Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2025

Japan's private sector growth accelerates but confidence slips to lowest for over four-years

Japan's private sector output growth accelerated for a third straight month in February, according to the flash PMI, supported by faster services activity expansion while manufacturing output fell at a softer pace. The latest data showed that overall growth was the fastest since last September.

That said, forward-looking indicators provided mixed signals. While incoming new orders continued to rise, the rate of growth softened since the start of the year. Meanwhile optimism levels fell to the lowest since January 2021 to indicate reduced expectations of business activity growth in the year ahead. While inflationary gauges eased, the rates of inflation remained above their respective series averages. Altogether the latest data highlighted greater uncertainties regarding the outlook for growth.

Japan's flash PMI signals fastest growth in five months

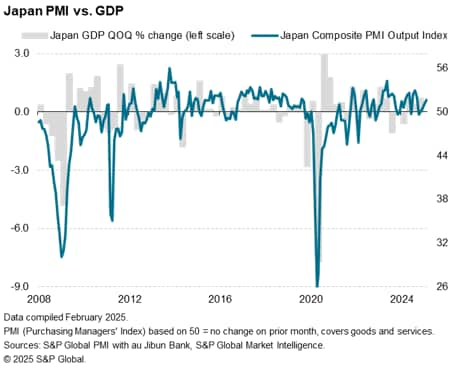

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 51.6 in February, up from a final reading of 51.1 in January. Posting above the 50.0 neutral mark, the latest reading signalled that Japan's private sector expanded for a fourth consecutive month. The rate of expansion was the fastest since last September. At current levels, the latest PMI reading is indicative of quarterly GDP growth at around 0.5% midway through the first quarter of the year.

Japan's private sector growth remains services driven, but manufacturing contraction also eases

The latest acceleration in private sector growth remained services-driven for a fourth successive month. Business activity in the service sector expanded at a rate that was the joint-fastest in six months. This was underpinned by continued sales growth, as service providers indicated that demand improved, particularly in the tourism sector. Export business notably increased at the quickest rate in nine months.

Manufacturing output meanwhile contracted for the sixth month in a row as manufacturers noted subdued conditions both domestically and overseas. February also saw the extension of goods export orders decline to three years for this export-dependent economy, with the key electronics sector among those facing falling foreign demand according to anecdotal evidence. The manufacturing sector nevertheless saw the rate of production decline ease since the start of the year.

Overall, the latest data suggest that private sector output growth tentatively improved, but had remained uneven going further into 2025.

Forward-looking indicators provide mixed signals for near-term growth

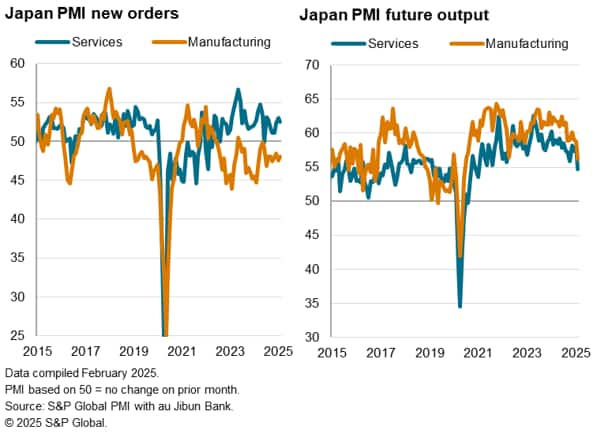

Looking ahead, forward-looking indicators presented mixed signals for near-term performance.

In particular, new orders rose at a slower pace midway through the first quarter of 2025, outlining the potential for a slowdown in growth in the near term. This was as services new business expansion eased since January, while manufacturing new orders remained in contraction.

Additionally, the survey's only sentiment-based indicator - the Future Output Index - showed that business optimism among Japanese private sector firms slipped to the lowest in over four years (since January 2021). This was attributed to falling confidence in both the manufacturing and service sectors. A weakened demand outlook and persistent inflation were among the key factors mentioned by panellists that held a pessimistic view regarding output over the next 12 months.

Importantly, frequent mentions of labour shortages among service providers also presented risks of a slowdown in the main growth sector. Services employment growth moderated in February, rising at among the slowest pace in the past year as firms faced difficulty in acquiring suitable candidates for hire. This provides challenges for business activity growth, with the possibility of growth potentially being limited by the lack of adequate staff.

Inflationary pressures remain historically elevated despite easing in February

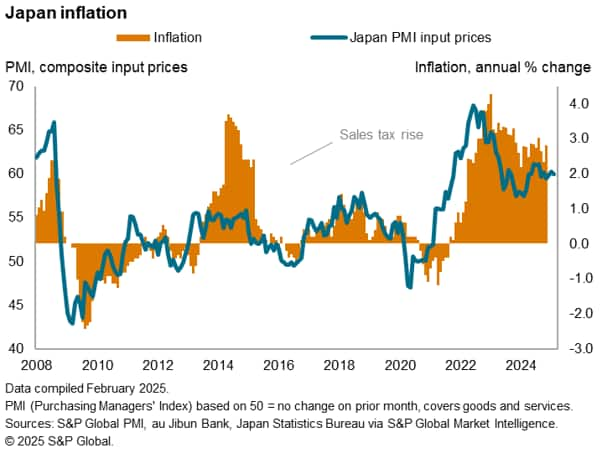

Finally, price pressures remained elevated for Japanese businesses in February, despite having softened since the start of the year.

Average input prices rose at a slower pace in February, though the rate of inflation remained well above its long-run average. While cost inflation eased in the service sector, manufacturers faced the joint-fastest increase in input costs in six months. Once again, raw material, transport and wage costs, partially underscored by weakness of the domestic currency, were the main contributors to steep inflation.

Consequent of the sharp increase in input costs, Japanese businesses continued to share their rising cost burdens with clients. The rate of output price inflation declined in line with input prices, but remained above both its long-run and past three-year averages to signal elevated inflationary pressures in Japan.

Overall, the latest PMI price gauges are indicative of inflation remaining at around the 2.0% mark in the coming months. After tightening in January, the Bank of Japan (BoJ) is not expected to lift rates again till much later in 2025. While the latest inflation data remain supportive of the BoJ's tightening bias, the forward-looking indicators paint an uncertain outlook for growth which we will continue to monitor via the PMI releases in the lead up to the September BoJ meeting, which is when we see the greatest potential the next hike.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-but-confidence-slips-to-lowest-for-over-fouryears-feb25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-but-confidence-slips-to-lowest-for-over-fouryears-feb25.html&text=Japan%27s+private+sector+growth+accelerates+but+confidence+slips+to+lowest+for+over+four-years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-but-confidence-slips-to-lowest-for-over-fouryears-feb25.html","enabled":true},{"name":"email","url":"?subject=Japan's private sector growth accelerates but confidence slips to lowest for over four-years | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-but-confidence-slips-to-lowest-for-over-fouryears-feb25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+private+sector+growth+accelerates+but+confidence+slips+to+lowest+for+over+four-years+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-but-confidence-slips-to-lowest-for-over-fouryears-feb25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}