Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 10, 2018

UK pay pressures continue to build as staff hiring remains robust

- Staff appointments continue to rise markedly during March

- Starting salary inflation remains sharp, driven by further decline in candidate availability

- Growth in demand for staff softens but remains strong

UK labour market conditions remained tight in March, according to the latest IHS Markit/REC Report on Jobs survey. Staff appointments continued to rise sharply at the end of the first quarter, while lower candidate availability and reports of skills shortages placed further pressure on employers to raise starting pay.

However, in a sign that the labour market has begun to soften, the latest drop in candidate availability was the weakest seen for a year, while recruiters noted that demand for staff grew at the slowest rate for 15 months.

The Report on Jobs data are compiled from a regular monthly survey of over 400 recruiters conducted by IHS Markit on behalf of the Recruitment and Employment Confederation. The trends signalled by the survey have acted as advance indicators of official (ONS) labour market data releases, most recently anticipating the nascent revival of earnings growth.

Staff appointments increase strongly

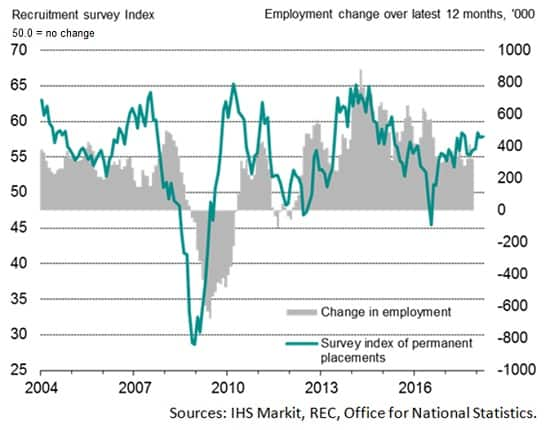

Recruiters signalled a further marked increase in permanent staff placements across the UK in March. Growth in temp billings also remained robust, despite the rate of increase slipping to a 13-month low. Overall, the data point to another robust rise in the official measure of employment over the first quarter of 2018.

Rising employment

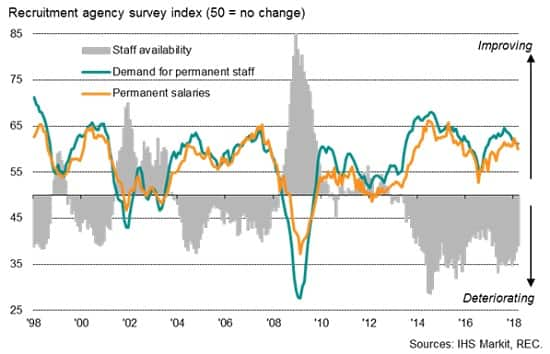

Candidate availability drops further

The survey also showed further steep declines in the availability of permanent and temporary candidates in March, despite the overall pace of deterioration easing to the least marked for one year.

Tightness of the labour market

Skill shortages remained widespread, with recruiters signalling difficulties in sourcing staff for a variety of roles including accountants, cyber security, HGV drivers, healthcare workers and teachers.

While deteriorating staff availability reflects the current low level of unemployment (the unemployment rate currently stands at a four-decade low of 4.3%), a number of panellists commented that the shrinking pool of candidates can also be linked to Brexit-related nerves among workers.

Pay pressures hold close to 2½-year peak

The solid hiring trend and skill shortages continued to drive up pay rates, albeit with some modest cooling evident in the latest survey period.

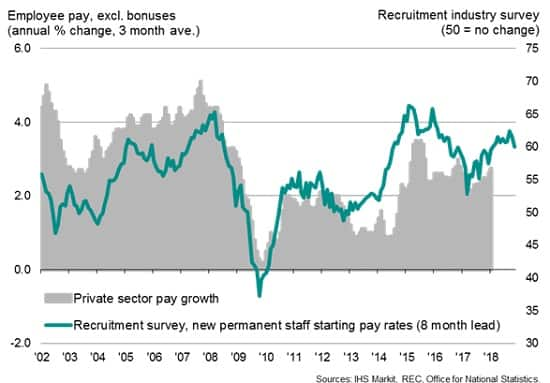

Surveys point to stronger future earnings growth

The data highlighted a further steep increase in salaries offered to newly-placed permanent staff during March, though the rate of growth softened further from January’s 31-month peak.

The latest data from the Office for National Statistics (ONS), available only up to January, have meanwhile shown earnings growth reach a near two-and-a-half-year high at the start of the year. Total pay (including bonuses) was up 2.8% on an annual basis in the three months to January. Average pay excluding bonuses meanwhile rose by 2.6% over the same period, to mark the strongest growth for over a year.

Although the survey of recruiters hints that growth in starting salaries has softened slightly since the start of the year, it’s still indicative of a level of pay growth which will add to hawkish views on interest rates, and as such will add to the odds of a May rate rise.

Furthermore, the data suggest the gap between rises in living costs and earnings is closing, paving the way for the first increase in real pay for over a year.

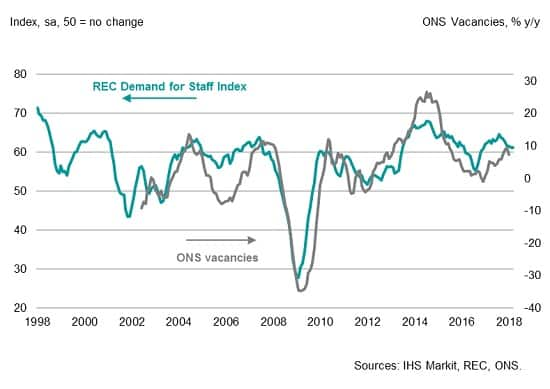

Demand for staff slips to 15-month low

While the latest recruitment industry survey data continue to point to a tightening labour market, there are also some signs of cooling. Although robust, demand for staff is growing at a reduced rate compared to last year’s peaks. Overall, staff vacancies expanded at the slowest rate since December 2016 in March. Although the dip in demand could partly stem from heavy snowfall during the month, the underlying trend has been one of a slowdown. Survey data show that growth of demand has softened in each of the past seven months.

Demand for staff shows signs of cooling

This adds to tentative signs in official data that vacancies are growing at a softer pace as we round off the first quarter. Latest ONS figures showed that vacancies rose by +7.4% year-on-year in the three months to February, down from +9.4% in the three months to January, and marking the first time that growth has softened since mid-2017.

Annabel Fiddes, Principal Economist, IHS Markit

Tel: +44 1491 461010

annabel.fiddes@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpay-pressures-staff-hiring-robust.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpay-pressures-staff-hiring-robust.html&text=Uk+pay+pressures+continue+to+build+as+staff+hiring+remains+robust+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpay-pressures-staff-hiring-robust.html","enabled":true},{"name":"email","url":"?subject=Uk pay pressures continue to build as staff hiring remains robust | S&P Global&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpay-pressures-staff-hiring-robust.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Uk+pay+pressures+continue+to+build+as+staff+hiring+remains+robust+%7c+S%26P+Global http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpay-pressures-staff-hiring-robust.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}