Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 10, 2025

Tracking tariff impact via the PMI: Assessing US inflationary trends through PMI indicators

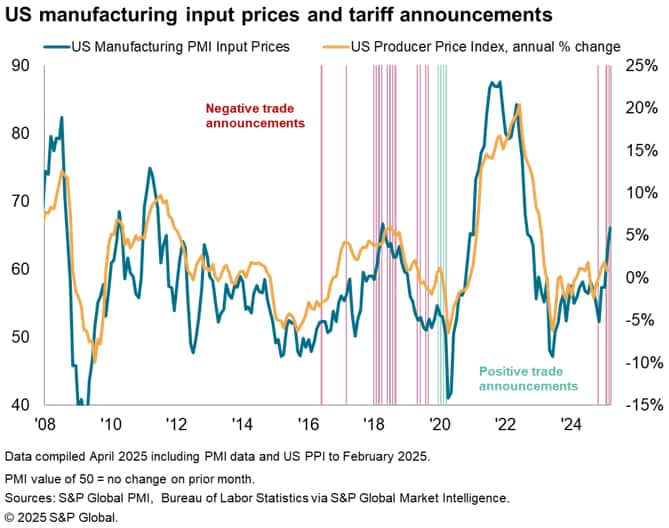

The US PMI data for March signalled that tariffs are already having a notable impact on companies' input costs, especially manufacturers, who are bearing the burden of rising import fees. Factory input prices increased at the sharpest rate since August 2022, and the rate of inflation already almost matches the 2018 peak observed during President Trump's first term tariffs.

Tariffs announced prior to the closure of the March PMI survey include measures on imports from China, Canada and Mexico, as well as tariffs on steel and aluminium. The additional tariffs announced on 2nd April are likely to eclipse these in their economic impact.

We have previously explored how our suite of PMI survey-based indicators will be vital for understanding how businesses are being impacted by protectionist policieshere. In this report, we focus on how the PMIs can be used to monitor the impact on prices in the US.

Why track with the PMIs?

The ability to track price pressures in the US and understand the policy implementations such as interest rate decisions has rarely been more important. Business surveys offer these crucial insights by directly asking firms to state any monthly changes in input and output prices, as well as the reasons behind these fluctuations.

The S&P Global US PMI is a monthly survey of around 1,000 US private sector businesses. As well as asking about prices, the survey questions firms about changes in output, new orders, employment and capacity. Data are normally released up to three working days after the survey month (one working day for manufacturing), with preliminary 'flash' data published about one week prior to the end of the reference months, which makes the PMI a very timely indicator of business conditions.

A similar survey on US business conditions is also published by the ISM. In comparing these two surveys we have previously noted how the S&P Global PMI offers benefits such as earlier publication, lower volatility and higher correlations with comparable official data.

Input prices

The US PMI Input Prices Index is the first port of call for assessing the tariff impact on inflationary pressures as it is a direct measure of changes in business costs. In March, this index rose sharply to signal the fastest rate of increase in input prices faced by US firms for almost two years.

The rise was observed in both services and manufacturing, although it was unsurprisingly the latter sector which saw a bigger spike. In fact, barring the pandemic, the pace of factory input cost inflation was the highest since April 2018, which was the peak observed in the first round of US tariffs. The historical relationship with US producer price inflation suggests that the latter could rise sharply to exceed 5% per annum in the coming months.

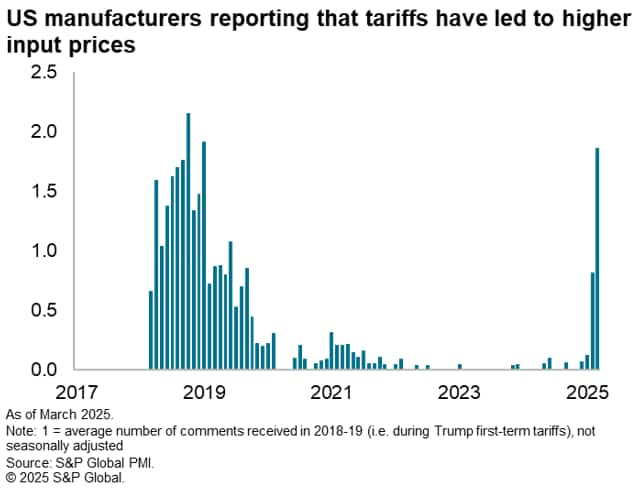

Comments from the PMI survey panel show that tariffs on imported items were the key driver of higher input prices. Around a third of reasons given by producers for an increase mentioned "tariffs", which is already higher than the average seen in 2018-19 during first-round tariffs.

As tariffs on a much wider range of US trading partners are expected to take effect in April, with a 10% baseline tariff on all goods, the impact on US manufacturers is likely to intensify.

Output Prices

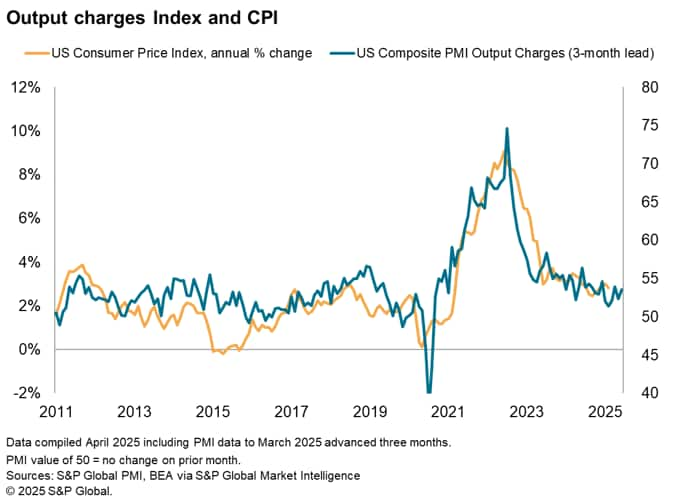

The extent to which higher input prices are passed on to customers can be easily tracked by the PMI Output Prices Index. This index tracks average selling prices for goods and services and is a useful leading indicator of consumer price inflation.

Back in 2018, the US PMI Output Prices Index was broadly consistent with the empirical consensus that tariffs had only a modest impact on consumer prices, with studies generally showing a one-off impact of less than 1%. However, there are reasons to suggest the impact this time will be larger. First, the tariffs being imposed are far larger and broader, giving domestic firms fewer options to reroute supply chains in order to avoid paying duties.

Second, the PMI data hint that charges at factory gates are already rising sharply. In March, the rate of manufacturing output price inflation accelerated to its fastest since February 2023 and was already much quicker than its long-run trend. Downstream sectors such as services are therefore likely to feel the pinch on their balance sheets, especially as April 2nd tariffs come into effect. Indeed, the Services PMI Input Prices Index was at an 18-month high in March, which generally leads to a faster increase in output charges.

Broad Sectors

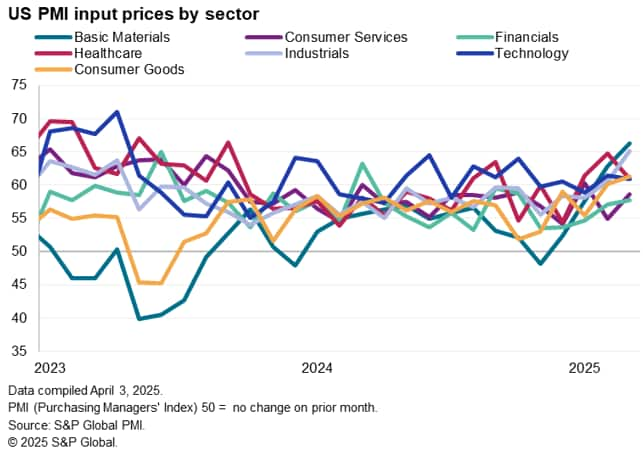

One advantage of the S&P Global PMI is the ability to track economic conditions by sector. The US Broad Sector PMIs provide this added insight at a crucial time as the US has already applied tariffs to specific sectors or goods such as metals and vehicles.

In March, the data showed that input price pressures were strongest at basic materials firms, which recorded the fastest overall rise in input prices in two-and-a-half years. Industrials firms also registered a steep uptick in costs - inflation here was the quickest seen since April 2023. The only broad sector to see inflationary pressures fall was Technology.

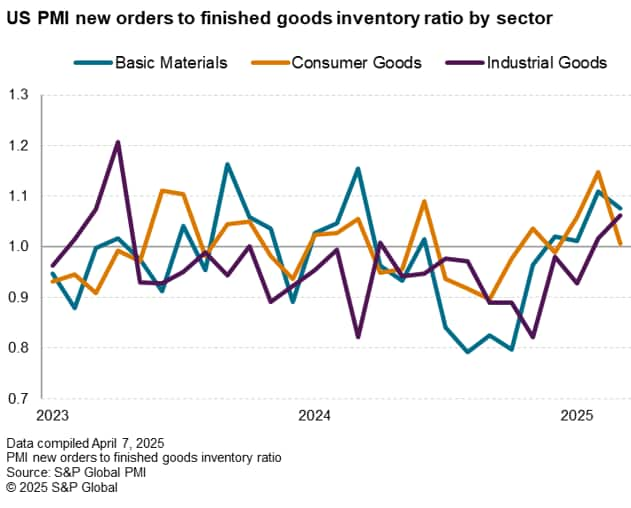

Another useful insight from the Broad Sector PMIs is how inventory levels in each manufacturing sector compare to demand, which can be tracked via the New Orders to Inventory Ratio. A weaker ratio shows that the accumulation of finished goods stocks is currently faster than new orders growth, which suggests that firms in this sector may be able to utilise existing stocks and delay the impact of tariffs on their costs. Most sectors were close to parity in March, with a notable fall in the Consumer Goods sector indicating there may have been some efforts to stockpile goods in order to soften future price impacts.

Commodity Price Pressures

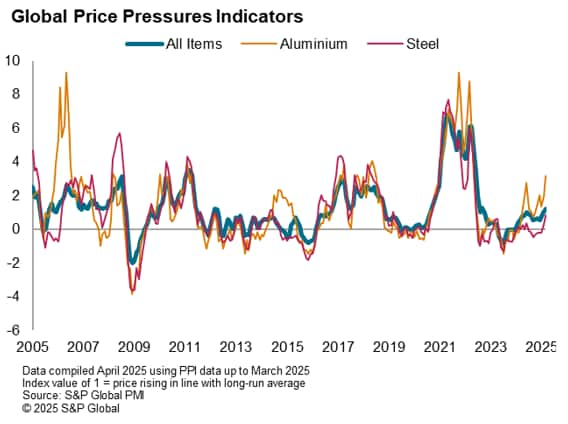

As well as hitting specific sectors, US tariffs are also expected to have diverging impacts on different commodities. Our suite of Global Price Pressures Indicators showed that rising import duties on aluminium and steel led to greater reports of price pressures faced by manufacturers worldwide in March. These indicators will also be useful for monitoring the impact of volatility in commodity markets during April following the 'liberation day' announcements, which sent many commodity prices into freefall, something which could act to dampen the wider inflationary impacts of tariffs.

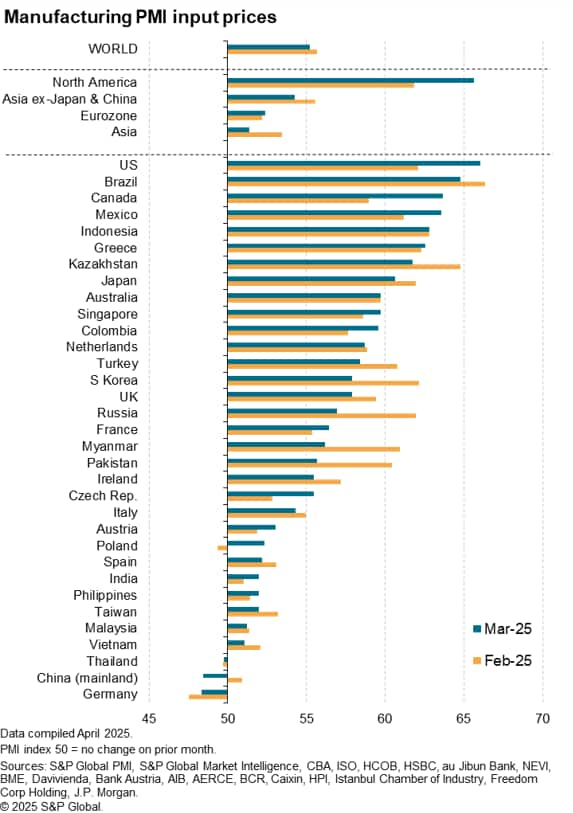

Outside of US

Manufacturing input cost inflation in the US was the highest recorded worldwide in March, surpassing the rates seen in all 33 economies surveyed by S&P Global for the first time since 2008. Elevated inflation was also observed in Canada and Mexico, which occupied the third and fourth spots in the global country rankings respectively. This highlights the immediate impact of reciprocal measures, as well as disrupted supply chains and client uncertainty in the North American market.

By contrast, there were only modest rates of inflation in the EU and APAC regions, with mainland China even registering a decrease in input costs. Mainland China holds a large trade surplus with the US and so should be less impacted on price by their recently announced reciprocal tariffs on US goods than vice versa. Nevertheless, the possible escalation of tariffs and spread of measures to all trade markets is likely to greatly alter price dynamics for many sectors.

As such, and as the much wider set of nations impacted by the April 2nd tariff announcements ponder reciprocal measures, the global suite of PMI data will be a crucial tool for users to monitor global macroeconomic impacts.

David Owen, Economist, S&P Global Market Intelligence

david.owen@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-Apr25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-Apr25.html&text=Tracking+tariff+impact+via+the+PMI%3a+Assessing+US+inflationary+trends+through+PMI+indicators+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-Apr25.html","enabled":true},{"name":"email","url":"?subject=Tracking tariff impact via the PMI: Assessing US inflationary trends through PMI indicators | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-Apr25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tracking+tariff+impact+via+the+PMI%3a+Assessing+US+inflationary+trends+through+PMI+indicators+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-Apr25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}