Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 21, 2025

Japan's growth momentum rises alongside improvement in business confidence

Business activity growth in Japan accelerated in November, according to the flash PMI data by S&P Global. While growth remained lopsided, driven by the service sector, the contraction in manufacturing production eased noticeably midway through the final quarter of the year.

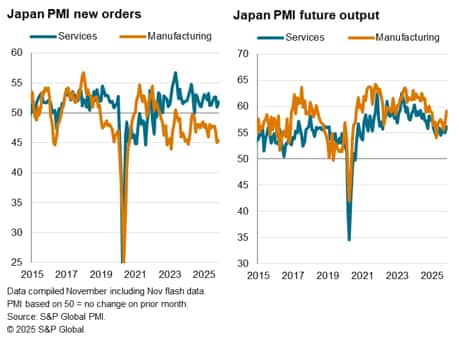

Notably, demand remained subdued as new business continued to fall, dampened by another steep fall in goods new orders. That said, an uplift in business confidence to the highest in ten months hinted at potential improvements in business conditions in the near-term.

Yen weakness meanwhile contributed to greater cost pressures for Japanese companies, which led to another solid increase in output charges. The elevated inflation, coupled with stronger output growth in November, therefore helps support calls for the Bank of Japan to raise rates at the end of the year, countering some weak signals on the economy from official data.

Japan's flash PMI reaches joint-highest level in 15 months

The S&P Global Flash Japan PMI Composite Output Index rose to 52.0 in November, up from 51.5 in October. Posting above the 50.0 neutral mark for an eighth consecutive month, the reading signalled another expansion in business activity. Moreover, the rate of growth was the joint-fastest since August 2024, matched also by those in August, February and last September.

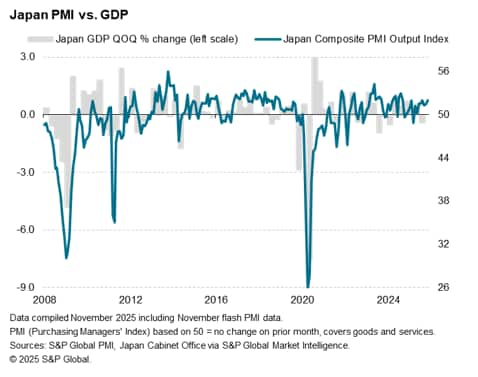

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of just over 0.5% in November, which is above the 0.2% average seen over the past decade. The first two-month average for the fourth quarter is currently also the highest seen since the third quarter of 2024.

The resilience of the PMI contrasts with the official GDP data, which registered an economic contraction in the three months to September for the first time since early 2024. As such, the PMI suggest the fall in GDP will likely prove short-lived, and will rebound in the fourth quarter. However, both the GDP and PMI data confer in signalling a stressed manufacturing sector, which also highlighting potential downside risks to any pullback in tourism related spending, which has provided an important stimulus to the dominant services economy.

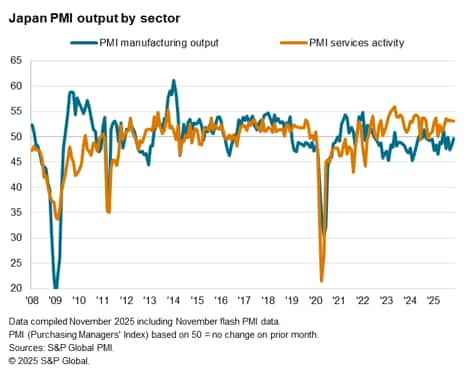

Services activity growth remains solid while manufacturing output contraction eases

Business activity growth remained limited to the service sector for a fifth consecutive month in November. The rate at which the service sector grew was unchanged from October, having maintained a solid pace since July. Overall, this extended the period in which Japan's business activity growth had mostly been powered by the service sector which commenced since mid-2022.

The latest growth in services activity was underpinned by a stronger rise in services new business. Although new export business contracted modestly again, anecdotal evidence suggested that various tourism-related activity had helped to stimulate the demand for services, including via the maintenance of tourist amenities ahead of the winter season. Services firms also hired additional staff to cope with ongoing workloads and in anticipation of rising demand, the latter seen via rising optimism regarding future output in November. The pace at which staffing levels rose notably accelerated to a five-month high and was above-average.

In contrast, manufacturing output fell for the fifth month in a row in November amid another sharp downturn in new orders for Japanese manufactured goods. Despite the reduction in uncertainty related to US tariffs, the pace at which goods new orders fell had eased only slightly from the October low. This was accompanied by a sharper fall in new orders from abroad. Comments from panellists often mentioned clients being conservative with their spending in the current economic backdrop. Some firms also noted that the conclusion of the World Expo in October posed a direct hit to new work inflows.

Despite subdued demand conditions, manufacturing output fell only marginally in November, easing from a modest pace in October. This was while sentiment regarding output in the next 12 months climbed to the highest in nearly a year, further contributing to goods producers expanding their workforce capacity at a quicker pace in November. Among the reasons provided for the surge in confidence levels were hopes for new product launches and business development efforts to drive sales, while some companies also expressed confidence in the new administration to support economic growth in the coming year.

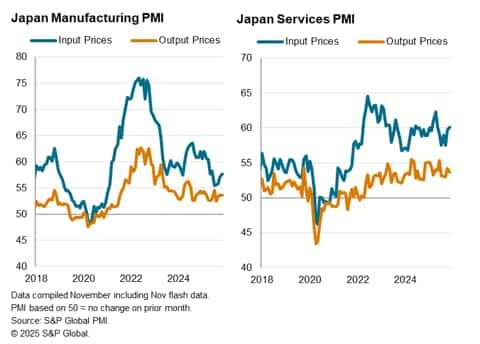

Cost pressure at six-month high

Turning to prices, average input costs continued to increase for Japanese companies in the penultimate month of the year. The rate of input cost inflation was the highest in six months with both manufacturers and service providers facing greater cost pressures in November. Moreover, the rates of inflation were above their respective series averages across both sectors amid reports of rising raw material, rent and wage costs, made worse by a weak domestic currency.

Although Japanese firms attempted to share their added cost burdens with clients, the rate of output price inflation was lower than in October. Service providers raised their charges at a slower pace to support sales while goods selling price inflation stayed unchanged in November against a backdrop of falling demand.

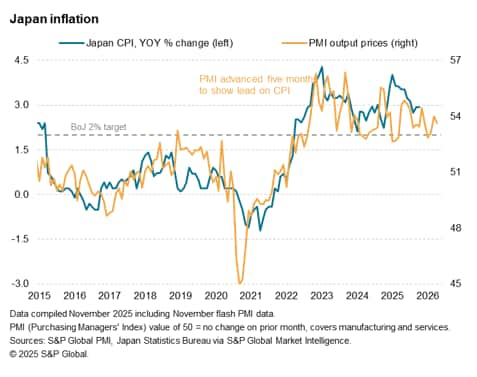

Overall, the rate of output price inflation matched the year-to-date average and is indicative of consumer price inflation continuing to run above the Bank of Japan's 2% target in the coming months, with the potential to rise further if companies start to pass on their increasing cost burdens to customers.

As such, the elevated price inflation trend, coupled with accelerating growth supported by a near-stabilizing manufacturing sector, keeps the BoJ on track to lift rates in its final meeting of 2025. Certainly, the weak export condition, attributed to higher US tariffs, remain a concern for growth, but current conditions indicated by the PMI continue to outline an opportune moment for the BoJ to move, especially amid lingering risks of the window closing should rising prices start to add pressure to demand.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-rises-alongside-improvement-in-business-confidence-nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-rises-alongside-improvement-in-business-confidence-nov25.html&text=Japan%27s+growth+momentum+rises+alongside+improvement+in+business+confidence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-rises-alongside-improvement-in-business-confidence-nov25.html","enabled":true},{"name":"email","url":"?subject=Japan's growth momentum rises alongside improvement in business confidence | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-rises-alongside-improvement-in-business-confidence-nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+growth+momentum+rises+alongside+improvement+in+business+confidence+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-growth-momentum-rises-alongside-improvement-in-business-confidence-nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}