Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 23, 2019

Onset of US/China Trade War in May Triggers Noticeable Steepening in the IHS Markit iBoxx™ USD Investment Grade Index

The rally in US investment grade bond spreads appears to have stalled following the breakdown of the US/China trade negotiations announced in early May.

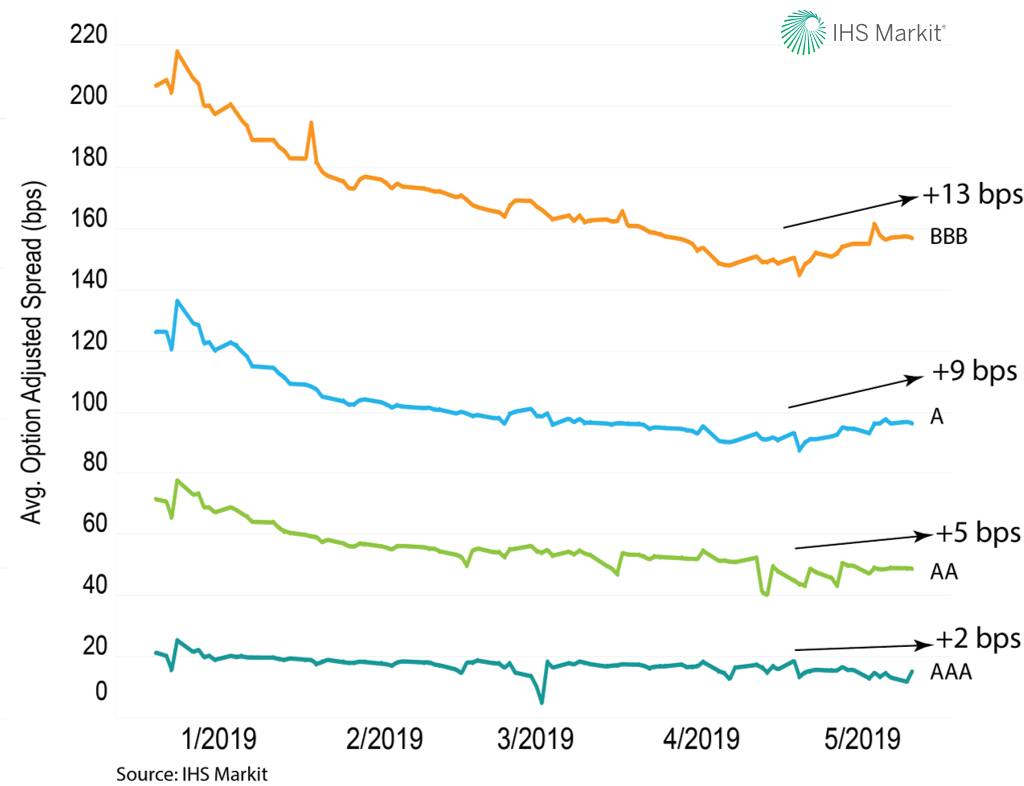

As shown in figure one, the average option adjusted spreads (OAS) for constituent data from the IHS Markit iBoxx USD Investment Grade Index hit their widest point in years on January 4, 2019, but then began to contract and continued to rally through the end of April 2019.

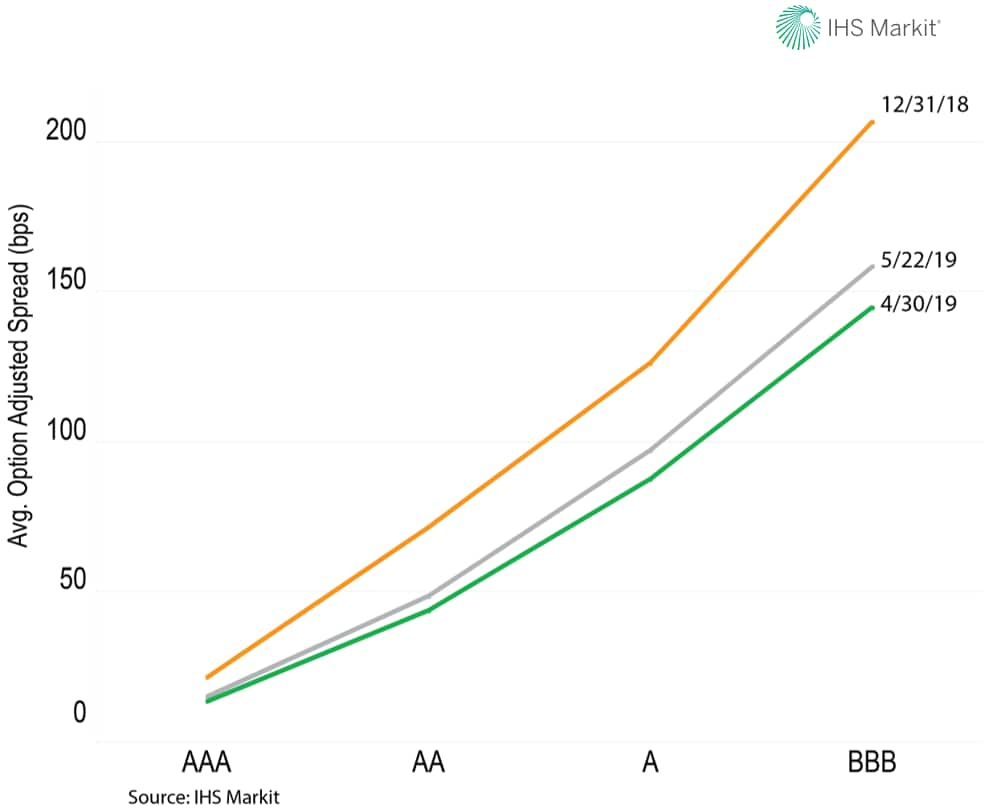

However, as seen in figure 2 below, the month of May has seen the most prolonged period of widening since the significant global equity and credit markets sell-off that began in October 2018:

- OAS spreads for USD BBB rated bonds had tightened 73bps to close at an average OAS spread of 145bps on April 30, 2019.

- BBB spreads have since widened 15bps to close at an average OAS of 158bps on May 22.

- Software and insurance were the hardest hit AAA rated constituent sectors, which both widened 11bps to an average OAS of 67bps and 55bps on May 22, respectively.

- Non-ferrous metal companies were among the worst performers of the BBB rated cohort, widening 40bps during the month to an average OAS of 231bps on May 22.

iBoxx bond indices offer broad benchmarking and liquid tradable index solutions that track bond markets globally. Fueled by multi-source pricing, iBoxx provides transparency to bond market performance. iBoxx rules-based methodologies are publicly disclosed and designed to be replicable.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fonset-of-uschina-trade-war-in-may-triggers-noticeable-steepeni.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fonset-of-uschina-trade-war-in-may-triggers-noticeable-steepeni.html&text=Onset+of+US%2fChina+Trade+War+in+May+Triggers+Noticeable+Steepening+in+the+S%26P+Global+iBoxx%e2%84%a2+USD+Investment+Grade+Index+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fonset-of-uschina-trade-war-in-may-triggers-noticeable-steepeni.html","enabled":true},{"name":"email","url":"?subject=Onset of US/China Trade War in May Triggers Noticeable Steepening in the S&P Global iBoxx™ USD Investment Grade Index | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fonset-of-uschina-trade-war-in-may-triggers-noticeable-steepeni.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Onset+of+US%2fChina+Trade+War+in+May+Triggers+Noticeable+Steepening+in+the+S%26P+Global+iBoxx%e2%84%a2+USD+Investment+Grade+Index+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fonset-of-uschina-trade-war-in-may-triggers-noticeable-steepeni.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}