Pandora glitters gold for short sellers

Short sellers target jewelers as the so-called global retail apocalypse continues to play out.

- Pandora jewelers most shorted European consumer durables stock

- Short sellers have increased bets against Pandora tenfold in last 12 months

- Other retail jewelers selectively targeted by short sellers

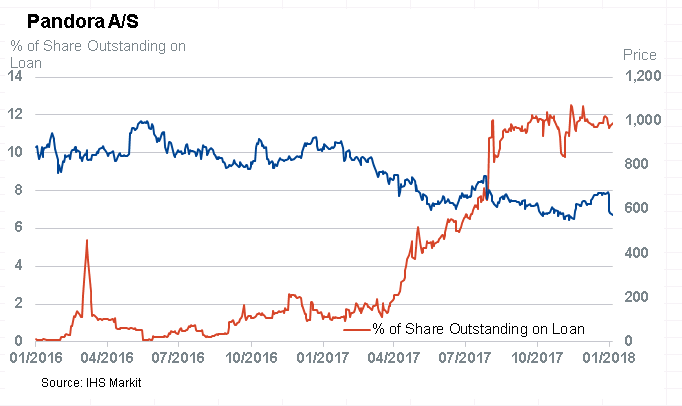

It’s been a wild start to 2018 for shareholders of Danish jeweler Pandora. The share price declined more than 15% between January 9th and 15th – a result short sellers have been waiting for since they started increasing bets against the firm in early 2017. Since then, shares have recovered more than half the decline, as the CEO has soothed some investor concerns; however, the short demand for Pandora is unchanged.

Since the start of 2017, short sellers have increased their positions in Pandora dramatically, and more than 11% of outstanding shares are now out on loan. The trade worked perfectly to start, with the double digit price declines in Q1 and Q2 of 2017. Short sellers continued to press in Q3 – undeterred by a rally of more than 20% in August – and were rewarded when shares appeared to resume the downtrend, setting a 52 week low of DKK 560.5 on November 24th. Meanwhile, it’s interesting to note that the demand for shares from short sellers has been flat since the start of September.

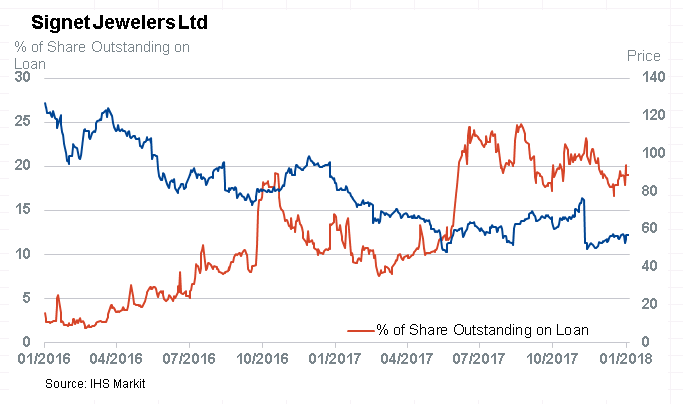

Short sellers are hoping that Pandora will follow Signet Jewelers, whose shares have declined in value by more than 60% since the all-time high in October 2015. Throughout the decline, short sellers increased their bets, reaching a peak of 24% of outstanding shares in September. On November 21st, Signet shares plunged 30% in a single day after the firm reported disappointing sales numbers. This was a sweet relief for short sellers who got in late, as shares rallied nearly 50% from their 52-week low in the preceding three months. While volatility has been elevated recently, no clear trend has emerged and, like Pandora, the share price is currently higher than it was at the end of Q2.

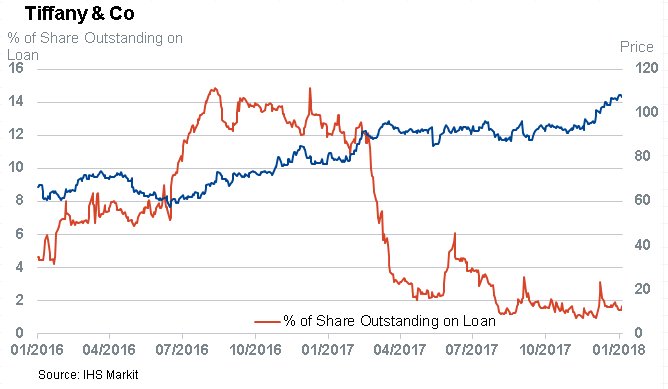

Short sellers are not indiscriminately betting against retail jewelers and have in fact covered significant positions in the sector over the last year. Tiffany’s attracted significant short activity in late 2016, but its share price rallied by 20% in Q1 of 2017, and short sellers took down positions. After treading water for the subsequent six months, shares rallied a further 16% in Q4, suggesting short sellers were wise to stay away. A similar narrative emerged in Swatch Group, which saw short interest decline by more than 50% in the last year while share price has increased 17%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.