Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 10, 2018

Strong rise in Czech manufacturing output continues into 2018, despite March slowdown

- Czech manufacturing growth eases in March, in line with weaker German production expansion

- Q1 2018 sees fastest overall expansion in production since Q1 2011

- Job creation remains steep, despite reports of ongoing labour shortages

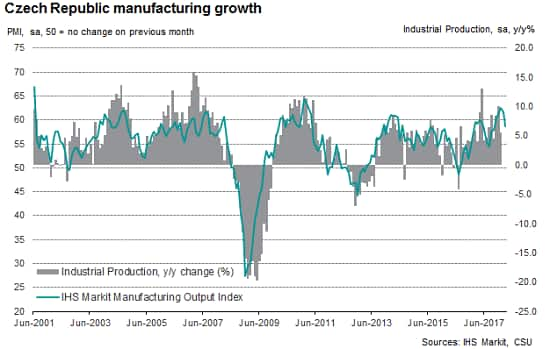

The Czech manufacturing sector started 2018 in rude health. Latest PMI survey data indicates that the average monthly growth in output over the first three months of the year was the strongest since Q1 2011. Although the rate of expansion eased in March, new business from abroad increased strongly, reflecting robust demand from European markets. However, companies have reported that recent supplier constraints and delays in the delivery of inputs have dampened output growth.

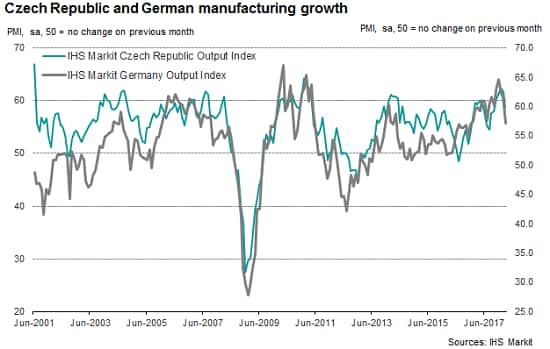

Although outside the eurozone, the Czech Republic has strong ties to large European markets including Germany, notably through the automobiles manufacturing sector. It is therefore no surprise that wider economic trends are often mirrored in the Czech economy. In addition, the recent peaks in the German manufacturing sector seem to have directly preceded multi-year production highs in the Czech Republic.

Export markets drive growth

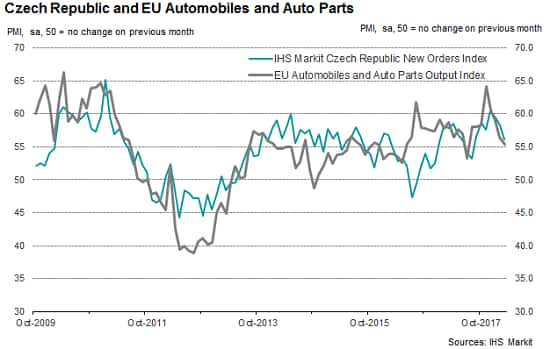

A key export industry for Czech manufacturers is the automobiles and auto parts sector, with motor vehicles accounting for 29% of total Czech exports in 2016 (the latest year for which complete data are available). In the final months of 2017 and into the start of 2018, IHS Markit EU Sector PMI data indicated a sharp upturn in output growth within this industry. A notable expansion among EU counterparts can then be traced through to the IHS Markit Czech Republic Manufacturing PMI New Orders Index, which almost reached an eight-year high in December, with growth remaining sharp in the following months. The two indexes exhibit a correlation of 0.74.

A more direct relationship, however, can be seen when comparing the Czech Republic Manufacturing PMI Output Index against that for Germany. Over the course of the series' history, the two indices have been closely linked, with trends in Germany seeming to slightly precede those in the Czech Republic. This trend is in line with the Czech Republic ranking seventh among largest importers to Germany, and also a large producer of goods and parts for the automobile industry.

Outlook surveys give greater insight

As demonstrated in the charts above, the strong relationship between the Czech Republic and large European economies, particularly Germany, suggests that by observing the movements of these economies we are given a greater insight into how demand for Czech goods may change.

Anecdotal evidence from the March IHS Markit Czech Republic Business Outlook report (covering February survey data) reflected some concerns regarding future overheating of the economy, and a domino effect which could arise following hypothetical slower growth in the automotive sector. Such sentiments were repeated in the German Business Outlook report, although it is important to say that output expectations for the coming 12 months remained strong in both countries.

Future expectations

The relationship between the Czech Republic and the wider European area can help explain some of the driving forces behind overall manufacturing growth; however, it is not the only contributing factor. Domestic supply pressures and demand growth remain key, particularly from external markets. Additionally, ongoing reports of labour shortages will continue to be influential in determining growth potential over the coming year, as panellists continue to highlight problems finding sufficiently skilled labour.Forthcoming economic data releases:

- 23 April: IHS Markit Germany Flash Composite PMI (April)

- 2 May: IHS Markit Czech Republic Manufacturing PMI (April)

IHS Markit Germany Manufacturing PMI (April) - 7 May: Czech Industrial Production Y-o-Y (March)

Sian Jones, Economist, Economic Indices, IHS Markit

Tel: +44 1491 461017

sian.jones@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-rise-in-czech-manufacturing-output-continues-into-2018-despite-march-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-rise-in-czech-manufacturing-output-continues-into-2018-despite-march-slowdown.html&text=Strong+rise+in+Czech+manufacturing+output+continues+into+2018%2c+despite+March+slowdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-rise-in-czech-manufacturing-output-continues-into-2018-despite-march-slowdown.html","enabled":true},{"name":"email","url":"?subject=Strong rise in Czech manufacturing output continues into 2018, despite March slowdown | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-rise-in-czech-manufacturing-output-continues-into-2018-despite-march-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+rise+in+Czech+manufacturing+output+continues+into+2018%2c+despite+March+slowdown+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-rise-in-czech-manufacturing-output-continues-into-2018-despite-march-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}