Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 02, 2018

Survey data point to weakest quarter since end of 2016

- Nikkei PMI rose to 49.5 in June, up from 47.6 in May

- Slower decreases in both output and new orders

- Employment returns to growth

- GST removal dampens inflationary pressure

Business conditions in Malaysia's manufacturing sector deteriorated further during June, according to latest Nikkei surveys, rounding off the worst quarter since 2016. However, there were tentative signs that economic activity could improve in coming months.

The June data also provided the first insights into a full month of manufacturing activity in the post-election environment.

Weakest quarter since end of 2016

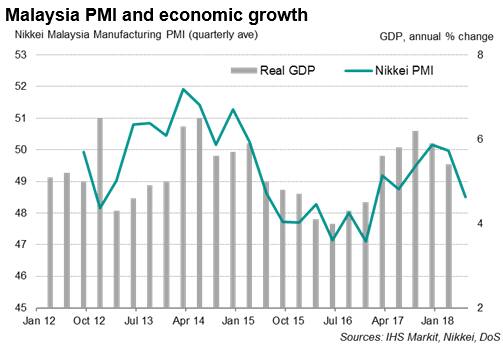

The Nikkei Malaysia Manufacturing PMI™ rose from 47.6 in May to 49.5 in June. The latest reading sets the scene for the first quarterly decline (48.5) in the health of the sector since the third quarter of 2017, and signalled the sharpest fall in activity since the fourth quarter of 2016.

Analysis of the PMI's gauge of output, which exhibits an 81% correlation with GDP growth, indicated that the second quarter average Output Index reading is consistent with an annual GDP growth rate of 4.9%.

That said, the slower rate of deterioration at the end of the second quarter suggests that we could be seeing a bottoming-out of the current manufacturing malaise. Net employment also returned to growth after dipping in May, while optimism remained positive.

Removal of GST

Although unpopular with credit agencies and budget hawks, the zero-rating of the Goods and Services Tax (GST), effective from 1st June, had provided a partial boost to sales, according to anecdotal evidence. While new business intakes fell further in June, the rate of decline was noticeably slower than in the previous two months.

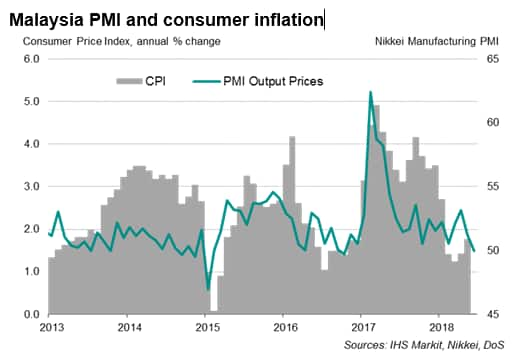

Where the impact of the GST removal was felt the greatest was in prices. Input cost inflation eased to the weakest in over three years. Among panellists that reported a decrease in input prices, the GST cancellation was widely cited as the main cause. At the same time, manufacturers kept output prices unchanged, marking the first time in just over one-and-a-half years that charges were not raised.

Meanwhile, business confidence of future output remained upbeat, although easing to an eight-month low. Optimism was linked primarily to expectations of higher sales due to the zero-rated GST.

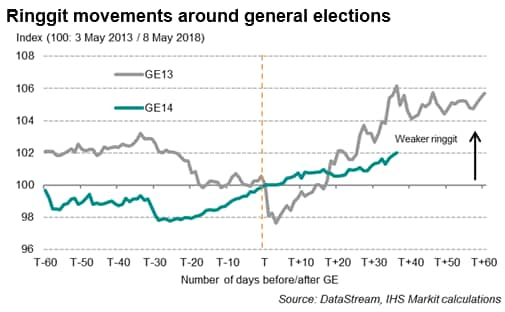

Monetary policy to remain on hold

With GST scrapped, inflation is widely expected to decline, as evident from the latest PMI data. Even if global oil prices rise further, the inflationary impact could be mitigated after the new government set aside three billion ringgits to subsidise fuel prices until the end of 2018. Therefore, there is less pressure for Bank Negara to raise interest rates, in contrast to several of its regional peers, who are also facing currency pressures. The ringgit remained relatively stable after the surprise election results. The policy rate was last increased in January by 25 basis points to 3.25%.

-

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-points-to-weakest-quarter-since-end-of-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-points-to-weakest-quarter-since-end-of-2016.html&text=Survey+data+point+to+weakest+quarter+since+end+of+2016+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-points-to-weakest-quarter-since-end-of-2016.html","enabled":true},{"name":"email","url":"?subject=Survey data point to weakest quarter since end of 2016 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-points-to-weakest-quarter-since-end-of-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Survey+data+point+to+weakest+quarter+since+end+of+2016+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-points-to-weakest-quarter-since-end-of-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}