Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

WHITEPAPER

May 29, 2024

Oil price cap policy — Customs and ship-tracking anomalies

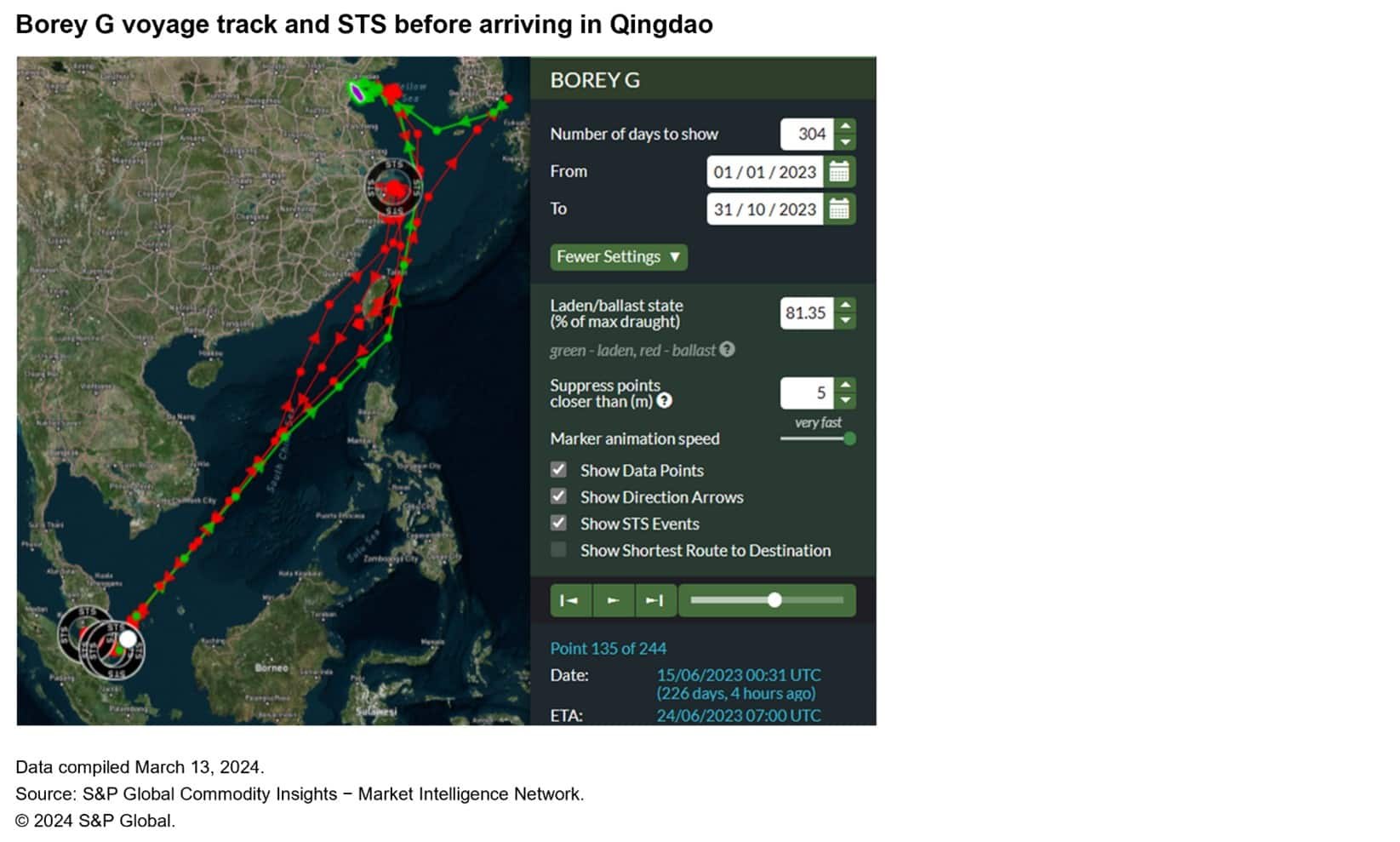

A recent report in local Chinese media outlets reported that an importer received 100,000 metric tons of oil product via tanker Borey G (IMO: 9199127) arriving at Qingdao, mainland China, in October 2023[1]. The cargo was declared as "other fuel oil" under HS Code 2710.19.29; however, it turned out to be utilized for refining purposes, therefore, implying a shipment of crude oil that should technically be reported under HS 2709. Mainland China customs data shows that in October 2023, the import volume under "other fuel oil" HS code 2710.19.29 exceeded its full-year volume in 2022. Additionally, the value of mainland China's oil imports classified under the HS Code 2710.19.29 increased by $2.6 billion in 2023.

In this context, it is important that the classification of petroleum products is done with care, ordinarily for local tax and customs regulation but also in respect to the G7 oil price cap policy for crude oil and petroleum products. Crude oil within the price cap policy falls under HS codes beginning 2709.00. Petroleum products fall under the premium-to-crude and discount-to-crude categories within the HS codes of 2710. In the case of oil on board Borey G, the HS Code 2710.19.29 is not covered directly in the documentation issued by the price cap policy. For oil cargoes classified at the tariff level (eight digits in this case), there is a possibility of using a HS code from a particular jurisdiction, although this tariff code may differ from those used by price cap coalition members or in its documentation.

From a trade compliance perspective, there is an additional factor to be reminded of in respect to understanding whether a cargo falls under the price cap or not. An organization determining "safe harbor" (oil cargo priced at or below the cap) needs to understand if the cargo follows the accepted recordkeeping and attestation process. Part of this process covers a requirement to retain documents highlighting that the oil cargo was shipped within the price cap's parameters. Alongside this type of check is the need to match HS codes to those on the list of covered articles falling under the price cap. A simple matching of HS codes or tariff codes in trade documents to the covered articles in the price cap is not sufficient, as certain local tariff codes will not match and go undetected. The HS/tariff code of 2710.19.29 is one such example. The HS/ tariff code is one method of determination for potential Russian-origin oil, but other factors also play a major role; an understanding of the vessels port of load, route diversions and cargo transfers, oil storage facilities and the ultimate owner of ship and cargo.

Using the example of Borey G, the trade documentation associated with its cargo and the tracking of the vessel's movements highlight potential discrepancies in the journey that can inform trade compliance teams of heightened risk and possible oil price cap evasion.

The recent US Quint Seal Compliance Note outlining "Know Your Cargo" principles (December 2023), the Price Cap Coalition Enforcement Alert (February 2024) and OFAC's Updated Guidance on Price Cap Policy (December 2023) reiterate several compliance issues potentially present in the Borey G case:

- Misreporting within the attestation process and the submission of incorrect details to obscure the nature or origins of the cargo

- Hidden vessel tracks whereby a ship's route is not entirely visible

- Potential consolidation of price cap avoidance in certain geographical locations

- Complex ownership structures obscuring group owners and relationships with unknown maritime actors

- Using incorrect product classification codes to hide the true state of the cargo or its potential usage

These key compliance elements will be explored in this paper to understand how potential risk can be identified and how using appropriate information as part of a wider risk and compliance screening tool can help to mitigate the identified risks.

<span/>Key takeaways

- Mainland China's use of tariff codes describing oil cargoes as "other fuel oil" have increased. Fuel oil recorded as imported from Malaysia rose from $137 million in 2022 to $2.2 billion in 2023.

- Malaysia has been a key trading partner for oil export to mainland China in 2023.

- Malaysia customs showed a discrepancy in the US dollar value of oil exported to mainland China when compared with the values recorded by mainland China customs in 2023. Mainland China's figures are considerably higher.

- "Other fuel oil" from Russia, South Korea and the United Arab Emirates to mainland China has increased in volume throughout 2023.

- Vessels have been diverted from other sea routes to service the trade of oil from Malaysia to mainland China in 2023.

- Loading locations of oil cargoes headed to mainland China have become more diverse with "floating oil storage" (FSO) prominent, increasing year over year since 2020.

- Reverse lightering is increasingly evident in Malaysian waters with smaller vessels transferring oil to FSOs. The compliance status of these smaller vessels are generally found to be of higher risk.

- Vessels involved in these reverse lightering activities have been found to have visited Russian ports.

- In 2023, Malaysia and Singapore increased their supply of fuel oil, some of it potentially of Russian origin, back to Northwest Europe and the Mediterranean.

- A similar pattern of fuel oil flow from Greek ports to the US also occurs in 2023. One vessel was involved in multiple ship-to-ship (STS) cargo transfers prior to reaching its destination in the US.

- Greece is also, in accordance with customs data, not an exporter of fuel oil to the US but has, through ship tracking data, seen a number of voyages completed between the two countries.

<span/>Analysis

<span/>Key findings of the Borey G

To determine how various crude oil and petroleum product cargoes are reported with customs and shipped from their load to discharge port, it is important to analyze sources from customs, government statistical authorities, and ship tracking and data services.

Since the beginning of 2023, the voyage history of Borey G has identified a number of sailing routes between Southeast Asia and mainland China coastal ports, with multiple STS activities taking place near Malaysia. A detailed look at these STS activities identifies four cargo transfers all located near Malaysia with crude oil tankers MSEnola and FSO SA Europe, twice respectively.

Click here to download the full complimentary paper where we will cover:

- Key findings of the Borey G

- Customs classification discrepancies

- Shipping activity related to customs discrepancies

- Global trade patterns for oil price cap cargoes

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter for the latest insight and opinion on trends shaping the compliance and shipping industry from trusted experts.

[1] See Sina Finance, "An importer received 100,000 tonnes of oil product via Borey G vessel, Jan. 20, 2024," https://cj.sina.com.cn/articles/view/6248544856/174713a580200181ig?finpagefr=p_104.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foil-price-cap-policy-customs-and-shiptracking-anomalies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foil-price-cap-policy-customs-and-shiptracking-anomalies.html&text=Oil+price+cap+policy+%e2%80%94+Customs+and+ship-tracking+anomalies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foil-price-cap-policy-customs-and-shiptracking-anomalies.html","enabled":true},{"name":"email","url":"?subject=Oil price cap policy — Customs and ship-tracking anomalies | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foil-price-cap-policy-customs-and-shiptracking-anomalies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+price+cap+policy+%e2%80%94+Customs+and+ship-tracking+anomalies+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foil-price-cap-policy-customs-and-shiptracking-anomalies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}