Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 22, 2020

Trade in 2020 - the initial results and possible scenarios forward

Key points:

- After an already sluggish 2019 a major upturn was expected in global trade in 2020; COVID-19 pandemic, the biggest black swan in a century, destroyed it

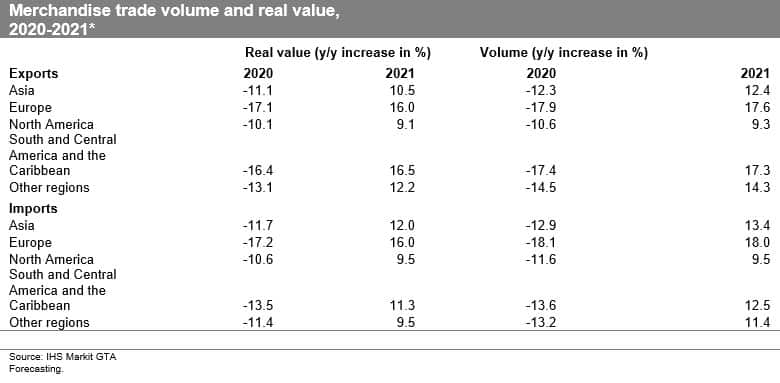

- World merchandise trade is expected to fall in real value by 13.6% in 2020 due to the COVID-19 pandemic

- A major recovery in trade is expected in 2021; its actual size will depend on the severity and the actual duration of the outbreak and the effectiveness of the policy responses worldwide

- The pandemic is affecting all regions; however, the severity of the impact is asymmetric with Europe being hit the hardest

- The available Q1 2020 results from the IHS Markit Global Trade Atlas as reported by national sources point to a significant and asymmetric shock in the first quarter of the year

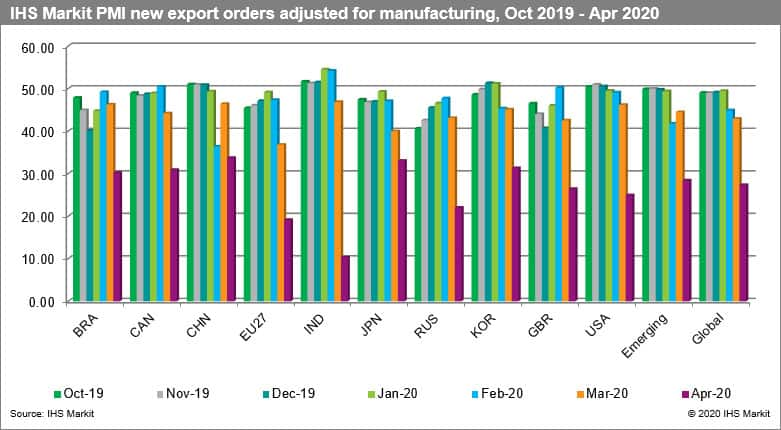

- PMI new export orders adjusted for most of the states in April 2020 is significantly below the 2009 levels indicating the size of the downturn; as the most prominent leading indicator it points to the possible bottom in Q2 2020

- The impact on trade will be larger on sectors (products) with more complex and geographically dispersed forward and backward linkages in the global value chains (GVCs)

- The impact will be direct due to restrictions on trade and production imposed as well as indirectly due to the impact on global demand

- The impact is not restricted to merchandise trade only; certain services sectors, such as passenger air transport, will be more adversely affected

- We now expect the value of global trade to reach USD 16,397.6 billion in 2020 (down by USD 3,037.1 billion in comparison to our last forecast) and the volume of global trade to fall to 12.1 billion metric tons

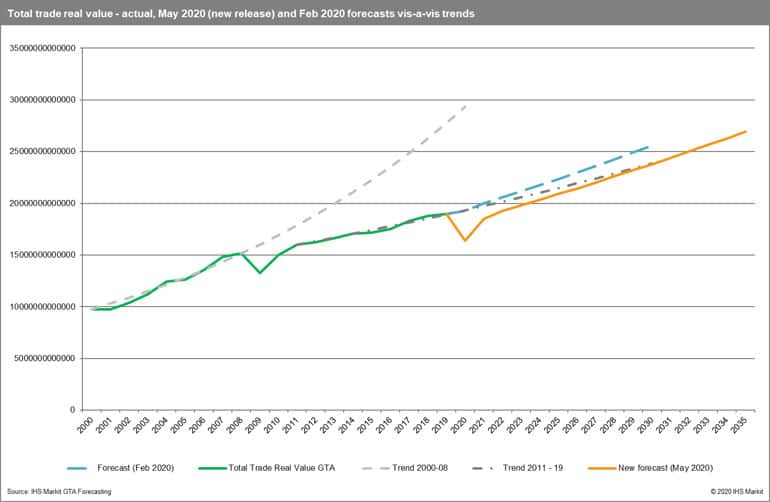

- The V shape recovery is expected; however, the trade levels are unlikely to reach the pre-COVID-19 path with a permanent gap in the trajectory of approx. 1.8 trillion USD and CAGR of 2.8% for 2021-2030; the forecasted average growth rate is very similar to our previous forecast

- Our forecast is closer to the "optimistic" scenario of the recent trade forecasts provided by the World Trade Organization

Main report

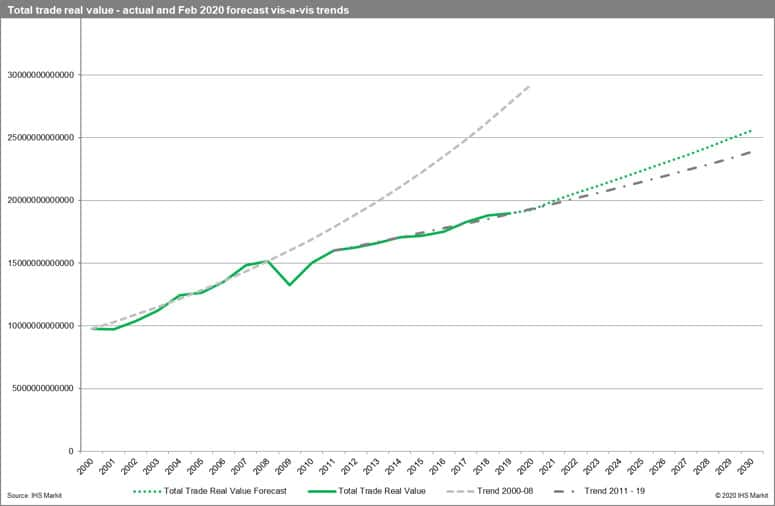

After an already sluggish 2019, a major upturn was expected in global growth and trade in 2020. As can be seen, the real trade value never recovered to the pre-financial crises' trajectory. The trend for 2010 - onwards was significantly below the prior trajectory. Our prior forecast predicted it to be above the CAGR 2010-19 and global trade to reach 25.2 trillion USD in 2029. COVID-19 pandemic, the biggest black swan in a century, destroyed it. Global trade collapsed in Q1 of 2020 though asymmetrically. The Q2 2020 results are likely to be much worse. We are very likely to find ourselves on a new trajectory - flatter than the preceding one and with a significant and increasing gap.

This year global economy is driven by the path of the pandemic and the policy response actions of individual countries as well as multinational organizations. Social distancing requirements, restrictions on the movement of people, stricter rules on goods transport, and forced production shutdowns, mean those whole sectors of services and manufacturing have been adversely affected. On the other hand, certain categories of commodities benefit (for instance IT communication equipment and services due to forces digital transformations of the whole sector of activities, certain medical goods, e-commerce, etc.).

The crisis is far from the end with several scenarios still possible and potential recovery in Q3, Q4, or sometime in 2021 and unfortunately possible second and further waves of the pandemic with a vaccine as an only permanent solution. For the time being, we have to learn how to function with COVID-19 and how to adjust our businesses, production, and logistics chains. The long-term impact of this unpredicted event will likely be much larger than was expected in the early days of this year. The so-called "new normal" is likely to emerge.

This is a global health crisis on an unprecedented scale affecting the very core of our globalized economy, disrupting global value and logistic chains. Despite the prior voices of its possibility, we, as humanity, were not prepared for it and thus are trying now to adjust. The unpredictability and uncertainty of the event make our efforts harder. On the positive note, if we manage to bring the situation under control, we will be better prepared for the possible shocks of similar nature in the future.

In the present report, we will try to utilize various data sources and results of predictive models, provided by IHS Markit experts, to identify the impact of the pandemics so far and to present the most possible scenario forward. Taking the uncertainty linked to the ongoing pandemics, the predictions have to be treated cautiously.

Trade in Q1 2020

By now, the impact of COVID-19 pandemics on the global economy is already larger than the impact of similar events in the past - in particular the outbreaks of SARS and MERS. The decline in the global economy is likely to be significantly larger than the impact of the global financial crisis of 2008-09.

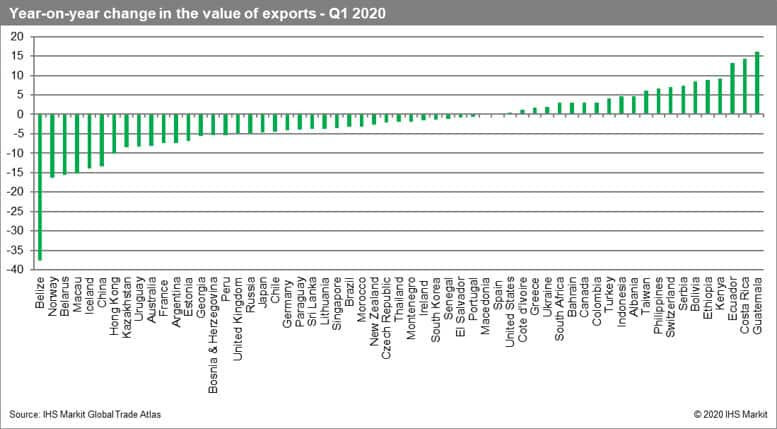

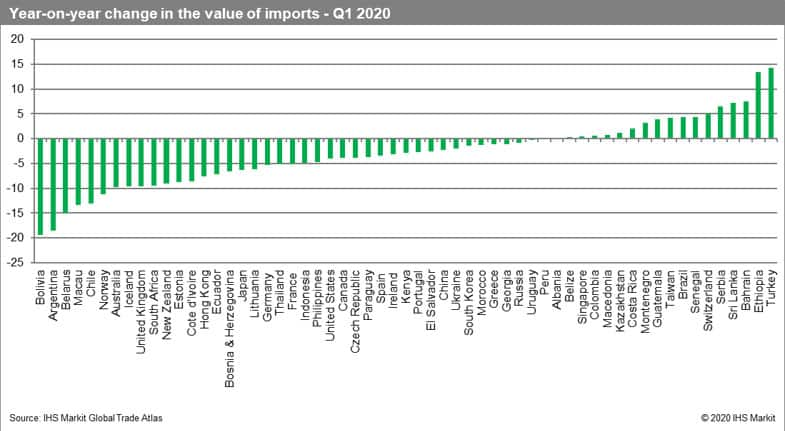

Taking into account the different reporting schemes of countries, using the IHS Markit Global Trade Atlas monthly data we estimated the trade pattern in Q1 of 2020. Please note that we only present reporters with full data for the first quarter of 2020 or two initial months (March data missing) and compare it to the data in the preceding year. The COVID-19 impact on exports and imports is asymmetric and that, at least in the first quarter, there was a significant number of countries showing year-on-year increases in both exports and/or imports. Among the worst affected exporters, we have China (mainland), Macau, and Hong Kong. The impact on Japan or South Korea was much shallower. Out of Europe, we have Norway, Iceland, and France. Italy has not reported the data yet. UK, Russia, and Germany suffered a decline of roughly 5%. American and Canadian exports grew year-on-year.

The impact is asymmetric for different types of commodities. IHS Markit Commodities at Sea data show that no extra adjustment is necessary for dry or liquid bulk with volumes partially recovering from the initial slump in January-February this year within the first quarter itself.

Discruption of global value chains

Approximately 70% of international trade today involves global value chains (GVCs) that are goods or services exported containing services, raw materials, parts, and components originally produced in other countries. Some goods are re-exported several times before reaching the final consumer. The global economy has been characterized by geographically diversified and fragmented production structures, widespread outsourcing, and other strategic linkages resulting in complex interactions among a variety of domestic and foreign suppliers. The extent of the interactions differs between commodities. Trade is likely to be more adversely affected by COVID-19 in sectors characterized by more complex backward and forward linkages in value chains. The restrictions imposed on trade and/or production (production outages) cause supply chains' disruptions which can be only partially addressed by shifting the production to other, less affected locations. The dominant paradigm of lean manufacturing and just-in-time approach with a low stock of parts proved to be very susceptible to the outbreak.

To accommodate this linkage in our forecast we took into account the data compiled by OECD in the Trade in Value Added (TiVa) database. In particular, we tried to identify the potentially most affected sectors by looking at the share of foreign value-added in gross exports. It is a foreign value-added intensity measure often referred to as the import content of exports and considered generally as a measure of backward linkages in GVC.

The extent of the linkages in the manufacturing sectors proved to be the largest in chemicals and non-metallic mineral products, computer, electronic and optical products (electronics), transport equipment with the automotive industry being most affected (manufacturing of motor vehicles, trailers, and semi-trailers) as well as in the manufacturing of basic metals and fabricated metal products.

Using various commodity-levels trackers we confirmed the impact on most of the commodities.

Trade in Q2 2020 - what are PMI new export orders showing?

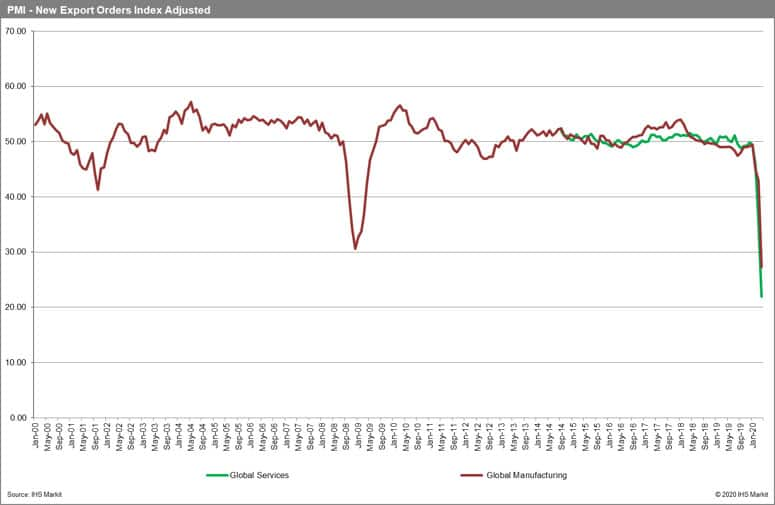

IHS Markit Purchasing Managers Indices (PMI) new export orders prove to be a very good indicator of forthcoming trade flows in the coming two, up to three months. Using the latest readouts from April 2020 we are thus able to predict the developments in trade in Q2 of 2020.

The PMI new export orders adjusted have collapsed in April 2020 with prior levels already below the benchmark value of 50.0 points indicating a major depression. The values are significantly beneath the 2008-09 readouts for both global manufacturing and services (even larger than in industry). We are thus likely to suffer the worst quarter in global trade in decades.

In addition, we show the evolution of the index for the ten largest economies of the world (responsible roughly for 75% of global trade) as well as globally and for the emerging economies over the period October 2019 - April 2020. The lowest readouts for April 2020 are for India, EU27, and Russia. The highest, still around 30.0 points, are for Asian economies - China mainland, South Korea and Japan.

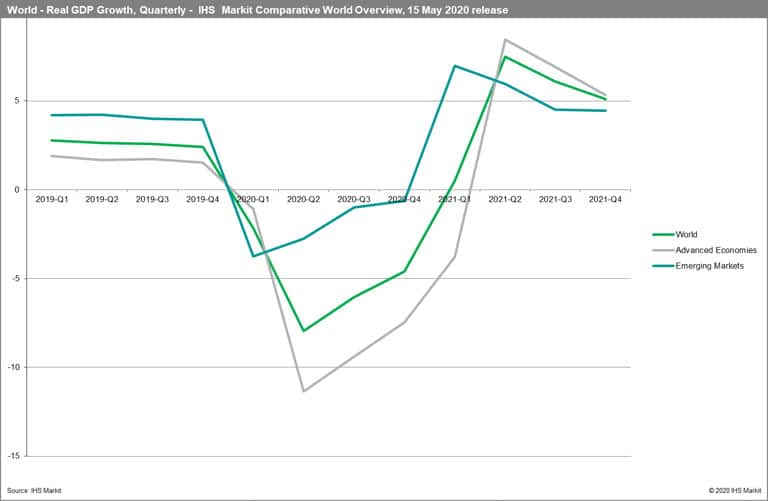

The most recent GDP growth forecasts accommodated

The relation between the growth rates observed in real GDP and growth rates observed in trade (exports and imports independently) at the country level. The multipliers show certain patterns with their values significantly higher in times of crisis. In general, trade reacts with more volatility to significant macroeconomic shocks in comparison to global production or GDP. On the basis of the most recent GDP quarterly forecasts available in IHS Markit (published on May 15), we calculated an extra multiplier to reflect this relationship.

The most recent GDP quarterly forecasts of the IHS Markit Comparative Industry division show that the decline should reach its bottom in Q2 2020 with a strong recovery predicted for 2021 Q1 only. Thus, at yearly time intervals, we are likely to see the V-pattern of the crises assuming we can bring the pandemics under control within 2020. And assuming no major secondary waves of the pandemic. appear. If, however, other waves materialize, then different, more negative scenarios would have to be adopted with U-shape or worst the L-pattern emerging.

It is also worth noting that the current crisis is mostly driven by the group of the so-called advanced economies responsible for most of the global trade. Emerging states with lower levels of participation in the global economy and global value chains are likely to be less affected.

Changes in the GTA Forecasting methodology and database

Having the opportunity, we would like to stress that in the current GTA Forecasting release (May 2020), a number of enhancements have been introduced to the GTA Forecasting database. These include:

- Extended range of the forecast until 2035

- New historical data edge - the majority of countries have been updated with the full data for 2019

- Upgraded forecasting models (SARIMAX) with additional COVID-19 impact factors (based on the most recent data from GTA, Commodities at Sea, PMI as well as macro-econometric forecasts from May 2020 as well as incorporating commodity level trackers and global value-added chains indicators)

- The updated list of exogenous variables by country (real GDP (for import models), real GDP for rest of the world (for export models), price deflators, real effective exchange rates, long-term and short-term interest rates, crude oil price and gas prices as well as average tariff rates.

World merchandise trade 2000-35

Our new forecast (released on 22 May 2020) shows that world merchandise trade is likely to go down in 2020 to USD 16,397.6 billion or by 13.6% year-on-year. In comparison to our prior forecast, it is lower by USD -3,037.1 billion or 18.5%. We expect a V like shape with recovery in 2021 and predict a year-on-year increase in the real value of trade of 12.6% in 2021 and 4.3% in 2020. The predicted CAGR for the period 2021-2030 is equal to 2.8%.

Our forecast is closer to the recent "optimistic" scenario for the development of world merchandise trade published by the World Trade Organization. However, the expected recovery (in 2021), will not be strong enough to bring trade close to its pre-pandemic trend. A new trajectory is likely to emerge.

The plunge in trade in 2020 in terms of real value puts the global economy at 2012 levels. More importantly, our model predicts a new lower trajectory of global trade development to 2035 significantly below the priorly predicted levels (in 2030 the difference is equal to USD 1.8 trillion or 7.5% of its value).

In terms of volume, we now expect global trade in 2020 to go down to 12.1 billion metric tons and to increase to 13.8 billion metric tons in 2021 and 14.3 billion metric tons in 2022. Thus, we expect a plunge of 14.3% in the global volume of trade in 2020 and the recovery in the forthcoming years with growth rates of 13.9% year-on-year in 2021 and 3.5% in 2022.

The forecasts should be treated cautiously. They are likely to be modified in the next release with the inflow of the new data reported by states. Due to the nature of the GTA Forecasting database and our modeling strategy we have decided to present the most probable scenario only. Uncertainty levels are at historically high levels. As economic developments will critically depend on the shape of the pandemic curve that at this stage cannot be fully predicted actual results could differ to our forecasts.

World merchandise trade by region

The COVID-19 pandemic is predicted to impact different regions of the world to a different extent and differ between exports and imports as well as the value and volume. For comparison purposes, we utilized the WTO definition of regions. We predict the highest decrease in volumes for Europe (-17.9%) and the South and Central America, and the Caribbean (-17.4%). North America will be the least affected (-10.6%).

In comparison to the WTO forecast, we predict a weaker recovery in 2021 for all the regions with levels of trade both in real values and volumes not returning to the pre-COVID-19 trends.

*Other regions comprise Africa, Middle East, and Commonwealth of Independent States (CIS) including associate and former member States. Asia includes Australia, New Zealand, and Oceania.

This column is based on data from IHS Markit Maritime & Trade resources including Global Trade Atlas, GTA Forecasting, and Commodities at Sea as well as other resources available from IHS Markit.

Learn more visit GTA Forecasting

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-in-2020-initial-results-and-possible-scenarios-forward.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-in-2020-initial-results-and-possible-scenarios-forward.html&text=Trade+in+2020+-+the+initial+results+and+possible+scenarios+forward+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-in-2020-initial-results-and-possible-scenarios-forward.html","enabled":true},{"name":"email","url":"?subject=Trade in 2020 - the initial results and possible scenarios forward | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-in-2020-initial-results-and-possible-scenarios-forward.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+in+2020+-+the+initial+results+and+possible+scenarios+forward+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-in-2020-initial-results-and-possible-scenarios-forward.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}