Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 11, 2023

Labour market cools as recruitment downturn intensifies

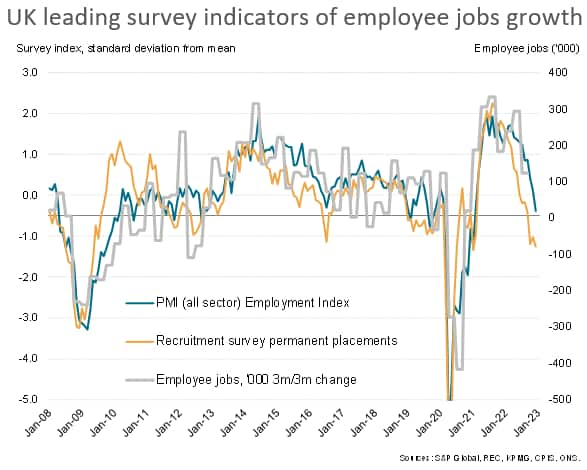

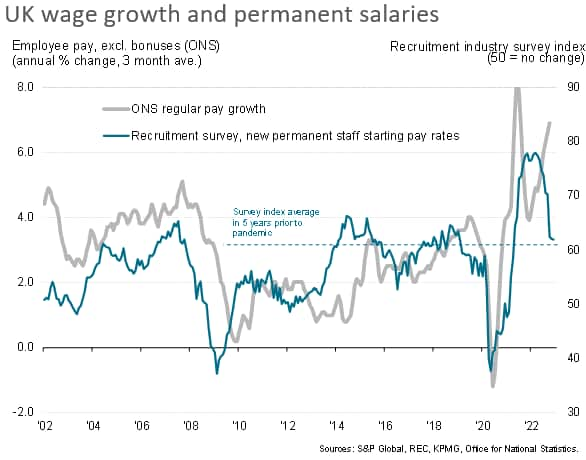

The UK labour market continued to cool at the end of 2022, according to survey data compiled by S&P Global. A sharp drop in the number of people placed in permanent jobs during December meant hiring in the fourth quarter of last year was the weakest since the global financial crisis if lockdown months are excluded. Demand for staff has cooled sharply, reducing upward pressure on starting salaries such that pay growth is now broadly in line with its pre-pandemic five-year average.

The data therefore indicate not only that wage pressures are moderating, to allay policymaker worries over an inflationary wage-price spiral, but that recession risks have intensified amid an ongoing cost of living crisis.

Permanent staff hiring falls for third month

Recruitment agencies in the UK reported a sharp fall in the number of people placed in permanent jobs for a third consecutive month in December, with an increasing rate of decline rounding off the weakest calendar quarter for placements since the spring of 2009 - deep in the depths of the global financial crisis - barring only the early lockdown months of the pandemic.

The decline signalled in the monthly survey of around 400 recruitment consultancies conducted by S&P Global on behalf of KPMG and the REC is a warning of marked cooling of the UK labour market.

The survey - which has been running since 1997 - has historically acted as a reliable indicator of major changes in labour market trends, with the data tracking permanent placements providing a particularly useful advance guide to official payroll numbers. The latest reduction in new job placements is an important advance signal of employment starting to fall after the robust post-pandemic jobs boom, reflecting growing concerns among companies about the economic outlook.

Hiring as a leading indicator

The fall in the recruitment series is accompanied by a deterioration in the employment trend recorded by PMI surveys of broader business conditions. Across manufacturing, services and construction, the CIPS/S&P Global PMI surveys have now signalled falling private sector employment for two consecutive months, with the latest data for December showing an increased rate of decline, albeit with the rate of job losses remaining only modest.

In fact, so far only the recruitment industry survey data are consistent with the official gauge of employment falling in the UK (see chart), though this largely reflects the extent to which the recruitment series tends to lead both the PMI employment index and the official data, as hiring tends to change before actual employment levels change. Typically, faced with disappointing sales or revenues, companies will first enact a hiring freeze before laying off staff. Similarly in an upturn, hiring is of course the natural precursor to higher employment.

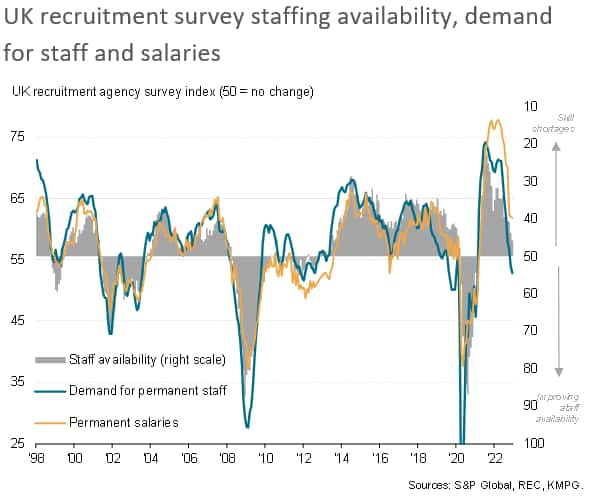

Cooling demand for labour

The recent slump in the number of people placed in permanent jobs is a function of cooling demand for staff from employers as business uncertainty rises. The recruitment industry survey's gauge of employer-demand for staff fell for a seventh straight month in December, dropping to the lowest since the lockdowns of February 2021.

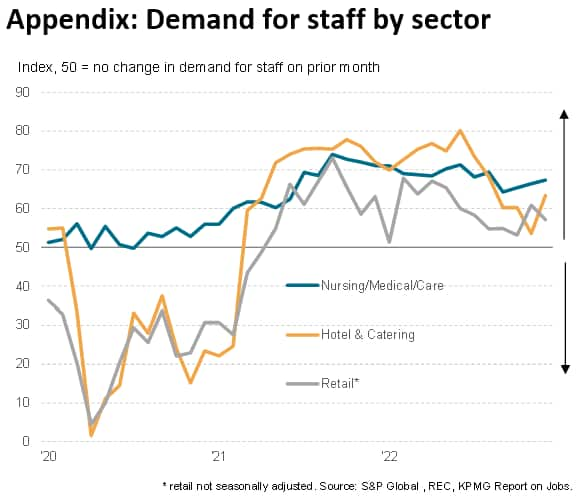

Nursing and hospitality remain strongest job markets

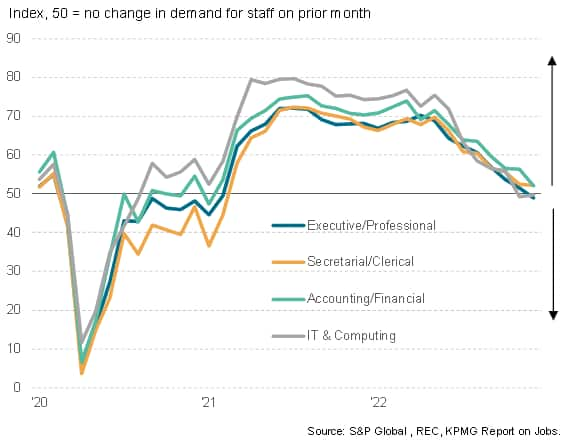

Digging deeper into the data by sectors, December saw falling demand for executive and professional staff for the first time since the COVID-19+ lockdowns, as well as lower demand for IT staff. Demand meanwhile showed only modest growth for accounting & financial staff and secretarial & clerical workers, underscoring a broad-based cooling in the white collar job market.

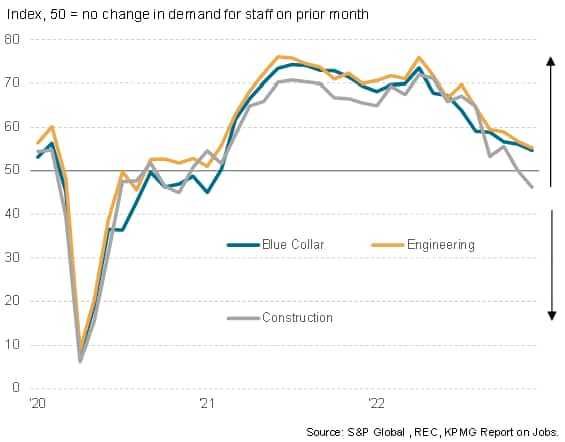

Demand growth also cooled for engineering and blue collar staff and fell for construction workers.

That left nursing/care and hospitality as the only major pockets of the labour market seeing strong and accelerating demand for staff.

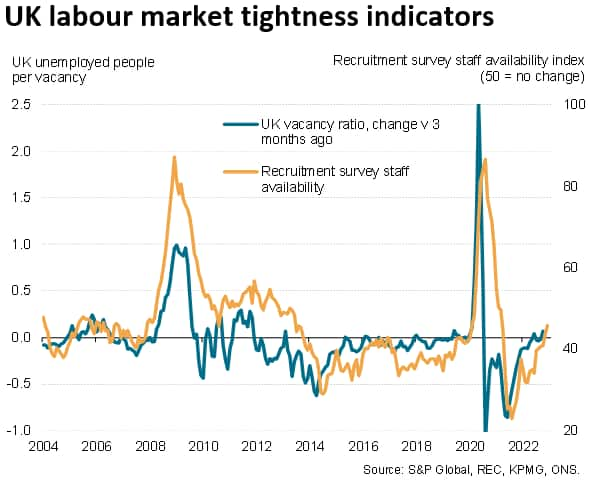

Staff shortages ease

A corollary of the recent drop in demand for staff, and fewer people being placed into jobs, has been a reduction in the number of recruitment consultancies reporting deteriorating availability of candidates to fill vacancies. While overall staff availability continued to deteriorate in December, the incidence of labour shortages was the lowest recorded since March 2021.

This improving situation in terms of candidate availability is indicative of the recent record labour market tightness starting to ease.

Salary growth cools for ninth month

With the demand for staff cooling and staff shortages moderating, wage growth has likewise slowed. The recruitment industry survey's gauge of average salaries awarded to people placed in permanent jobs rose in December at the slowest rate for 20 months, the rate of inflation easing for a ninth successive month.

Permanent salary growth cools close to pre-pandemic average

It's notable that the recent slowing of wage growth in the recruitment industry survey takes the rate of increase within a whisker of its pre-pandemic five-year average. This should naturally be of comfort to policymakers fearing the possible development of a wage-price spiral. However, it also suggests that underlying annual wage growth has fallen below 4% at a time when consumer price inflation remains in double digits. As such, real incomes appear to be falling sharply still, which will add to concerns over the cost of living crisis, as well as fuel fears of a further pull-back in consumer spending and accompanying recession risks.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flabour-market-cools-as-recruitment-downturn-intensifies-January2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flabour-market-cools-as-recruitment-downturn-intensifies-January2023.html&text=Labour+market+cools+as+recruitment+downturn+intensifies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flabour-market-cools-as-recruitment-downturn-intensifies-January2023.html","enabled":true},{"name":"email","url":"?subject=Labour market cools as recruitment downturn intensifies | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flabour-market-cools-as-recruitment-downturn-intensifies-January2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Labour+market+cools+as+recruitment+downturn+intensifies+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flabour-market-cools-as-recruitment-downturn-intensifies-January2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}