Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2024

Japan's private sector returns to growth at start of 2024 while price pressures ease

Japan's private sector expanded for the first time since October, though led mainly by services growth, according to the latest flash PMI data. This was as services new business rose at the quickest pace in four months, although manufacturing new orders also fell at a shallower pace.

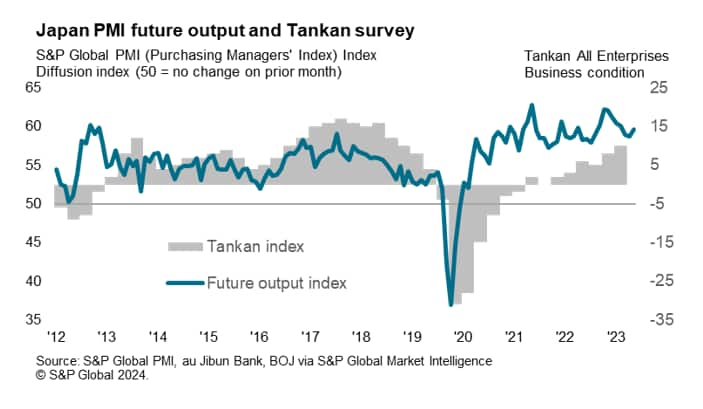

Importantly, positive signs have been observed across other forward-looking indicators, notably including the PMI backlogs of work index, which stabilised over the latest survey period. Business sentiment also remained encouragingly elevated.

Price pressures have meanwhile eased within Japan's private sector at the start of 2024, though both input cost and output price inflation rates remained above-average, broadly supporting convictions of a Bank of Japan exit from current negative interest rate regime.

Japan's flash PMI signal fastest growth in four months

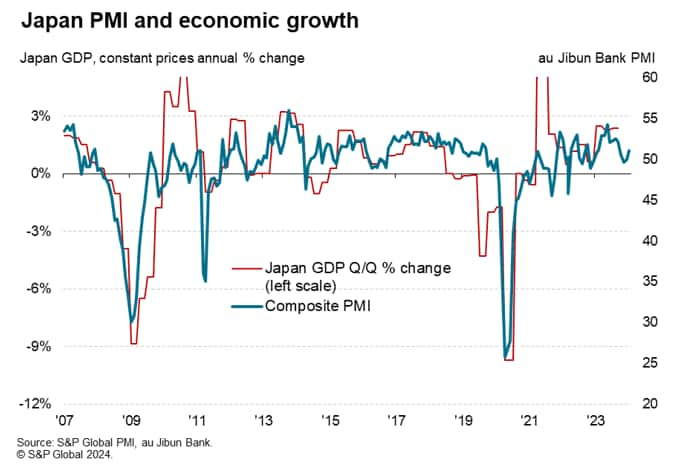

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose from the 50.0 neutral print in December to 51.1 at the start of 2024. The flash reading, based on approximately 85%-90% of total PMI survey responses each month, therefore suggested that Japan's private sector conditions improved for the first time since October. The latest composite output reading - covering both manufacturing and services - further points to GDP growing at an annual rate around 1-2% at the start of the first quarter quarter.

Japan's service sector remains main engine of growth

Supporting the latest improvement in the composite output index was faster service sector growth. Services activity expanded in January at the quickest pace since September 2023 as incoming new business grew more rapidly, the latter driven by improvements in underlying demand conditions and favourable currency conversion conditions. Further spillover into backlogged orders was also observed with the services backlogs of work index rising to a seven-month high. Notably, foreign demand improved for the first time since August last year, indicating a broad-based rise in demand for services both domestically and externally. All these factors continue to bode well for services activity to sustain growth in the coming months.

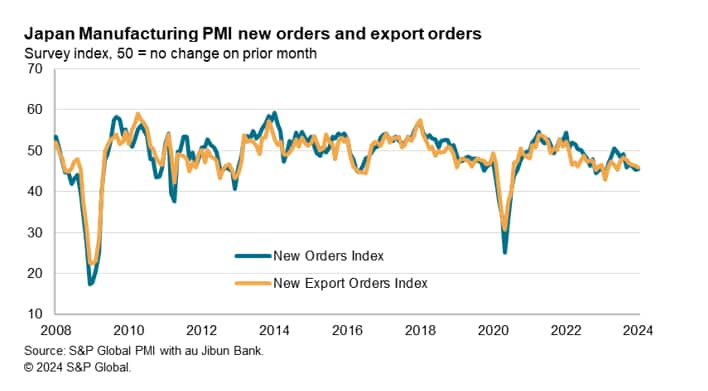

Meanwhile manufacturing output was caught in an eighth straight month of contraction at the start of 2024, though the rate of decline eased moderately from December. The pace of new order reduction similarly eased from the prior month, albeit remaining marked by historical standards. Anecdotal evidence suggested that new orders fell as market conditions remained subdued. The earthquake which hit the Ishikawa prefecture also dampened manufacturing activity at the start of the year.

Assessing forward-looking indicators, a faster depletion of manufacturing backlogs of orders, the quickest since August 2020, hints at further softening of manufacturing sector conditions in the coming months. Manufacturers also reduced their input inventory holdings, anticipating lower production ahead, as business optimism fell.

The latest flash PMI therefore hints at further divergence between the manufacturing and service sectors in the coming months.

Further cooling of price pressures

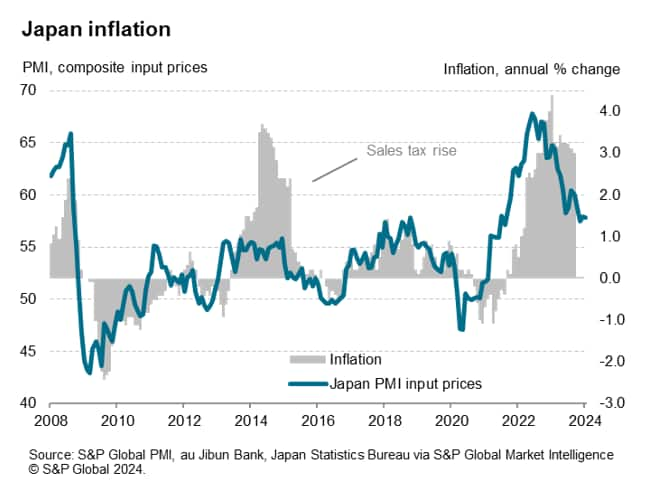

On inflation, overall price pressures cooled at the start of the new year. Despite input cost inflation remaining elevated by historical standards, the rate of inflation fell slightly from December. A decline in selling price inflation was meanwhile also observed, with Japanese private sector firms absorbing some of the recent rise in costs in a bid to support sales. Overall selling price inflation was the lowest in just under two years, with both manufacturing and service sectors recording lower levels of output price inflation.

The latest indicators are consistent with the headline CPI sliding to around the 2.0% level in the months to come. Once again, any further easing of price pressures may add to uncertainties over the Bank of Japan's exit path from the ultra-accommodative monetary policy settings. That said, with the current price trend preluded by PMI prices data, one may argue that the window may be shortening for the lift-off of rates and further build the case for an earlier move.

Optimism improves

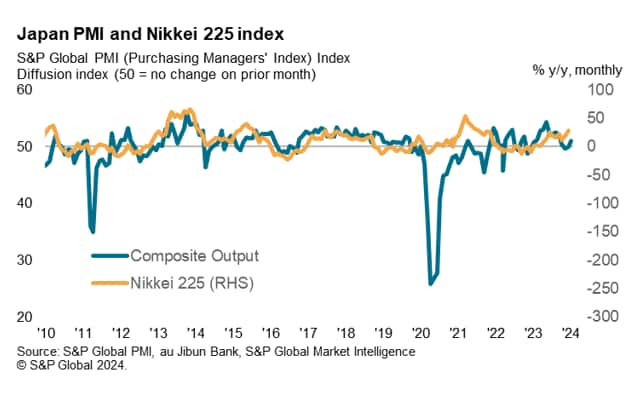

Examining the correlation of the PMI and the Japanese equity market, we have seen optimism surrounding Japanese equities carrying the Nikkei 225 higher of late. The good news is the divergence between the Nikkei 225 and the PMI appears to be closing with the PMI Composite Output Index rising in the latest survey period, thereby supporting current bullish equity market sentiment.

The Future Output Index, the only sentiment-based PMI sub-index, meanwhile outlined improvements in expectations with regards to output in the 12 months ahead, albeit being driven by services at present.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-returns-to-growth-at-start-of-2024-while-price-pressures-ease-jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-returns-to-growth-at-start-of-2024-while-price-pressures-ease-jan24.html&text=Japan%27s+private+sector+returns+to+growth+at+start+of+2024+while+price+pressures+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-returns-to-growth-at-start-of-2024-while-price-pressures-ease-jan24.html","enabled":true},{"name":"email","url":"?subject=Japan's private sector returns to growth at start of 2024 while price pressures ease | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-returns-to-growth-at-start-of-2024-while-price-pressures-ease-jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+private+sector+returns+to+growth+at+start+of+2024+while+price+pressures+ease+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-returns-to-growth-at-start-of-2024-while-price-pressures-ease-jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}