Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 11, 2024

Trade conditions deteriorate for fourth straight month in September

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

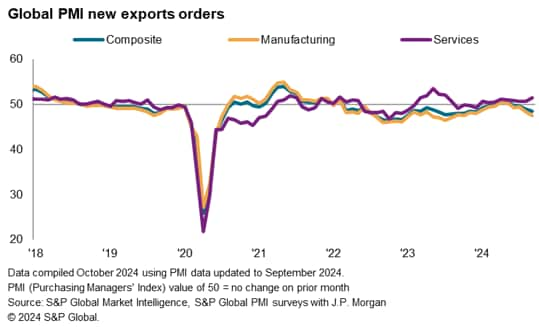

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade deteriorated again at the end of the third quarter of 2024.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 48.4 in September, down from 48.9 in August. The latest reading signalled that trade conditions deteriorated for a fourth successive month and at the most pronounced pace since December 2023. The reduction in trade activity was notably driven by deteriorations in the manufacturing sector while services export business rose at an accelerated pace.

Sharpest fall in manufacturing export orders in nearly a year

Manufacturing new export orders fell at the joint-fastest pace in 13 months in September, with the rate of reduction also matched by that in October 2023. The latest fall in export orders is aligned with a wider slowdown in manufacturing sector conditions with the J.P. Morgan Global Manufacturing PMI, compiled by S&P Global Market Intelligence, signalling the sharpest deterioration in operating conditions in nearly a year. Overall new orders in the manufacturing sector meanwhile declined for a third straight month and at the most pronounced pace since December 2022.

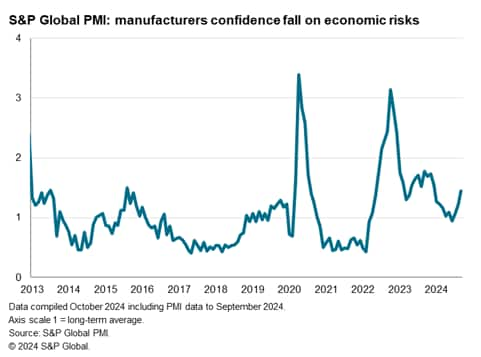

According to data compiled from panel comments, global manufacturers are seeing greater uncertainties, which affected demand. Concerns also rose surrounding economic risks, reaching the highest degree this year within the goods producing sector. At the same time, instances of safety stocks building remained below the long-run average according to panel comments, thereby suggesting that global goods producers have yet to commence restocking. The latest fall in manufacturing export orders correspond to global trade volumes falling approximately 3-4% in year-on-year terms at the end of the third quarter of 2024.

Incoming new business for services from abroad rise at quickest rate pace since July 2023

In contrast to the trend for manufacturing, the expansion of services export business accelerated for a second successive month to the fastest since July 2023. This quickening of export business expansion also contrasted with the wider slowdown in new business growth for services worldwide, albeit with the latter remaining solid overall.

More detailed sector PMI data helped to pinpoint the key areas of service export business growth, with four of the top five sectors being service sectors in September - namely commercial & professional services, industrial services, insurance and software & services. Pharmaceuticals & biotechnology had ranked fourth. On the other end, the worst performers included various manufacturing sectors such as automobiles & auto parts, forestry & paper products and metals & mining, while real estate - a service sector - was also nestled amongst which.

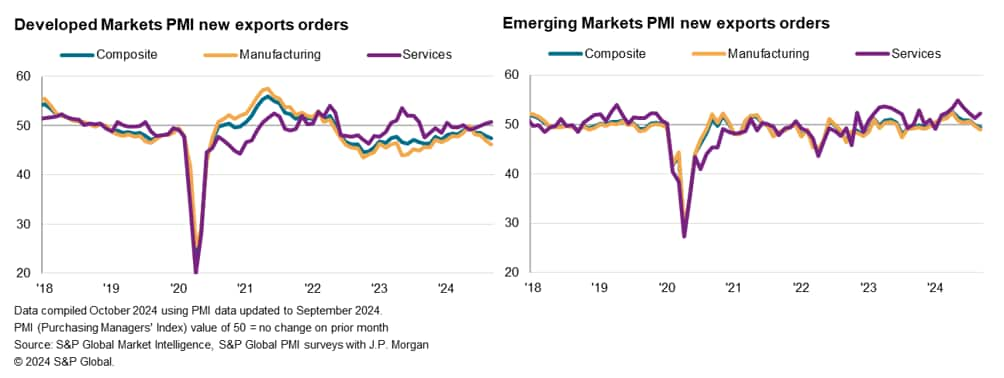

Fall in export orders quickens across both emerging and developed markets

Developed markets continued to lead the downturn in exports in September with the rate of decline accelerating to the fastest in the year-to-date. This further extended the period of developed world export contraction that commenced mid-2022. In line with the global trend, the slowdown in export conditions is centred on the goods producing sector, where export orders fell at the sharpest pace in nearly a year while services exports increased at the fastest rate since August 2023.

While developed markets led the decline, emerging markets were not spared. A second straight month of falling export business was recorded in September, and one which the most pronounced in ten months. Likewise, faster manufacturing export contraction, the quickest since August 2023, was contrasted by an acceleration in services export business in emerging economies. The deepening of the manufacturing export downturn in the emerging market space further highlighted our concerns that goods demand has continued to fall at the source.

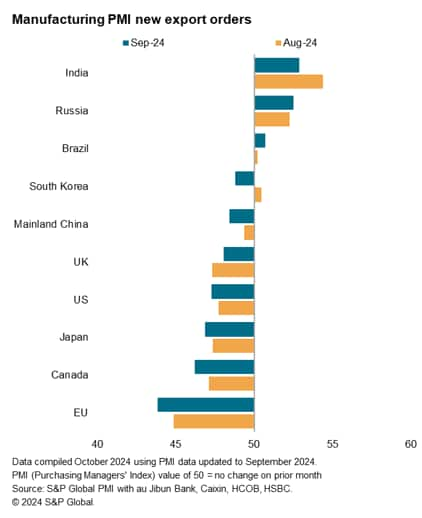

India retains thin lead for goods export orders in September

A mere three of the top ten trading economies recorded higher goods export orders at the end of the third quarter of 2024, with only India and Russia seeing noticeable improvements as Brazil recorded only a marginal rise in goods exports. While India retained the lead for a nineteenth straight month, the lead is slim as export orders growth slowed for a second successive month to softest since March 2023. According to panellists, fierce competition curbed further growth in demand for Indian manufactured goods in September, thereby contributing to the slowest expansion of the Indian manufacturing sector since January. In contrast, manufacturing export orders growth accelerated in Russia and Brazil.

Mainland China was the only major emerging market economy to record lower goods export orders among the big four, with the rate of contraction rising to a 13-month high. Heightened competition, fall in underlying demand and subdued market conditions were key drivers for the reduction in overall goods orders according to the September survey.

Meanwhile the bottom five of the list were all developed economies with EU in the lead as the fall in good export orders unfolded at a rate that was sharp and the most pronounced in nine months. This was part of a wider manufacturing downturn for the eurozone, with Germany's manufacturing PMI posting the lowest reading in nearly a year. This was followed by Canada and Japan, while the US and UK registered only modest declines in goods export orders in the latest survey period.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-deteriorate-for-fourth-straight-month-in-september-oct24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-deteriorate-for-fourth-straight-month-in-september-oct24.html&text=Trade+conditions+deteriorate+for+fourth+straight+month+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-deteriorate-for-fourth-straight-month-in-september-oct24.html","enabled":true},{"name":"email","url":"?subject=Trade conditions deteriorate for fourth straight month in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-deteriorate-for-fourth-straight-month-in-september-oct24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+conditions+deteriorate+for+fourth+straight+month+in+September+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-conditions-deteriorate-for-fourth-straight-month-in-september-oct24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}