Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 08, 2024

Trade conditions remain in decline at end of 2023

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

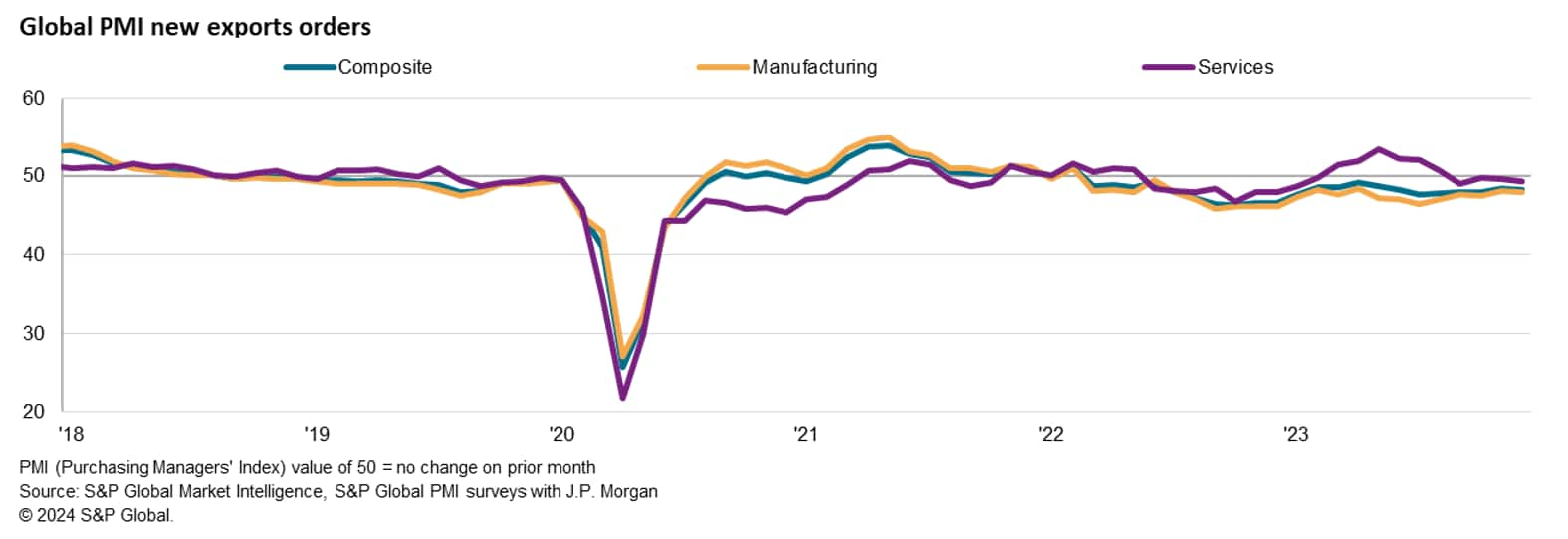

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration of global trade in December, thereby extending the sequence of decline to 22 months. The rate of contraction remained moderate, despite picking up from November, with the seasonally adjusted PMI New Export Orders Index posting 48.3, down from 48.5. The latest reading also matched the 2023 average.

Trade downturn led by falling goods exports

The latest fall in the composite global PMI New Export Orders Index was brought about by faster a reduction in trade flows in both the manufacturing and service sectors in December. That said, further signs of convergence, albeit in contraction territory, were observed at the end of 2023, bringing the gap between the two sectors to the smallest since January 2023.

Manufacturing new export orders extended the sequence of decline to 22 months in December. The rate of contracted accelerated slightly from November, but remained slower than the rolling 12-month average to signal the continued lightening-up of the goods trade decline into the yearend. Despite the pivoting of market sentiment into the end of 2023 amid rate cut expectations, demand for goods remained under pressure from past interest rate hikes. Forward-looking PMI indicators have also hinted at more conservative expectations with regards to manufacturing production. By broad product category, the intermediate goods sector was again the worst performer, followed by investment goods. Consumer goods notably recorded the slowest decline in new export orders since March 2023, resulting in only a marginal deterioration.

The basic materials sector continued to record the sharpest downturn in goods trade according to more detailed sub-sector data. This was with the chemicals sub-sector from basic materials seeing the most pronounced downturn. Construction materials and paper & timber products followed, with both reporting steep declines in December.

Meanwhile services trade deteriorated only fractionally for the fourth successive month in December, though the rate of decline accelerated slightly from November. Similar to goods producers, service providers continued to experience the cooling effect on overseas sales from high interest rates and still-elevated services inflation in December. Given this being the first year of unfettered travel around the world, January's figures will be keenly watched for the net impact of holiday-season travelling and high prices. Detailed sector data revealed that real estate, banks and tourism & recreation were among the worst performers at the end of year. On the other hand, insurance, commercial & professional services saw the fastest rise in overseas enquiries.

By broad region, both developed and emerging markets recorded lower trade activity, extending the sequence of broad-based deterioration to six months. That said, the rate of decline in emerging markets was the softest since October and marginal overall. Mild reductions in goods export orders for emerging markets continued to offset gains in the exchange of services, which accelerated in December. On the other hand, developed markets saw a sharper downturn in overall export orders as both manufacturing and service sector firms experienced steeper falls in new business from abroad on aggregate.

Euro area remains worst performer among developed markets

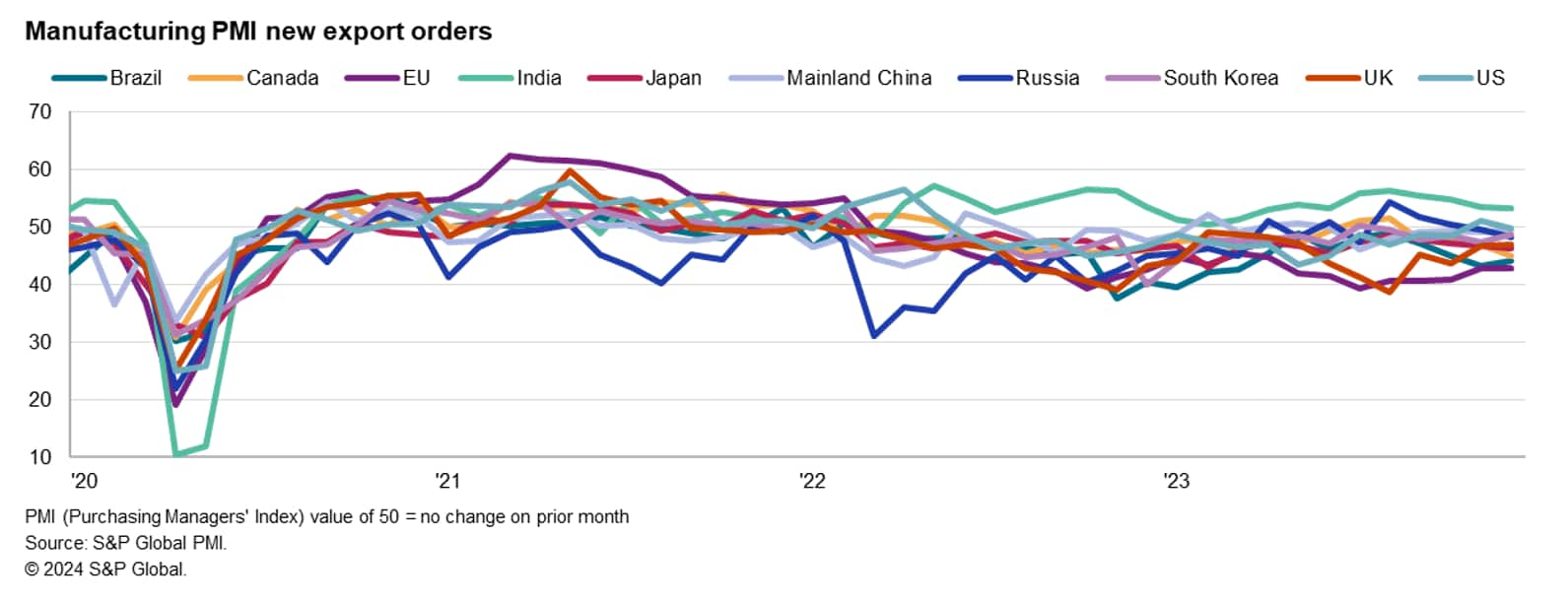

Measured across both goods and services, trade deteriorated across all the top 10 economies with the exception of India. This is with Russia and the US rejoining the majority in PMI's sub-50.0 (contraction) territory in December pertaining to the New Export Orders Index.

Among the developed markets tracked, the EU remained the worst performer at the end of 2023, as its trade downturn extended to 22 months. Furthermore, the rate of decline accelerated from November to rise above the rolling 12-month average. Incoming new orders from abroad fell especially sharply in France and Germany, with both manufacturing and service sectors reporting reduced sales from abroad. Overall, the EU recorded sharper declines in goods trade than the exchange of services.

Canada followed the EU in likewise reporting a solid deterioration in trade conditions in December. The rate at which export orders fell was notably the sharpest since June 2020. Sector trends for Canada showed divergence from the global picture with services exchange worsening at a quicker pace compared to goods. Japan also saw a solid reduction in new export orders mainly in the manufacturing sector, though services firms also recorded a third monthly fall in new export business, albeit being marginal.

The UK and Japan meanwhile saw comparatively mild declines in goods trade in December. Japan saw increased rates of decline in exports of both goods and services, but in the UK a faster fall in manufacturing export was in part countered by a mild gain in the service sector.

For the US, a renewed deterioration in both the manufacturing and service sectors were observed in December, though both export declines were slight in nature.

India the brightest spot for trade

Focusing on emerging markets, India was the only economy recording improvements in trade conditions of the four major emerging markets - Brazil, India, mainland China and Russia. The overall rate of emerging market export growth was the slowest in six months, despite being remaining substantial. This contrasted with overall new orders growth in India, which accelerated in December to a three-month high. Both manufacturing and services export business rose at slower rates in December, with manufacturing staying in the lead.

Russia and mainland China both recorded mild declines in new export orders in the latest survey period. The dip into sub-50.0 territory for the seasonally adjusted New Export Orders Index for Russia was notably the first since July and only the third in the past nine months. Quicker declines in manufacturing export orders more than offset a faster rise in services trade in December. Mainland China's service sector also saw faster growth in services new export business in December, the quickest since June. The improvement in services exchange, coupled with a slower fall in goods export orders, led to overall conditions staying almost unchanged at the end of 2023.

Brazil ranked last among both the emerging and developed economies tracked in December, with new export orders continuing to decline at a sharp rate, little changed from November. This is with Brazil's service sector recording the sharpest decline in new business from abroad for over nine-years, outside of the pandemic period. Manufacturing trade conditions also deteriorated but to a lesser extent compared with services.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-remain-in-decline-at-end-of-2023-Jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-remain-in-decline-at-end-of-2023-Jan24.html&text=Trade+conditions+remain+in+decline+at+end+of+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-remain-in-decline-at-end-of-2023-Jan24.html","enabled":true},{"name":"email","url":"?subject=Trade conditions remain in decline at end of 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-remain-in-decline-at-end-of-2023-Jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+conditions+remain+in+decline+at+end+of+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-remain-in-decline-at-end-of-2023-Jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}