Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 04, 2018

Nikkei Indonesia PMI points to faster growth, but also higher cost pressures

- Manufacturing PMI rises to 51.7 in May, highest in nearly two years

- Inflationary pressures intensify, largely due to a weaker rupiah

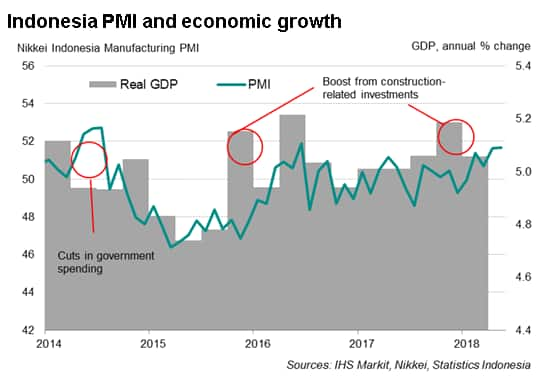

Growth in the Indonesian manufacturing sector picked up slightly midway through the second quarter, according to the Nikkei PMI surveys, setting the sector on course for its strongest quarterly expansion for four years. However, the surveys also point to sharp cost pressures, largely driven by the depreciation of the rupiah.

Improved growth

The headline Nikkei Indonesia Manufacturing PMI™ edged up from 51.6 in April to 51.7 in May, signalling only a modest improvement in the health of the sector. May data took the average PMI reading so far for the second quarter to the highest since the second quarter of 2014.

Survey data suggested that growth was driven by robust expansions in both output and new orders, though the upturn failed to boost hiring in the manufacturing sector. Part of the reason for the weaker labour market was on-going spare capacity in the sector, as indicated by a further decline in firms' backlogs of work.

Rate hikes to stabilise rupiah

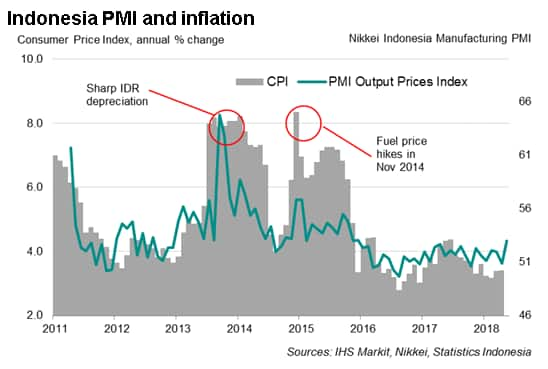

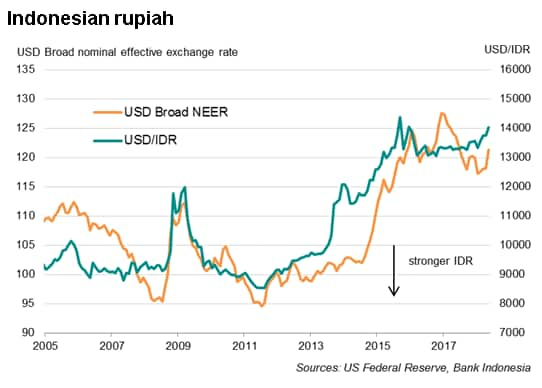

However, of particular concern in May was a stronger rise in input costs. While higher global prices for raw materials (notably oil) pushed up costs, inflation was largely driven by a sharp depreciation of the rupiah, according to survey evidence. The rupiah lost 1.8% against the US dollar in May, and breached the psychological level of 14,000.

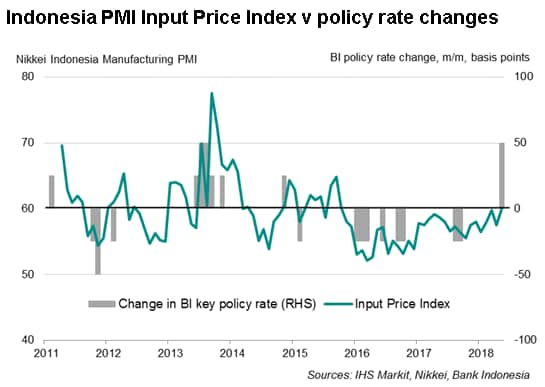

In response to a sharply weaker currency, Bank Indonesia raised its policy rate twice within two weeks in May from 4.25% to 4.75%, with the second hike announced at an additional monetary policy meeting called by the new governor soon after taking office. The PMI's gauge of input prices can provide clues as to changes in monetary policy at the central bank. When the input price index reaches a certain level, the increase in price pressures signalled is consistent with Bank Indonesia tightening monetary policy. In May, input costs rose at a rate not seen since late 2015, reaching the trigger point for higher interest rates. Average selling prices meanwhile showed the largest increase for nearly two-and-a-half years, which could feed through to consumer inflation in coming months.

With the focus on curbing rupiah volatility, the central bank said it is prepared to move again to ensure stability in the currency. However, further rate hikes over such a short period of time could hurt economic activity in the country. As such, the next PMI release on 2nd July will provide more clarity about the initial impact of recent rate hikes.

Bernard Aw, Principal Economist, IHS MarkitTel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-indonesia-pmi-points-to-faster-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-indonesia-pmi-points-to-faster-growth.html&text=Nikkei+Indonesia+PMI+points+to+faster+growth%2c+but+also+higher+cost+pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-indonesia-pmi-points-to-faster-growth.html","enabled":true},{"name":"email","url":"?subject=Nikkei Indonesia PMI points to faster growth, but also higher cost pressures | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-indonesia-pmi-points-to-faster-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nikkei+Indonesia+PMI+points+to+faster+growth%2c+but+also+higher+cost+pressures+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-indonesia-pmi-points-to-faster-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}