Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 23, 2024

Semiconductor supply chain Q3 2024 outlook: Multispeed recovery

Learn more about our data and insights

Semiconductors lie at the heart of most manufactured goods' supply chains, so tracking their performance can provide useful insights into industry more broadly. Our latest quarterly reading indicates that, heading into the second half of 2024, most segments are in recovery, but at markedly different rates between AI applications, consumer devices and industrial products including autos.

The hurdle to recovery comes from export controls related to national security, particularly by the US and EU, which impact semiconductor supply chains connected to mainland China who are advancing their domestic chip production capabilities.

Even with funding and progress, mainland Chinese chipmakers face challenges like poor production yields, while the US, Japan and the EU consider further restrictions. These controls may affect chipmakers' revenues significantly, as 30% of their sales come from mainland China.

Multispeed recovery in different segments

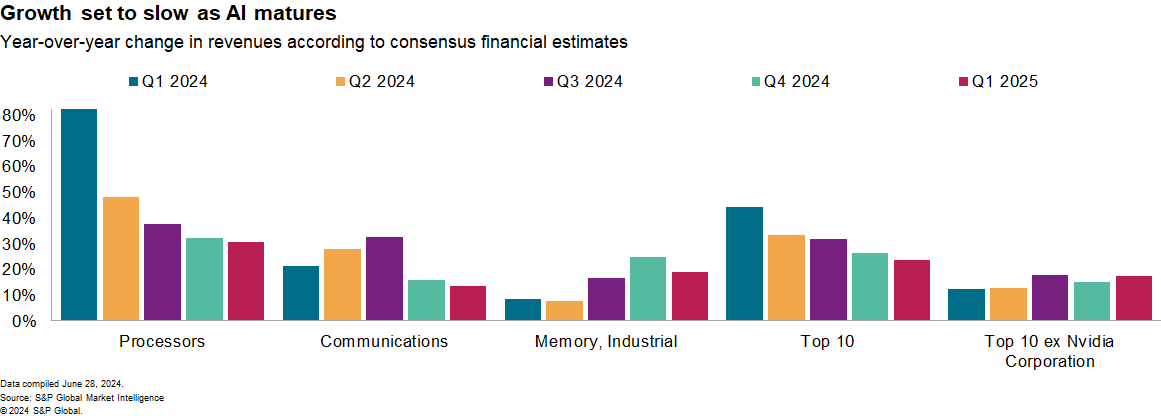

The consensus of financial analysts' forecasts shows revenues of the top 10 chip producers rose by 44% year over year in the first quarter of 2024, with growth expected to slow to 24% by the first quarter of 2025.

AI applications for graphics processors and application-specific integrated circuits (ASICs) have meant processors have been the fastest growing segment of the sector. While growth is expected to slow to 31% in the first quarter of 2025 from 82% in the first quarter of 2024, that is still significantly faster than memory chips' growth of 19% and communications chips' 14%.

As has been the case for processors in the past, AI systems are moving into an annual cycle of upgrades. Rolling out steady upgrades may therefore be more complex from a supply chain perspective than the historical delivery of upgrades to single chips only, underlining the importance of integrated manufacturing.

End-user devices including smartphones, PCs and connected devices such as streaming media and videogame consoles are also moving at a variety of speeds, reflecting disparate upgrade cycles and new product releases.

International trade data backs up the thesis of a multispeed recovery. Our data for exports of smartphones from early reporters (mainland China, Hong Kong, South Korea and Singapore) rose in May by 7.9% year over year after a 9.1% dip in the first quarter. At the aggregate, the total value of exports of semiconductor-using consumer goods fell by 0.6% as the growth in phones was offset by other devices.

Industrial and automotive sectors struggling

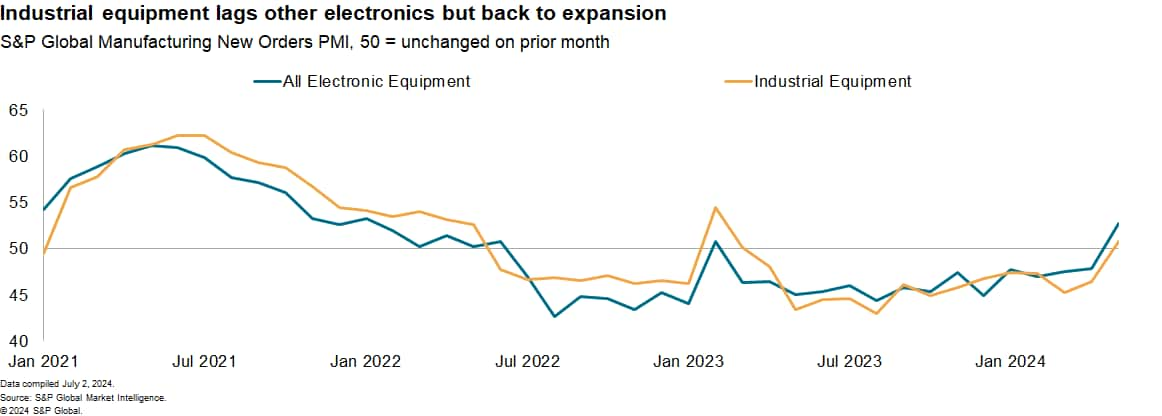

The industrial equipment and automotive sectors have lagged other chip-using supply chains, though the S&P Global Manufacturing Purchasing Managers' New Orders Index showed growth in May 2024 for the first time since March 2023. The index recovery was also rapid, reaching 50.7 (over 50 indicates sequential growth) from 46.4 in April.

Industrial equipment has historically lagged other electronic equipment sectors, reflecting capital expenditures typically rise later in the economic cycle than for other goods, as well as a pause in the upgrade cycle for corporations, potentially exacerbated by higher interest rates. Many of the industrial chipmakers still have a bearish outlook due to challenges to industrial capex from higher interest rates as well as inventories of chips that are proving difficult to clear.

Aside from industry equipment, there have been specific challenges for chip suppliers linked to the slowdown in electric vehicle demand growth.

Consumer electronics market trends

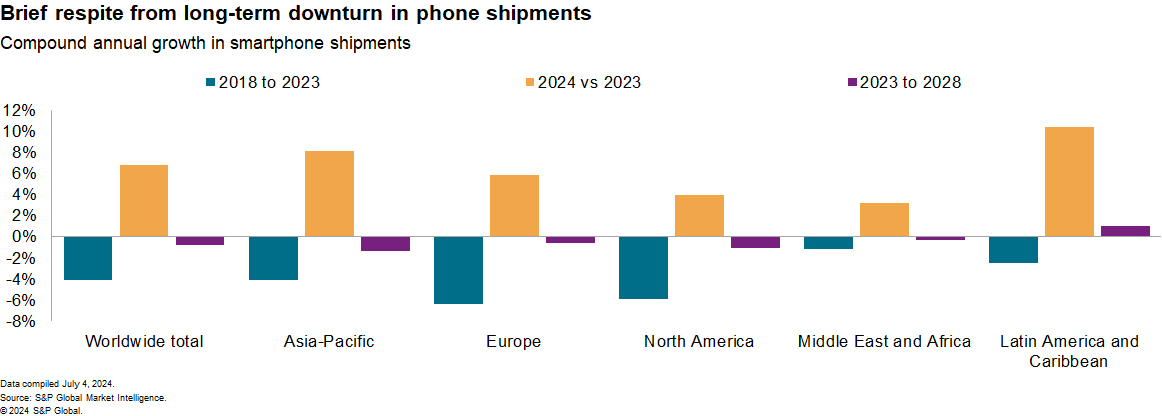

The new outlook for global smartphone shipments from S&P Global Market Intelligence shows a temporary return to growth in deliveries. Pent-up demand that has been building over the past two years during smartphone shipment declines may be enough to reverse the downward trend temporarily, but the larger influence of lengthening replacement cycles and the shrinking pool of those yet to own a smartphone will hold back unit shipments in the long run. Deliveries are expected to jump by 10.4% in 2024 from the 2023 low, though that's dependent in part on new product releases focused on AI applications enticing buyers back.

Shipments of personal computers are also expected by manufacturers to enter a new upgrade cycle as machines delivered in 2020 and 2021 reach their replacement age, aided by offerings of AI-enabled machines.

Among other connected devices the recent progress is somewhat slower, reflecting market maturity and an absence of new product launches. Global shipments of streaming media devices fell by 6.5% year over year in the first quarter of 2024. That represents the 11th straight quarterly decline. Global shipments of video game consoles fell by 32.3% year over year in the off-peak first quarter of 2024. The absence of new systems is expected to lead to further declines in the rest of the year, alongside high prices and a lack of major new software series.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsemiconductor-supply-chain-q3-2024-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsemiconductor-supply-chain-q3-2024-outlook.html&text=Semiconductor+supply+chain+Q3+2024+outlook%3a+Multispeed+recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsemiconductor-supply-chain-q3-2024-outlook.html","enabled":true},{"name":"email","url":"?subject=Semiconductor supply chain Q3 2024 outlook: Multispeed recovery | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsemiconductor-supply-chain-q3-2024-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Semiconductor+supply+chain+Q3+2024+outlook%3a+Multispeed+recovery+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsemiconductor-supply-chain-q3-2024-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}