Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 08, 2024

Peak season surcharges land earlier, and higher, in hot trans-Pacific market

Trans-Pacific container lines are capitalizing on earlier-than-expected peak season momentum by levying seasonal surcharges now on the capacity-constrained trade -- and seeking more than double the usual amount.

Ocean carriers began implementing peak season surcharges (PSSs) on June 1, about a month earlier than usual. A number of carriers implemented PSSs of $600 per FEU on June 1 and another $400 on June 15, with at least one liner announcing a $2,000 per FEU PSS effective July 1, several non-vessel-operating common carriers (NVOCCs) told the Journal of Commerce this week.

Besides coming early, carriers are also seeking higher PSSs than they have in past years - totaling $1,000 to $2,000 thus far. In past years, carriers would start with a $600 per FEU PSS in July and raise or lower it in subsequent months based on the strength of the market, the NVOs said.

"This is definitely not a normal PSS environment," said Rachel Shames, vice president of pricing and procurement at the forwarder CV International. "This is more of a COVID environment."

An importer in the automotive sector said he has paid PSSs totaling $1,000 per FEU so far. The proposed July 1 PSS is "still a little bit fuzzy," he said.

"Nobody's gone hard and fast on it yet, so like anything else, everything's negotiable," the source said. "We are fighting this as much as we can."

PSSs are charged on fixed-rate shipments that move under an importer's annual service contract, or an NVO's named account contract. Carriers and mid-sized accounts concluded most of their service contracts in May at rates of $1,500 to $1,700 per FEU to the West Coast. With spot rates to the West Coast now more than $6,000 per FEU, carriers are trying to make up some of the difference through PSSs, a forwarder source said.

"Carriers fixed their contracts at too low a price point," the source said. "They're trying to close that spread."

Carriers must file their peak season surcharges with the Federal Maritime Commission 30 days before implementation, and the actual amount paid is subject to negotiation with individual customers. As the effective date approaches, it is common for carriers to lower the PSS if the market will not support the rate filed with the FMC.

Importers urged to book shipments earlier than normal

The current tight capacity situation in the eastbound trans-Pacific, in which importers are being advised to book their shipments at least four weeks in advance if they want to secure vessel space instead of the more typical one to two weeks, is challenging, Shames said.

"It's especially frustrating," she said, because importers don't know what magnitude of PSSs the market will sustain four weeks out or longer.

"It's all a dance," said an importer of home furnishings who is involved in negotiating a PSS. "They want $1,000 (per FEU), we countered with $300." The importer is waiting to hear back from the carrier.

The source said he must also make a calculated risk: If he doesn't meet the carrier's PSS demand, does he have enough other core carriers that will agree to load all of the shipments he needs when the time-sensitive shipments must move?

A carrier executive told the Journal of Commerce his line is booked from Asia to the US for the next month. The soonest he can accept bookings is for late July-early August

"There is no room from Asia," the executive said. "This is not even a matter of money. There is no room."

He is advising customers who are desperate for space in the coming weeks to go to the secondary market of NVOs, both large and small. That may require cobbling together a few slots each from a dozen or more NVOs, though managing so many vendors can be quite difficult, he acknowledged.

Capacity in the Asia-US trades is exceptionally tight right now due to a confluence of factors, the main one being the ongoing vessel diversions around southern Africa to avoid Houthi militant attacks in the Red Sea and Gulf of Aden, which is forcing carriers to avoid the Suez Canal. The much longer route is adding more than 10 days to voyages from Asia to Europe and the US and is absorbing a significant amount of capacity.

Also, congestion in Asian ports is adding time to many services from Asia to Europe and the US and resulting in blanked sailings as vessel schedules are disrupted. Carriers are moving more vessels into the Asia-Europe trades, where freight rates are higher than in the trans-Pacific.

Helping to tighten capacity, particularly for smaller carriers that don't have extra ships to spare, is the requirement that carriers drydock vessels for maintenance every five years, the carrier executive noted. Those requirements under the International Convention for the Safety of Life at Sea (SOLAS) were suspended during COVID, the executive said.

Spot rates soaring due to general rate increases

Trans-Pacific carriers have been quite successful in implementing several general rate increases (GRIs), which are levied on spot rates, and in the case of NVOs, on freight all-kinds (FAK) shipments. As with peak season surcharges, carriers must file their GRIs with the FMC 30 days in advance, though there is no certainty the full amount, or any of it, will actually be implemented. If the market is strong, carriers may get the entire amount. If not, they will implement a lower amount, or none at all if the market weakens considerably from the time the GRI was filed.

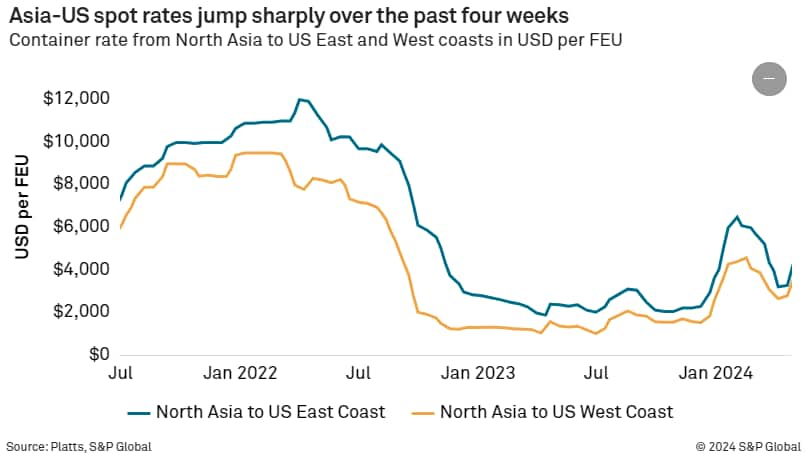

The spot rate from Asia to the US West Coast on May 3 was $4,000 per FEU, jumping to $5,000 per FEU on May 17, $6,200 on June 7 and $6,875 on June 13, according to Platts, a sister company of the Journal of Commerce within S&P Global.

The East Coast spot rate on May 3 was $4,800 per FEU, increasing to $6,110 on May 17, $7,300 on June 7 and $7,975 on June 13.

A number of carriers have announced new GRIs due to take effect June 15. Those GRIs, which will most likely stick given the strength of the market, would raise the West Coast spot rate to $7,200-$7,300 per FEU and the East Coast rate to $8,200 to $8,300 per FEU, said Kurt McElroy, executive vice president of the forwarder Kerry Apex.

There is no consensus among NVOs and carriers as to how long the current situation of tight capacity and elevated freight rates will last. But they say it is becoming more obvious that since the Red Sea diversions show no sign of letting up, it's likely that importers will face GRIs and PSSs at least through Golden Week in Asia in the first week of October.

Meanwhile, shipping lines seeking to bolster their container fleets through chartering will face a market of rapidly increasing lease rates. The average container leasing rates have doubled since November on the China to US route, according to Container XChange, which tracks the charter market. For example, the leasing rate on the Shanghai to Los Angeles route increased from $643 last November 2023 to $1,100 in May. The average leasing rate from Shanghai to Long Beach is $1,230 in May this year, up from $610 in November.

*This article was published on June 14, 2024 by the Journal Of Commerce

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpeak-season-surcharges-land-earlier-and-higher-in-hot-transpac.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpeak-season-surcharges-land-earlier-and-higher-in-hot-transpac.html&text=Peak+season+surcharges+land+earlier%2c+and+higher%2c+in+hot+trans-Pacific+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpeak-season-surcharges-land-earlier-and-higher-in-hot-transpac.html","enabled":true},{"name":"email","url":"?subject=Peak season surcharges land earlier, and higher, in hot trans-Pacific market | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpeak-season-surcharges-land-earlier-and-higher-in-hot-transpac.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Peak+season+surcharges+land+earlier%2c+and+higher%2c+in+hot+trans-Pacific+market+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpeak-season-surcharges-land-earlier-and-higher-in-hot-transpac.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}