Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Nov 13, 2019

Protests to weigh on Hong Kong SAR's dividend outlook

Earnings estimates for companies in travel & leisure, retail and real estate sectors were directly impacted by the protests and have been sharply revised downwards over the past three months. Notably, street analysts continue to cut earnings estimates for over 70% of the constituents in these three sectors. For travel & leisure, recent data show that 60% of the constituents saw a 5% or greater cut in consensus earnings compared to the projections three months ago. Similarly, 30% of the companies in retail and property sectors have their earnings estimates cut by at least 5% over the same period. However, we are still expecting dividends to grow by 6% and 8% respectively in 2019 and 2020, mostly attributed to the banking sector and real estate sector. The projected increase in dividends over these two years is modest compared to the growth rates registered in 2017 and 2018, during which dividends grew by double digits.

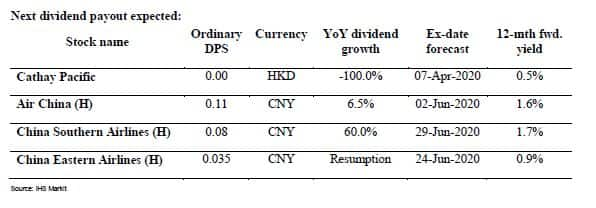

Travel & Leisure Industry

Aggregate dividends from this industry are expected to grow at a

slower pace in 2020, with a 0.6% increase, compared to the 15.8%

growth rate estimated for 2019. Top dividend contributors in this

industry are expected to increase dividends slightly or maintain

stable dividend payouts.

We expect that Cathay Pacific Airways will suspend its upcoming

dividend. According to recent releases from Cathay Pacific, the

flag carrier of Hong Kong experienced a decrease in both the number

of passengers and the amount of cargo and mail carried in August

and September compared to same period last year. The most

significant drop comes from mainland China. In its passenger

business, revenue passenger kilometers dropped by 28.1% and 23.2%

yoy in mainland China in August and September respectively, the

largest drop among all regions. Cathay Pacific's cargo and mail

revenue tonne also showed a 14.0% and 4.4% yoy drop in August and

September respectively. The proportion of revenue from the mainland

has increased in recent years, with almost 50% of its revenue

generated from mainland China in FY18.  The large variance across Cathay Pacific's projected

earnings for FY19 suggests a significant amount of uncertainty in

its outlook, underpinning our low confidence flag for the upcoming

2nd interim dividend estimate. We expect that Cathay Pacific will

suspend its dividend as latest earnings projections suggest that

they could generate a loss in the second half of FY19. Our

expectation is consistent with the poor performance reported in

their latest filing. Earnings prospects remain bleak in the short

term, with management expecting the upcoming months to be

challenging due to the weak demand for travel following the

protests. We note that when Cathay Pacific underperformed in the

second half of FY16, it suspended its final dividend.

The large variance across Cathay Pacific's projected

earnings for FY19 suggests a significant amount of uncertainty in

its outlook, underpinning our low confidence flag for the upcoming

2nd interim dividend estimate. We expect that Cathay Pacific will

suspend its dividend as latest earnings projections suggest that

they could generate a loss in the second half of FY19. Our

expectation is consistent with the poor performance reported in

their latest filing. Earnings prospects remain bleak in the short

term, with management expecting the upcoming months to be

challenging due to the weak demand for travel following the

protests. We note that when Cathay Pacific underperformed in the

second half of FY16, it suspended its final dividend.

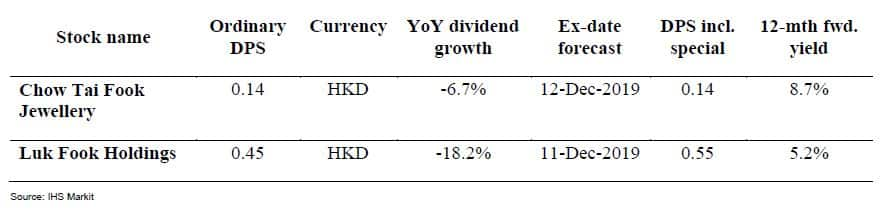

Retail Industry

The aggregate dividends from the retail industry are expected to

grow 6.4% to HKD 11.7 billion in 2020, supported by stable

dividends from well-known retail enterprises, as well as the fast

growth in dividends from a few education companies. In 2016, total

dividends from education related companies accounted for

approximately 2% of the aggregate dividends in the retail sector,

and we expect their contribution to jump to 20% in 2020. The

expected slowdown in growth from other retail companies, which are

negatively affected by the macro economic uncertainties and the

social unrests in Hong Kong, are likely to keep a lid on the growth

of payouts from this sector. Notably, we are expecting Chow Tai

Fook Jewellery and Luk Fook Holdings to decrease their upcoming

payouts by 6.7% and 18.2% on a year-on-year basis.  Real Estate Industry

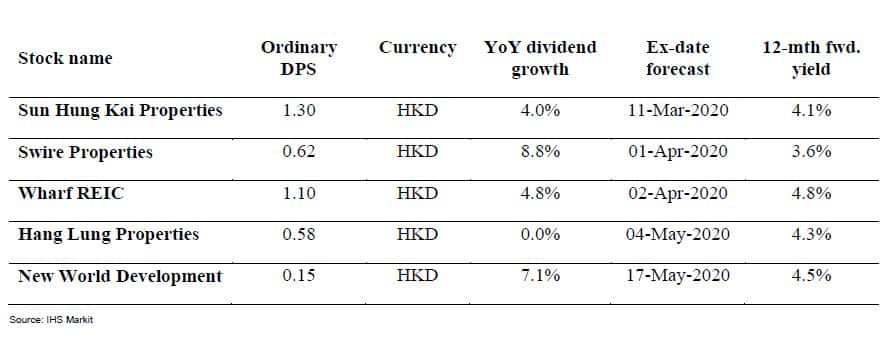

Real Estate Industry

Dividend growth from the real estate sector is expected to moderate

in 2020. The deceleration in growth of payouts from companies in

mainland China can be attributable to the tightening property

measures implemented in recent years. The limited upside potential

in dividends from Hong Kong property firms can be attributed to the

weak macro environment and the prolonged political unrest.

Companies with large retail and hotel portfolios, such as Sun

Hung Kai Properties, Swire Properties and Wharf REIC are expected

to suffer the most from the protests. The undercut in tourist

spending will affect the ability of retail tenants to afford rent

and will lead to lower hotel occupancy. For example, in their

latest annual report, the management of Sun Hung Kai expressed

their concern that weakening consumer sentiment and declining

tourist spending have posed challenges in the retail market for

recent months. Property rental and hotel operations contributed to

30% of Sun Hung Kai Properties' total revenue in FY2019, and some

of its major shopping malls such as IFC Mall and The Sun Arcade are

at the storm eye of the ongoing protest.

To access the report, please contact dividendsupport@ihsmarkit.com

Maojun Ye, CFA, Principal Research Analyst at IHS

Markit

Qianwen Ruan, FRM, Senior Research Analyst II at

IHS Markit

Yang Yang, CFA, Senior Research Analyst I at IHS

Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-to-weigh-on-hong-kong-dividend-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-to-weigh-on-hong-kong-dividend-outlook.html&text=Protests+to+weigh+on+Hong+Kong+SAR%27s+dividend+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-to-weigh-on-hong-kong-dividend-outlook.html","enabled":true},{"name":"email","url":"?subject=Protests to weigh on Hong Kong SAR's dividend outlook | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-to-weigh-on-hong-kong-dividend-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Protests+to+weigh+on+Hong+Kong+SAR%27s+dividend+outlook+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-to-weigh-on-hong-kong-dividend-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}