Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 18, 2018

PMI data continues to signal solid growth prospects for Australia

- Output rising strongly, according to survey data…

- …Encouraging firms to hire at a quicker pace

- Panellists report higher wages

The latest Commonwealth Bank of Australia PMI data signalled another month of solid output growth at the end of the first quarter. Inflows of new work remained strong, prompting firms to raise operating capacities by recruiting additional staff. Stronger demand for workers in turn exerted upward pressure on wages, with panellists reporting higher salaries as a key component behind input price inflation during March.

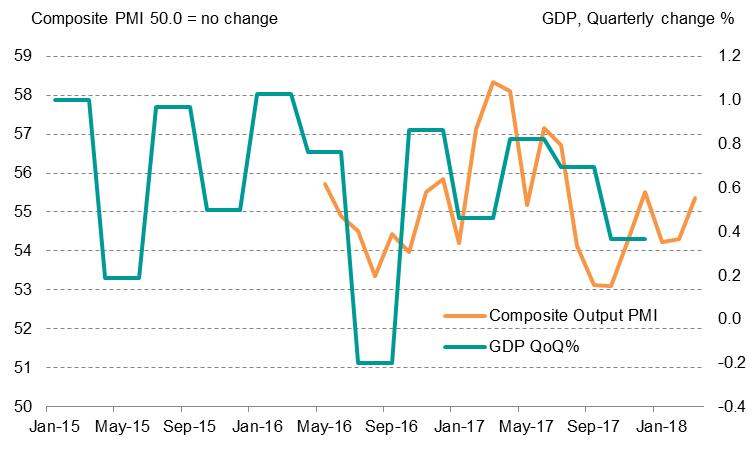

The PMI survey Composite Output Index rose from 54.3 in February to 55.4 in March, signalling a strong rate of growth in business activity across the private sector. The latest upturn was a reflection of strengthening growth in the crucial service sector. In contrast, the pace of expansion across the manufacturing economy has slowed across the first quarter. Nonetheless, the overall rate of output growth seen in the first quarter was broadly in line with those seen in the latter half of 2017.

Private sector output growing strongly

Source: IHS Markit, CBA, Australian Statistics Bureau

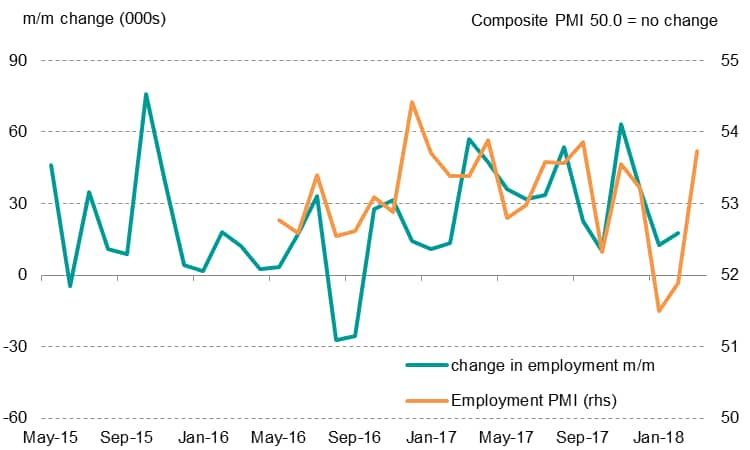

PMI points to marked rise in employment

The PMI surveys also recorded strong demand pressures during the first three months of 2018, with an average reading for the seasonally adjusted New Orders Index of 54.9. With inflows of new work rising at a healthy clip, the solid expansionary trend in business activity should carry on into the second quarter.

The securing of sales encouraged firms to recruit additional staff during March, providing a sign of confidence towards the demand outlook. Although the rate of job creation had eased to a fresh survey low during January, there has since been a marked rebound, with the PMI signalling around 55,000 newly created jobs in March.

PMI data signals marked employment gains

Source: IHS Markit, CBA, Australian Statistics Bureau

Signs of strong employment growth will provide hope that the labour market is beginning to tighten to a greater extent. The unemployment rate has been fairly stable over the past 12 months, remaining in a range between 5.7% and 5.4%.

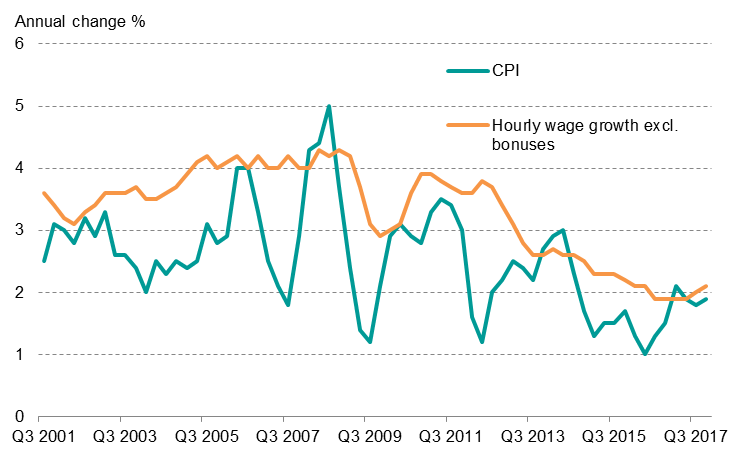

Wage growth has picked up mildly recently in line with the improving labour market, accelerating in each of the past two quarters to now stand at 2.1% on an annual basis. Any easing of pay growth would be most unwelcome, given there is little leeway before real earnings growth turns negative. The annual consumer price inflation rate is running at 1.9%. In fact, PMI data suggest official inflation data are likely to rise even further over the coming quarter.

Real earnings squeezed by rising living costs

Source: Australian Statistics Bureau

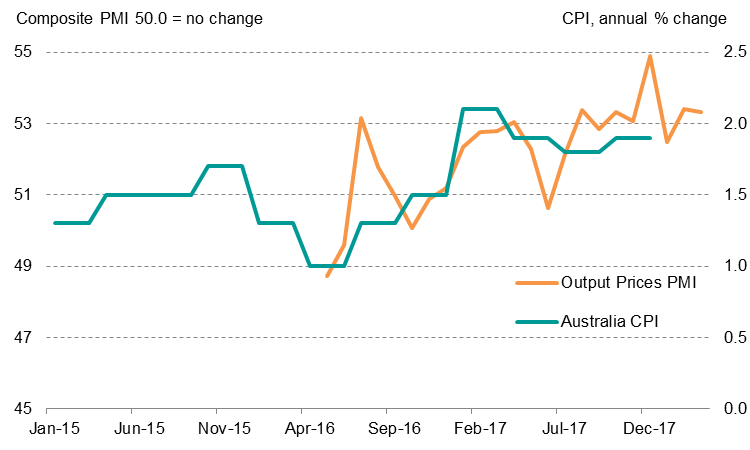

Inflationary pressures mount

A combination of robust demand conditions and rising costs encouraged private sector firms to raise average selling prices. Anecdotal evidence from panellists indicated that key contributors to greater operating expenses were higher salaries and increased payroll numbers. With the Composite Output Prices PMI signalling a further uptick in official annual inflation data during recent months, further wage growth will be important to ensure real earnings continue to remain positive and support household spending, which had been a key driving force behind GDP growth late last year.

Inflation to edge up, according to PMI

Source: IHS Markit, CBA, Australian Statistics Bureau

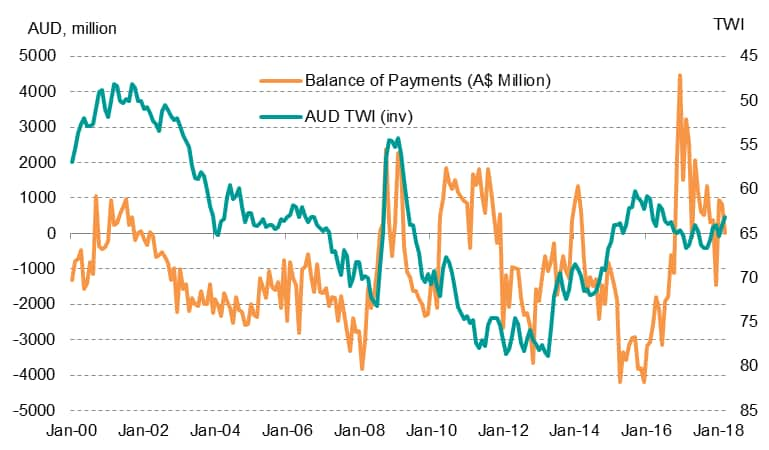

Narrowing trade surplus despite weak AUD

Source: Datastream

As a result of the economy's sustained expansion, Australians have increased their purchases of goods and services from abroad. On a trade-weighted basis, the Australian dollar has depreciated over the course of 2018. Consequently, a narrower trade surplus and a weaker currency will result in Australia importing inflation.

Brighter prospects

The Reserve Bank of Australia has held interest rates at 1.5% since August 2016 and has not hiked rates since 2010. Although an interest rate hike is not on the immediate agenda for the RBA, a depreciating Australian dollar, combined with strong demand, is likely to exert further inflationary pressures. Without businesses rewarding their employees with improved pay packages, the uptick in living costs will hamper household spending.

Nonetheless, PMI data signalled upbeat prospects for the Australian economy for the first quarter of 2018, with accelerated output and employment growth recorded in March. Additionally, confidence towards the 12-month outlook for business activity remained strongly positive across both the manufacturing and service sectors. Amid rising output prices, reports of wage increases from panellists will help to allay fears that firms are not adequately remunerating their employees.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-continues-to-signal-solid-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-continues-to-signal-solid-growth.html&text=PMI+data+continues+to+signal+solid+growth+prospects+for+Australia+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-continues-to-signal-solid-growth.html","enabled":true},{"name":"email","url":"?subject=PMI data continues to signal solid growth prospects for Australia | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-continues-to-signal-solid-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+continues+to+signal+solid+growth+prospects+for+Australia+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-continues-to-signal-solid-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}