Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2023

Supply improvement boosts global factory output, but demand continues to fall

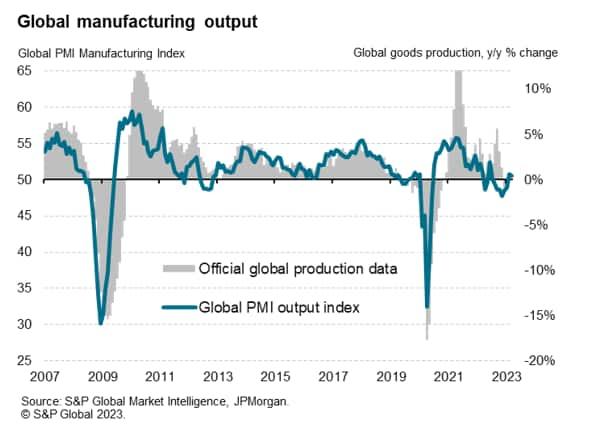

Global manufacturing output rose marginally for a second month in a row in March, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, but the nascent return to growth after the steep declines seen late last year is built on unsustainable foundations.

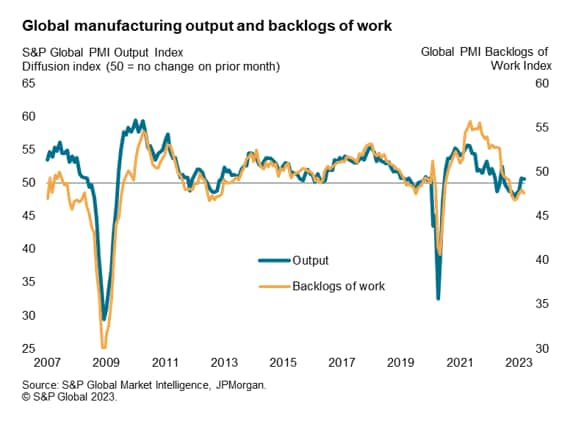

The PMI survey subindices and anecdotal evidence points to a rise in production that has been driven by improving supply chains, in turn helping companies reduce their backlogs of work, which had in many cases accumulated during the pandemic. However, new orders continued to fall in March, led by a steepening decline in global trade flows. This drop in demand is encouraging increasing numbers of companies to cut production in order to wind down their inventory holdings. Absent of a revival in new orders, global production will therefore inevitably fall once existing backlogs of work are depleted.

Global factories eke out modest output gain

Global manufacturing output edged higher for a second successive month in March, according to the latest PMI surveys compiled by S&P Global, helping to reverse some of the losses incurred over the prior six months. At 50.6, the JPMorgan Global Manufacturing PMI Output Index remained above the 50.0 threshold which separates contraction from expansion, albeit dipping from 50.7 in February to signal only a marginal expansion of factory production.

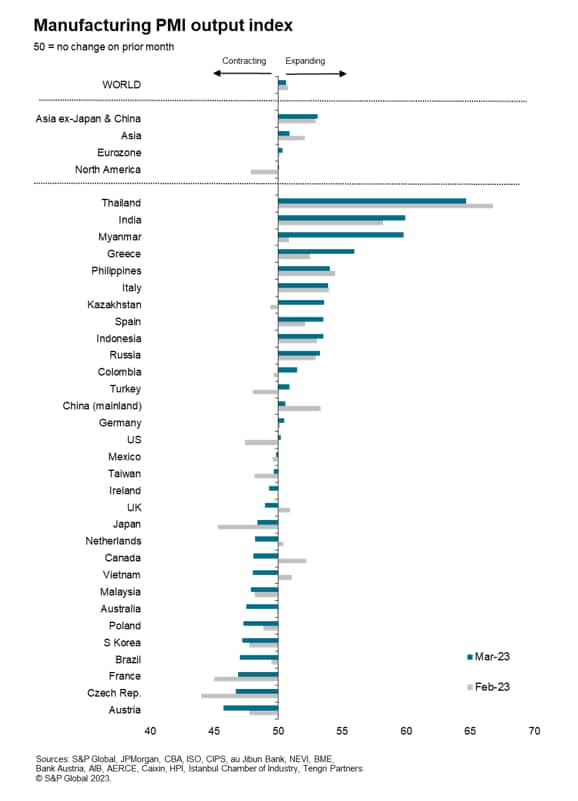

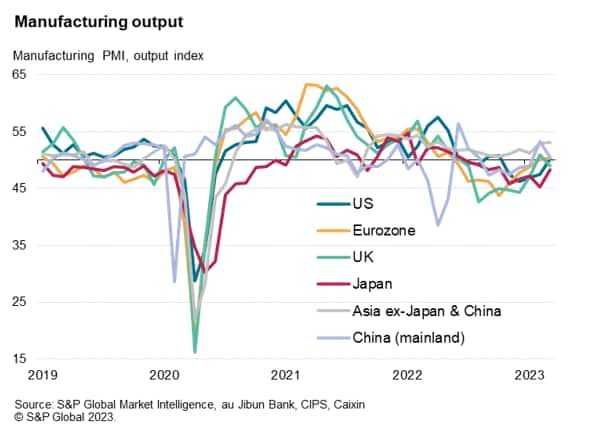

The tentative return to growth in the latest two months is by no means universal. While 15 economies reported higher production, led by Thailand and India, some 16 reported lower output levels in March. Moreover, of those reporting higher production, four recorded only modest gains, and these included the world's two largest producers: the United States and mainland China. The eurozone as a whole also saw near-stalled production, albeit with varying performances witnessed within the single currency area. Of the world's other major manufacturing economies, Japan, Canada, Brazil, the UK, Taiwan, South Korea, Malaysia and Vietnam all saw production decline in March.

Output buoyed by improving supply…

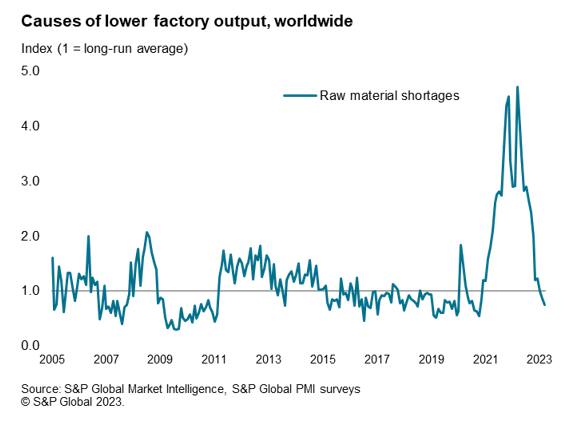

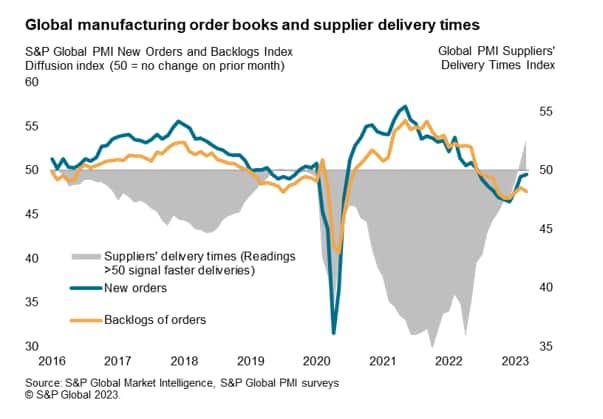

Where output was raised, the increase was often reported to have been facilitated by improving supply chains. Average supplier delivery times shortened for a second month in March, contrasting sharply with the lengthening seen over the prior 42 months, encompassing the pandemic. The latest overall improvement in supplier performance was the best since May 2009.

Reflecting this improved supply situation, the number of companies reporting that output was constrained by raw material shortages fell to its lowest since October 2020, dropping further below its long-run average to point to a marked reversal of the supply-driven production constraints seen at the height of the pandemic.

By facilitating higher output, the improved supply situation is allowing companies to eat into their backlogs of work, which had risen sharply on average during the pandemic. Backlogs of uncompleted orders consequently fell for a ninth successive month in March, having risen continually over much of the past two years. Only mainland China, Indonesia, the Philippines and India reported higher backlogs of work in March.

… but constrained by a lack of demand

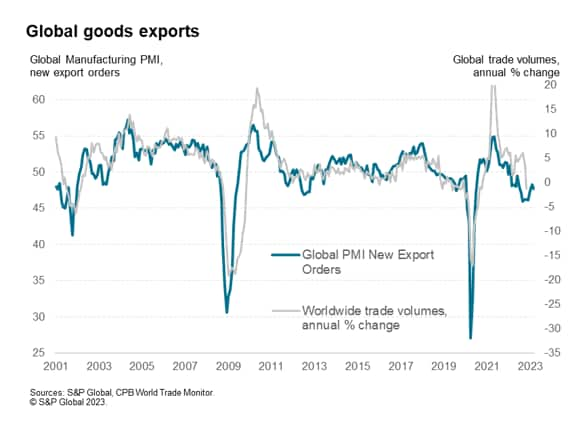

A key concern, however, is that inflows of new orders also fell for a ninth successive month in March. Although declining only marginally, the ongoing fall in new orders represents a further deterioration in the demand environment facing factories. Global export orders likewise fell, down for a thirteenth straight month, the rate of decline gathering pace slightly to signal a worsening global trade picture.

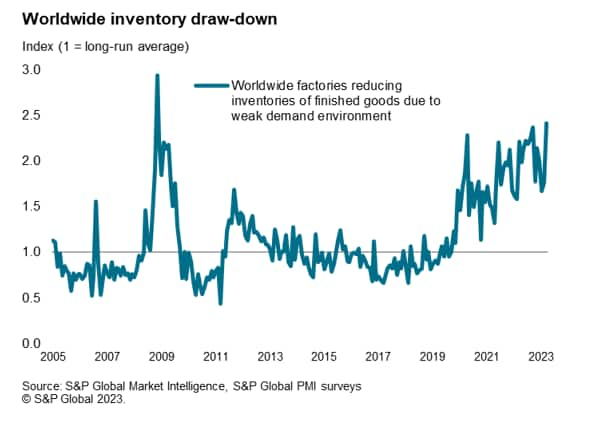

Demand-led stock reduction

The impact of this falling order book trend is underscored by the March PMI surveys recording a steep increase in the number of companies reporting that inventories of finished goods were being wound down as a result of subdued demand. The incidence of deliberate stock reduction in the face of weak demand has in fact now risen to its highest since November 2008, which was the only month since data were first available in 2005 that saw a greater incidence of demand-led destocking.

Outlook

The March survey data therefore suggest that a key driver of the recent nascent increase in global manufacturing output is an improving supply situation rather than an improvement in demand. Fewer shortages have facilitated higher production and allowed firms to reduce their backlogs of work, which in many cases had accumulated during the pandemic. Demand, on the other hand, continues to deteriorate and act as a drag on production.

The suggestion is, therefore, that unless new order inflows pick up in coming months, the production trend will likely weaken again once existing backlogs of work are depleted.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-improvement-boosts-global-factory-output-but-demand-continues-to-fall-Apr23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-improvement-boosts-global-factory-output-but-demand-continues-to-fall-Apr23.html&text=Supply+improvement+boosts+global+factory+output%2c+but+demand+continues+to+fall+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-improvement-boosts-global-factory-output-but-demand-continues-to-fall-Apr23.html","enabled":true},{"name":"email","url":"?subject=Supply improvement boosts global factory output, but demand continues to fall | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-improvement-boosts-global-factory-output-but-demand-continues-to-fall-Apr23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Supply+improvement+boosts+global+factory+output%2c+but+demand+continues+to+fall+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-improvement-boosts-global-factory-output-but-demand-continues-to-fall-Apr23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}