Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2020

Top ten themes to watch in global banking for 2021

Despite unprecedented macroeconomic declines and fears of widespread banking sector stress as COVID-19 lockdowns first went into place in early 2020, financial sectors globally held up remarkably well, but will that stay the case in 2021?

Regulatory reforms that followed the global financial crisis have boosted capital buffers substantially and improved the liquidity of global banks. The absence of widespread credit booms ahead of the pandemic suggests major banks are better prepared to meet the challenge of rising bankruptcies and unemployment rates that will follow the current recession.

That doesn't mean the global financial sector won't face challenges in 2021. In fact, underlying problems will take longer to unfold than real economy indicators but will materialize as support measures and regulatory forbearance start to diminish. Banks in economies with pre-existing asset quality problems and those operating in economies with potentially slow recovery from the 2020 shock - like Angola, India, Kenya, and Turkey - are likely to face a swift rise in credit risks. More resilient banking sectors will facilitate faster macroeconomic recoveries.

Overall, the global financial sector is likely to avoid major crises in 2021 - at least in advanced economies - but challenges remain immense. Below, a summary of our top ten trends to watch for in global banking for 2021.

- Regulatory support measures are likely to remain in

place well into 2021 despite positive vaccine

prospects.

As countries are imposing renewed COVID-19 driven economic restrictions, loan payment moratoriums that had expired or were close to expiring are widely being reinstituted (as in the EU) or extended (as in Saudi Arabia, the UAE and Egypt). As 2021 progresses, these measures are likely to be scaled back and become increasingly targeted on jumpstarting recovery in priority and badly-affected sectors such as services and tourism. Removing support measures prematurely would risk the financial sector amplifying the economic downturn by sharply curtailing its lending. - Despite large-scale economic declines, reported bank

impairment has not risen sharply - so far.

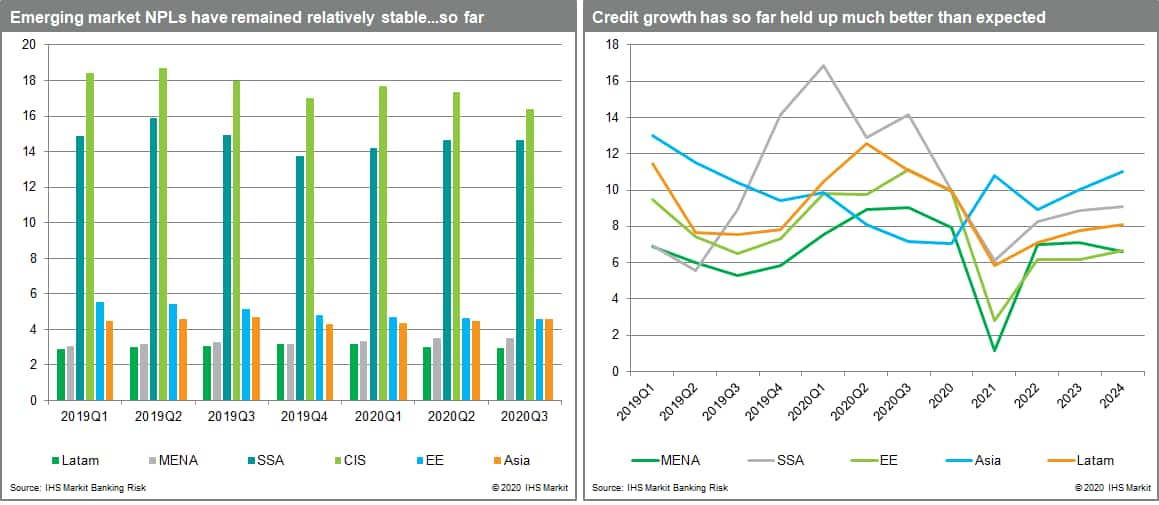

NPLs remained remarkably stable on average across both emerging and advanced economies in 2020. Extensive COVID-19 support measures have played a large role in this, and reported impairment could rise rapidly once support measures are lifted. Corporate loans are most at risk initially, but household credit quality will deteriorate if permanent unemployment rises. We envisage that NPLs will start to materialize late in 2021 if recently extended support measures are withdrawn, but is more likely in early 2022 given the extended timescale for corporate failures.

- Credit extension will slow as banks in many economies

tighten lending standards.

Despite initial fears to the contrary, banks globally expanded credit provision to the real economy in early 2020, even during the worst of the COVID-19 lockdowns. Credit growth trends exhibited more divergence in the second half of 2020, however. IHS Markit expects credit growth to decelerate further across most emerging markets throughout 2021. We are currently forecasting credit growth to decelerate across most regions in 2021. The exception could be emerging Asia where relatively fewer extreme COVID-19 related lockdowns have supported faster and earlier economic recovery. - Banking sector profits will remain

depressed.

Many banks have expanded their provisions to hedge themselves against future loan losses, depressing reported profits in 2020. Lower interest rates for lending - reflecting lower policy rates - in combination with decelerating credit growth will further depress margins in 2021. New and increased taxation on banks as governments seek ways to address their widening budget deficits could exacerbate this trend, especially in Central and Eastern Europe. - Capital buffers should remain supported even if

dividend restrictions are lifted.

In many major economies, expansionary monetary policies have pushed term debt costs sharply lower, conditions which are expected to remain in place well past 2021. This offers banks scope to arrange favorably-priced longer-term funding including the sale of capital instruments (Additional Tier 1 and subordinated debt) supporting liquidity and reinforcing capital buffers. We expect banks to maintain precautionary excess capital buffers in light of significant tail risks related to potential heavy future write-downs on corporate loans, a threat clearly flagged in advanced economy central bank stress tests. - Two-speed recovery would permit stronger banking

sectors to expand acquisitions of banks in weaker

economies.

Further compression of profits and the threat of substantial asset quality problems will accelerate banking sector consolidation both within, and between, borders - yielding increased sector concentration. Large banks in economies that achieve faster and more sustained economic rebounds, like China, or banks in economies with pre-existing expansion goals like Japan, Kenya, and the Gulf are likely to take the lead, acquiring strategic stakes in high growth potential economies. - Sovereign exposures are likely to continue growing in

emerging markets.

Banks in emerging markets, particularly Sub-Saharan Africa, Latin America and some parts of Asia, such as Pakistan, further increased their holdings of domestic sovereign debt in 2020. Several of these same governments are facing severe fiscal constraints increasing the likelihood of debt renegotiations and possible defaults - in turn threatening to damage banks' liquidity and profitability, all while crowding out private sector investment. - Renewed emphasis on bank recovery and resolution

regimes.

We expect regulators to restart efforts to upgrade local bank recovery and resolution regimes in 2021. The EU, for example, is seeking full harmonization of its framework across member states by 2024 as one of the key steps towards eventual banking union. The European Commission is also considering making a new proposal for the European Deposit Insurance Scheme, another pillar of banking union, after national governments have failed to agree on a common scheme since 2015. - Enhanced focus on ESG (Environmental, Social, and

Corporate Governance) initiatives.

Shifting focus amongst investors from COVID-19 to the environment will make ESG issues an increasing priority. Banks are likely to respond by issuing ESG-targeted debt to fund transformative economic initiatives. While this clearly is gaining focus in advanced economies, emerging markets from Hungary to Malaysia are placing greater emphasis on evaluating banks' exposure to climate related risks in particular and are encouraging funding of green initiatives through preferential capital treatment. - The global financial sector is likely to face regular

small cyber security incidents, with continuing risk of a

large-scale attack.

Branch closures in highly penetrated markets and the shift in emphasis to digital transactions is highly likely to continue. This shift increases banks' potential vulnerability to damaging cyber security incidents. During the pandemic, most cyber security frameworks have at best been marginally improved, leaving the threat of cyber security issues - such as customer identity theft, digital robbery, extorsion and data leaks - a key threat to the global financial sector and one that, at its worst, could prove globally devastating and systemically important.

You can listen to Alyssa and Senior Economist Greta Butaviciute discuss these issues in more detail on our podcast.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-ten-themes-global-banking-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-ten-themes-global-banking-2021.html&text=Top+ten+themes+to+watch+in+global+banking+for+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-ten-themes-global-banking-2021.html","enabled":true},{"name":"email","url":"?subject=Top ten themes to watch in global banking for 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-ten-themes-global-banking-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+ten+themes+to+watch+in+global+banking+for+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-ten-themes-global-banking-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}