Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2020

Brazil’s economy recovers but risks mount

- The outlook for Brazil's economy calls for growth but the widening deficit is increasing the need for fiscal prudence, implying lower public investment and signaling the inevitable end of some emergency COVID-19 stimulus measures such as cash transfers to vulnerable populations.

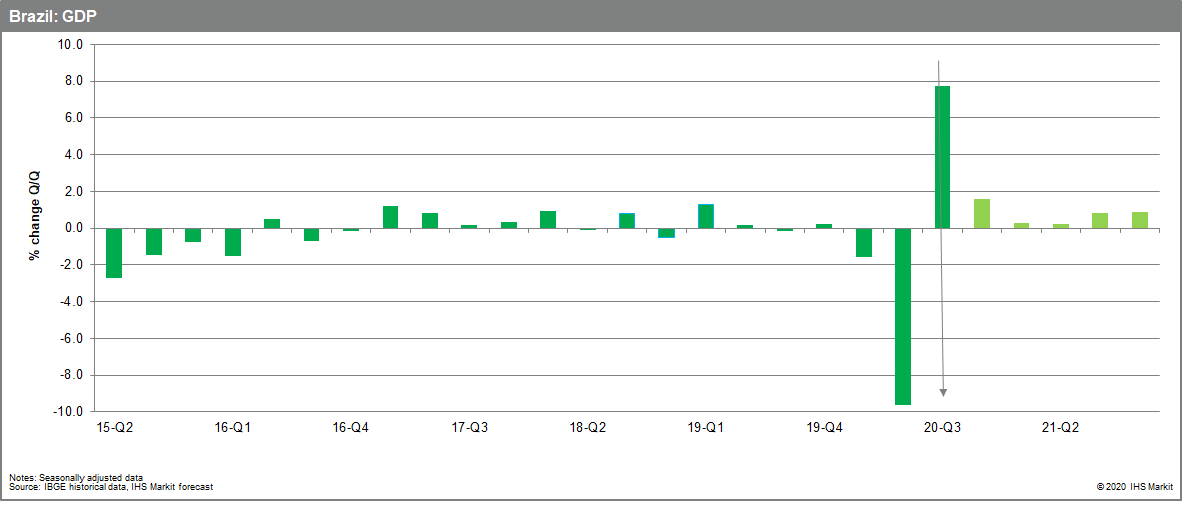

- Brazil's GDP increased by 7.7% in the third quarter of 2020 compared with the second, but it was insufficient to offset the 9.6% drop it posted in April-June. Monthly indicators show that the pace of recovery continues to slow down. The progressive withdrawal of fiscal stimulus will constrain growth in the first half of 2021, while the availability of a vaccine for the coronavirus disease 2019 (COVID-19) virus will benefit the economy in the second half of the year.

- Growth in Q3 2020 was driven by the reopening of many sectors and businesses after the lifting of the COVID-19-virus-related-lockdown, and also by the fiscal stimulus package provided by the government to help the economy navigate the pandemic. The data confirms the rebound suggested by the monthly index of economic activity (MIEA) - published by the Central Bank of Brazil (Banco Central do Brasil: BCB) - which started expanding as early as May. Still, the drop during March and April was so severe that GDP is still 4.1% lower than its fourth-quarter 2019 level.

Technically, Brazil has come out of recession, but it will take at least until late 2021 or early 2022 to return to the GDP level recorded in the fourth quarter of 2019. From a demand perspective, drivers of growth in the third quarter were private consumption (up by 7.6% q/q) and fixed investment (up by 11.0%); in both cases, only partially rebounding after plummeting in the second quarter. Brazilian consumers are benefiting from sizeable transfers from the government, though these transfers were are already declining in the last quarter of 2020. Interest rates have decreased following the BCB's decision to cut its policy rate, also benefiting consumption.

In annual terms, GDP was down by 3.9% with respect to quarter-three 2019. This figure more clearly portrays the state of Brazil's economy. IHS Markit forecasts that the economy will return to pre-pandemic levels only in early 2022.

The manufacturing Purchasing Managers Index (PMI) remained strong in November, signaling that the expansion will continue during the last quarter of the year. The service PMI also remained in expansionary territory during November; it showed that for the first time since February employment in the service sector has increased. Other sentiment indicators offer mixed signals and demonstrate the unevenness of the post COVID-19 recovery: after expanding from May through September, consumer confidence decreased in October and November (month on month); the same happened to the service sector's confidence index. Confidence in the manufacturing sector continued to expand.

In September, for the first time since the beginning of the pandemic, the labour market yielded positive results in terms of employment; the economy created 800,000 new jobs, but the absolute level of employment is still 10 million jobs below February 2020; labour market indicators usually lag the economy. On the upside of the sequence, growing employment becomes part of a virtuous cycle, as it leads to higher spending and consumption.

A major risk to Brazil's expansion in 2021 is the weak state of public finances, which require a significant effort not only in terms of the budget but also in the approval of unpopular structural reforms (in the short-term an administrative and a tax reform); if these bills are not approved by congress, it may cause a major shock to market confidence, and may lead business sentiment and investment to decline. Markets may become very volatile and Brazil's sovereign ratings may be revised downwards. Public debt in Brazil is approaching unsustainable levels and inability to quickly enact these reforms will cause Brazil to continue down an increasingly difficult financial path. The government faces additional pressure to enact these reforms quickly due to the fact that significant reforms are less feasible during an election year, which is coming up quickly in 2022.

At the same time, passage of such reforms or efforts to increase the flexibility within the budget (which would reduce the growth of various social benefits) would likely be politically unpopular and heightens the risk of social unrest. Coupled with the upcoming elections in 2022 and the already volatile environment, this could create a significant downside risk for Brazil's medium-term growth.

The outlook for the next two quarters is one of deceleration in economic growth as the fiscal stimulus measures are progressively withdrawn. IHS Markit assumes that a vaccine will be available for most Brazilians in the third quarter of 2021, which will help the normalisation of most activities, especially in the service sector.

Our latest forecast is for GDP to grow by 3.2-3.4% in 2021 after dropping by 4.6% in 2020.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazils-economy-recovers-but-risks-mount.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazils-economy-recovers-but-risks-mount.html&text=Brazil%e2%80%99s+economy+recovers+but+risks+mount+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazils-economy-recovers-but-risks-mount.html","enabled":true},{"name":"email","url":"?subject=Brazil’s economy recovers but risks mount | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazils-economy-recovers-but-risks-mount.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil%e2%80%99s+economy+recovers+but+risks+mount+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazils-economy-recovers-but-risks-mount.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}