Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 08, 2023

Recession-resistant recruitment set to continue as business confidence picks up

A jump in business confidence at the start of 2023 amid signs that downturns across key developed economies may be shorter and less severe than feared means that the 'recession-resistant recruitment' that we have seen in recent months is likely to continue as companies prepare for a recovery in business activity. Indeed, we have now moved from a position of job creation being unprecedented in the face of deteriorating output, to one where it would be unusual for firms to be scaling back employment.

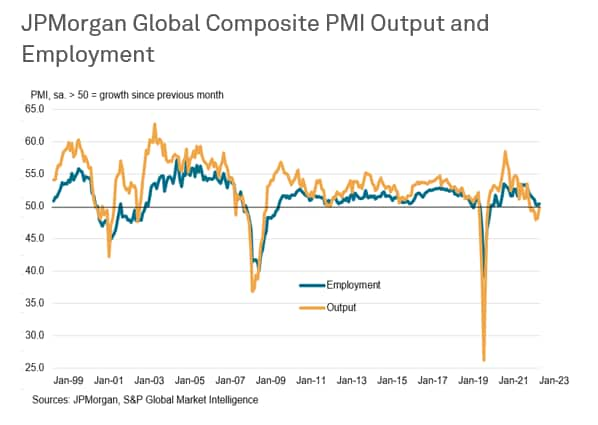

Global job creation maintained despite sustained fall in output

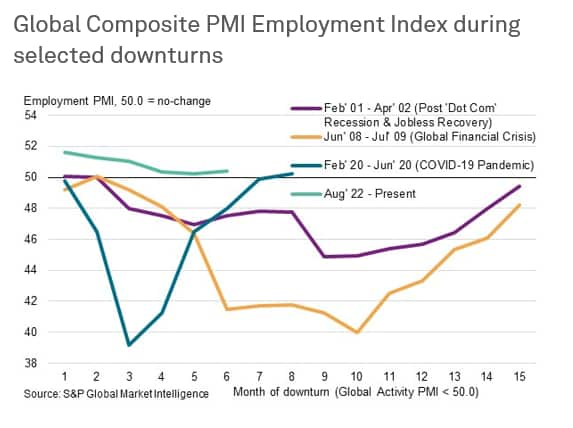

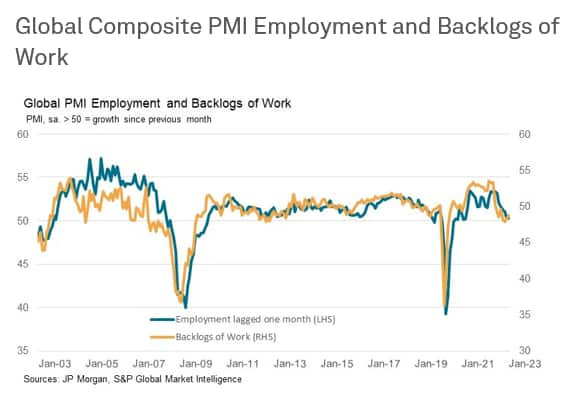

Towards the end of last year we highlighted the unprecedented picture of employment continuing to rise despite a sustained period of falling global business activity. These trends have continued since then, with the JP Morgan Global Composite PMI Employment Index, compiled by S&P Global, pointing to a twenty-ninth consecutive monthly improvement in workforce numbers in January, despite output now having fallen for six successive months. To some extent this has been due to efforts by companies to clear backlogs of work that had built up over the course of the COVID-19 pandemic and subsequent period of intense supply-chain disruption.

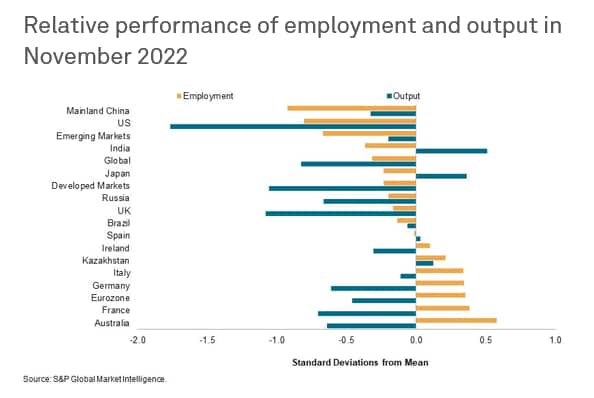

Developed economies, and a number of eurozone countries in particular, remain the main source of the unusual outperformance of employment relative to output.

Business confidence at eight-month high

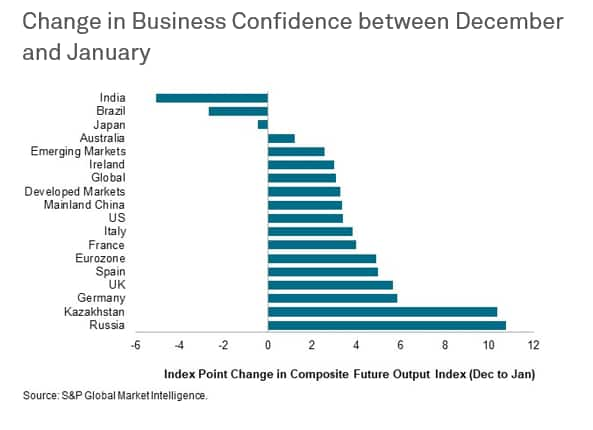

One of the key developments since we looked at this in December has been the brightening of the economic environment. Output fell only marginally at the global level in January and at the softest pace in the current period of decline, with economic prospects less gloomy in Europe and the US than had been the case in late-2022, plus the loosening of pandemic restrictions in Mainland China acting to boost economic activity there. An easing of global supply chain constraints have also helped encourage many businesses to raise their capacity expansion plans, notably in the US and Eurozone.

As such, business confidence jumped higher at the start of 2023, reaching an eight-month high, with a range of countries signalling an improved outlook.

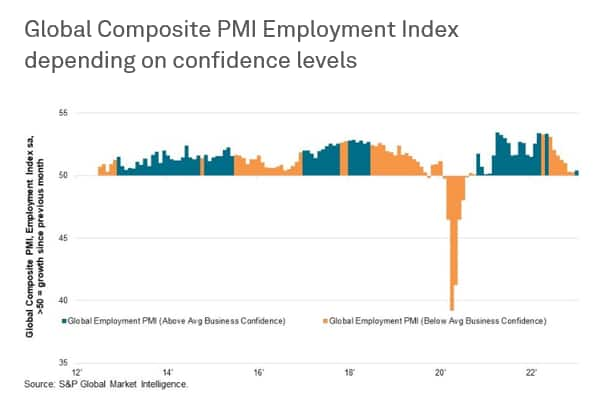

Optimism is now at a level where it would be unusual for firms to be scaling back employment. In fact, our analysis shows that when the Global Composite Future Output PMI is above its historical average, as it was in January, global employment levels have never fallen (since data were available in 2012).

While there is still the possibility for economic conditions to deteriorate again, it currently looks as though the period of decline we have seen in global business activity will come to an end with no interruption to employment growth throughout.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

Joe Hayes, Senior Economist, S&P Global Market Intelligence

Tel: +44 1344 328 099

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecessionresistant-recruitment-set-to-continue-as-business-confidence-picks-up-feb23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecessionresistant-recruitment-set-to-continue-as-business-confidence-picks-up-feb23.html&text=Recession-resistant+recruitment+set+to+continue+as+business+confidence+picks+up+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecessionresistant-recruitment-set-to-continue-as-business-confidence-picks-up-feb23.html","enabled":true},{"name":"email","url":"?subject=Recession-resistant recruitment set to continue as business confidence picks up | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecessionresistant-recruitment-set-to-continue-as-business-confidence-picks-up-feb23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Recession-resistant+recruitment+set+to+continue+as+business+confidence+picks+up+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecessionresistant-recruitment-set-to-continue-as-business-confidence-picks-up-feb23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}