Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 07, 2018

Strong fundamentals beneath market volatility

Research Signals – February 2018

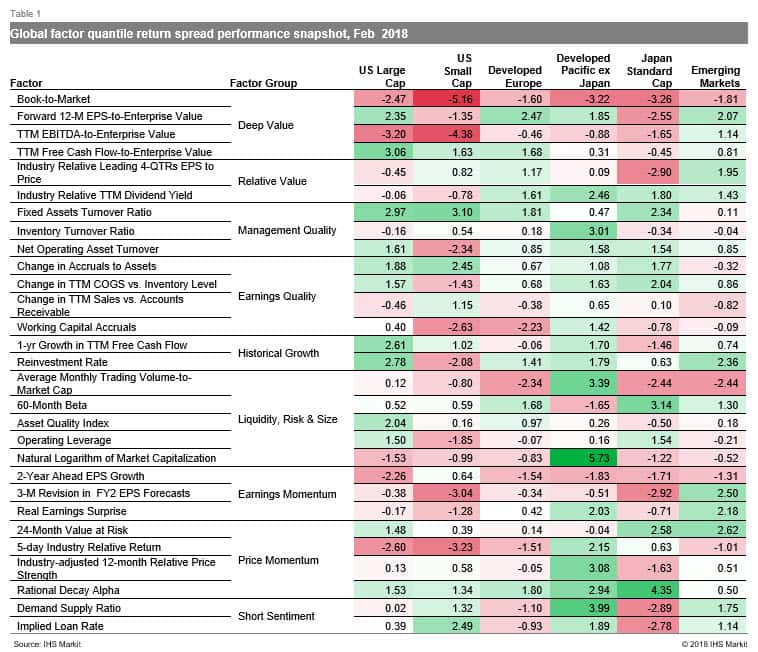

Stock market uncertainty, which picked up in late January, carried over into February and drove global stocks down for the month. Of particular concern for investors is the prospect that the US Federal Reserve will increase its pace of interest rate increases this year, a view that IHS Markit put forth on 1 February, with a change in the Fed call to anticipate four interest rate hikes in 2018 versus the previous expectation of three. However, global economic growth strengthened in February according to the J.P. Morgan Global Manufacturing & Services PMI™, indicating a near three-and-a-half year high in the rate of expansion in global economic output and supporting investors’ outlook of overall strong fundamentals conveyed in factor performance for the month (Table 1).

- US: High quality firms outperformed, elevating factors such as Fixed Assets Turnover Ratio (management) and Change in Accruals to Assets (earnings)

- Developed Europe: Solid fundamentals and positive outlook were rewarded, as captured by factors including Forward 12-M EPS-to-Enterprise Value, Fixed Assets Turnover and Reinvestment Rate

- Developed Pacific: In regional markets outside Japan, small cap stocks were bid up (e.g., Natural Logarithm of Market Capitalization), though overlaid with a safety trade as highly shorted names lagged (e.g., Demand Supply Ratio)

- Emerging markets: Top performing themes spanned several styles, represented by 24-Month Value at Risk, 3-M Revision in FY2 EPS Forecasts and Reinvestment Rate, among others

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-fundamentals-beneath-market-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-fundamentals-beneath-market-volatility.html&text=Strong+fundamentals+beneath+market+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-fundamentals-beneath-market-volatility.html","enabled":true},{"name":"email","url":"?subject=Strong fundamentals beneath market volatility&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-fundamentals-beneath-market-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+fundamentals+beneath+market+volatility http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrong-fundamentals-beneath-market-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}