Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 11, 2019

September HY Decomposition

- Consumer Goods sector has largest positive return

- $23B in face value on loan across index constituents

- Mallinckrodt largest negative contribution issuer

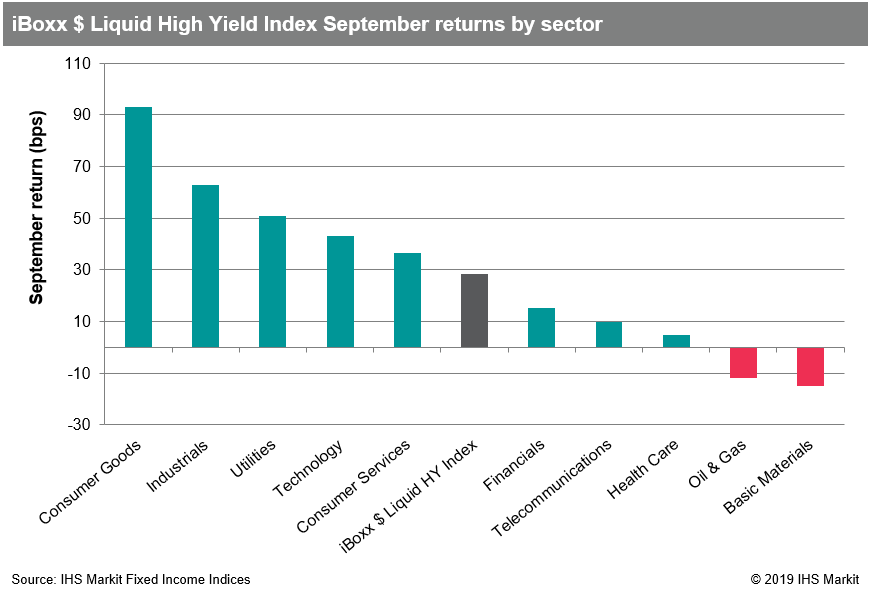

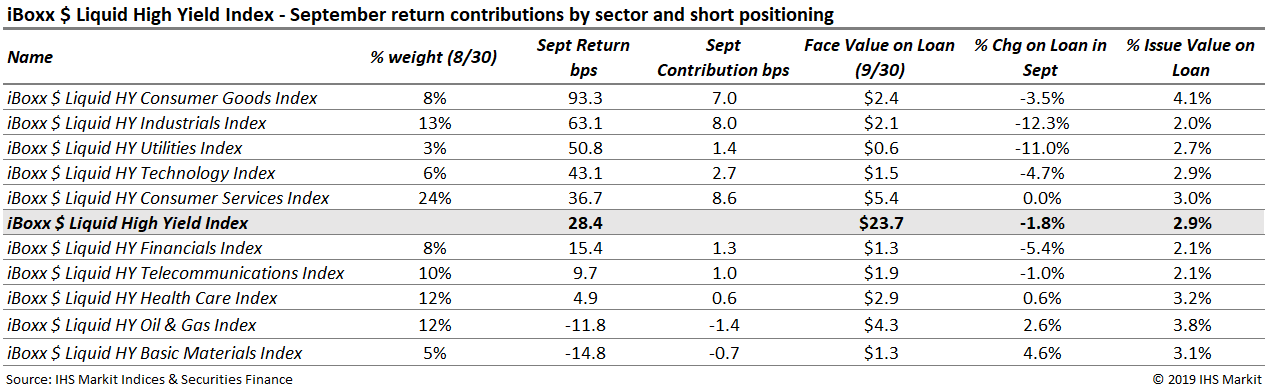

The iBoxx $ Liquid High Yield Index returned 28 basis points in September, with the strongest returns coming from Consumer Goods (+93bps) and Industrials (+63bps). There were 28 issuers whose bonds had a negative return for September, which combined to contribute -40bps to the index return.

Oil & Gas and Basic Materials were the only two sectors in the red, however it’s interesting to note that five sectors underperformed the index in September compared to only two in August, reflecting a greater dispersion of returns across sectors. Short positioning in constituent issues, using the face value of borrowed bonds as a proxy, declined 1.8% in September to $23.7bn.

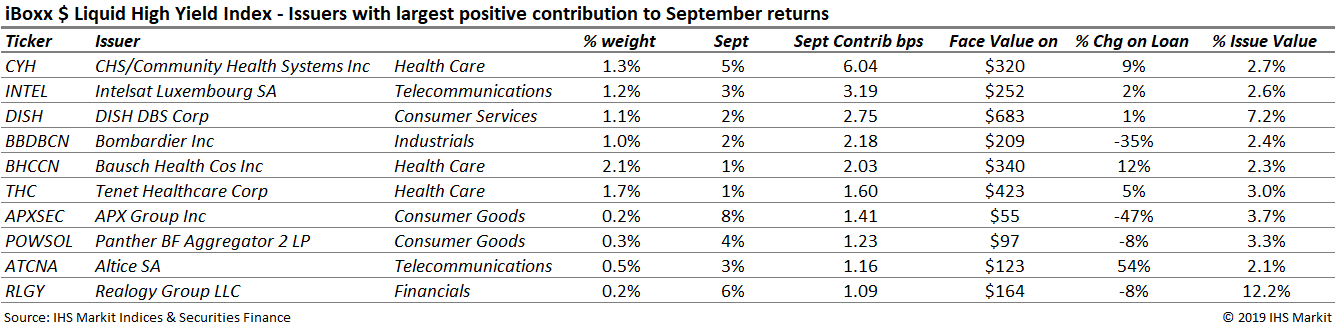

Top 10 Issuers by Return Contribution

The ten best performing issuers contributed 23bps to September returns. Return contributions were led by Community Health Systems Inc., who have been following a prescription of asset divestiture to improve their balance sheet. Looking at their CYH 6.875% 2/1/2022 bond, the bond began the year priced at $45.34 and an annual yield of 42.5% and has returned 76.5% YTD.

Realogy is the only issuer among the top with more than 10% of the issue value of their bonds on loan. However, short sellers may be heading for the exits amid strong returns, with the face value of bonds on loan down 8% from the start of September.

Bottom 10 Issuers by Return Contribution

The ten worst performers contributed -25bps to index returns in September. As noted in the opening, there were 28 issuers with negative returns in September, which contributed -40bps return to the index.

Mallinckrodt International Finance SA had by far the worst performance, returning -34% with a contribution of -5bps. Mallinckrodt has struggled under legal pressures for their role in the opioid crisis. Taking their largest bond in the index by notional, MNK 5.625 10/15/2023 which has a face value of $680.2m, the bond has returned -53.2% YTD. The equity hasn’t fared any better, down 84% YTD.

There have been varying short positions in the MNK equity and credits over the last few years. The recent trend is short covering in the bonds and increasing short positions in the equity, however on both fronts the notional positions are far below their peaks due to a declining price. The borrow cost for the MNK bonds reached a new high in September, which may have been part of the motivation for credit shorts to move on. It is also worth noting that the third largest detractor from September HY returns was Teva Pharmaceutical, another firm with exposure to the opioid crisis.

Netflix also contributed -2bps to on a -1.83% return. The NFLX bonds included in the index saw a 59% increase in bonds on loan during September. The total face value on loan in NFLX bonds peaked at $492m in March 2019 and ended September at $305m. It is worth noting that Netflix was added to CDX HY during the September index roll.

Wrap-up

September added to the positive returns for the HY index in the prior months of 2019, putting the total return at 11.56% YTD. The Oil & Gas sector had another month of challenging returns, contributing -11.8bps to the index in September, after having been the worst performing sector in August. Basic Materials was the worst performing sector in September, contributing -14.8bps to the index.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseptember-hy-Decomposition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseptember-hy-Decomposition.html&text=September+HY+Decomposition+-+HTML+Meta","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseptember-hy-Decomposition.html","enabled":true},{"name":"email","url":"?subject=September HY Decomposition - HTML Meta&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseptember-hy-Decomposition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=September+HY+Decomposition+-+HTML+Meta http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseptember-hy-Decomposition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}