. Highest imports are recorded in the energy and mining sector, with 57 million tonnes, chemicals with 19 million tonnes, and glass and non-metallic products with 7.3 million tonnes.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

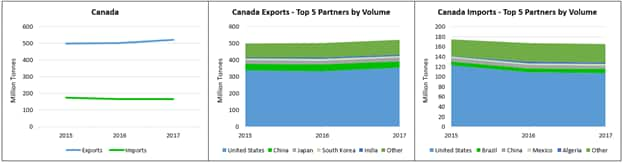

Canada

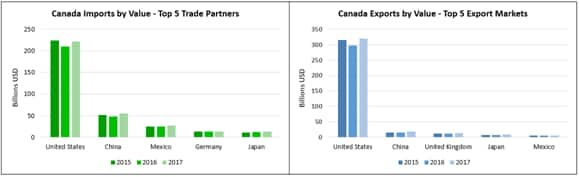

In 2017, imports were close to 433 bn USD, an increase of 7.4% compared to the previous year. Exports reached close to 421 bn USD, 8% higher than in 2016.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

The sectors with largest volumes of exports are energy and mining with a total of 333 million tonnes, vegetable products with 60 million tonnes, wood and paper with 48 million, and chemicals with 38 million tonnes. The top sectors for imports are energy and mining sector with 86 million tonnes, chemicals with 18 million tonnes, vegetable products with 16 million tonnes, and metals with 12 million tonnes.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

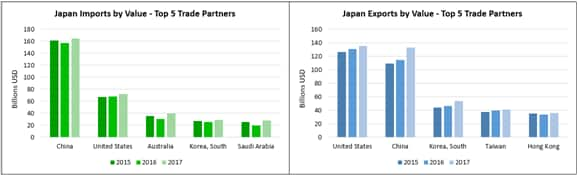

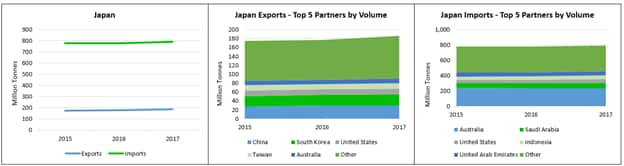

Japan

Japan imports reached 672 bn USD in 2017, an increase of 11% over the previous year. Exports increased by 8% compared to 2016, reaching 698 bn USD.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

Highest levels of exports were recorded in the following sectors: metal products with 57 million tonnes, energy and mining with 44 million tonnes, chemicals with 30 million tonnes, transportation equipment and parts with 20 million tonnes, glass and non-metallic products with 13 million tonnes.

The sectors with the largest volumes of imports are energy and mining with 650 million tonnes, vegetable products with 47 million tonnes, and wood and paper products with 30 million tonnes.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

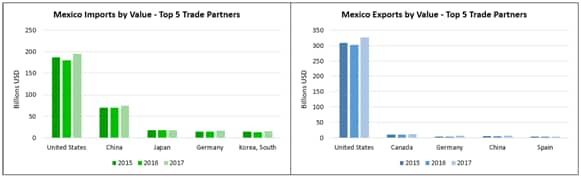

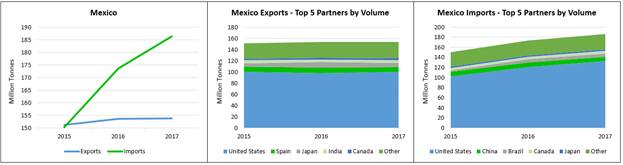

Mexico

In 2017, imports reached 420 bn USD, an increase of 8.6% over the previous year, and exports grew at 9.48% compared to 2016, reaching 409 bn USD.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

The sectors with the largest volumes of exports are energy and mining with 83 million tonnes, vegetable products with 19 million tonnes, chemicals with 10 million tonnes, transportation equipment and parts with 9.7 million tonnes.

Imports were highest in energy and mining reaching 76 million tonnes, vegetable products with 38 million tonnes, chemicals with 25 million tonnes, and metals and metal products with 19 million tonnes.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

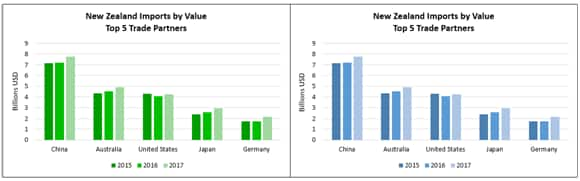

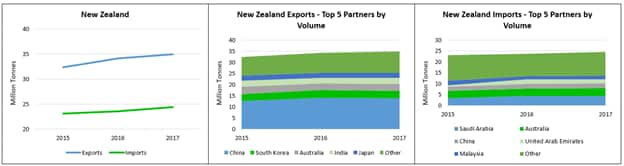

New Zealand

Imports reached 40 bn USD in 2017, an increase of 11% over the previous year. Exports totaled 38 bn, a 13% increase over 2016.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

The sectors with the largest volumes of exports are wood and paper with 21 million tonnes, animal products with 5 million tonnes, and energy and mining with 3 million tonnes.

Imports were highest in the energy and mining sector, reaching 10 million tonnes, chemicals with a total of 5 million tonnes, and vegetable products with a volume of 4.3 million tonnes.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

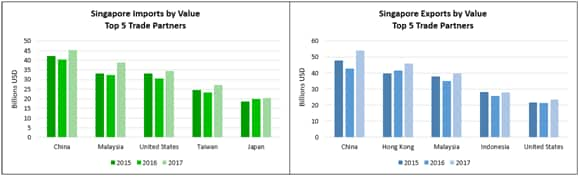

Singapore

Imports reached 328 bn USD in 2017, an increase of 16% over the previous year. Exports totaled 373 bn USD, an increase of 13% compared to 2016.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

Largest volumes of exports and imports were recorded in energy and mining with 94 million tonnes exports and 192 million tonnes imports, followed by chemicals with 18.5 million tonnes exports and 11.4 million tonnes imports.

Source: IHS Markit © 2018 IHS Markit

Source: IHS Markit © 2018 IHS Markit

This column is based on data from IHS Markit Global Trade Atlas (GTA) and World Trade Service (WTS).

Risks, opportunities, impact on supply chains and shipping industry can be identified for any products at 6-digit code level within GTA. Insights can be complemented with bill of lading data from PIERS and vessel movements via AIS.

We provide The New Intelligence for strategic decision-making to over 50,000 customers in 140 countries - Governments and private sector, including 80% of Global Fortune 500 companies.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-new-tpp-trade-agreement.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-new-tpp-trade-agreement.html&text=Trade+Policy+Insights%3a+New+TPP+trade+agreement+%e2%80%93+%e2%80%98No%e2%80%99+to+Protectionism+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-new-tpp-trade-agreement.html","enabled":true},{"name":"email","url":"?subject=Trade Policy Insights: New TPP trade agreement – ‘No’ to Protectionism | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-new-tpp-trade-agreement.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+Policy+Insights%3a+New+TPP+trade+agreement+%e2%80%93+%e2%80%98No%e2%80%99+to+Protectionism+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-new-tpp-trade-agreement.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}