Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 24, 2025

Japan's business activity growth slows in September as manufacturing downturn deepens

Japan's private sector business activity expanded at the slowest pace in four months in September, according to the flash PMI. While services activity continued to rise at a solid rate, manufacturing output contracted at a faster pace, weighing on overall performance. A sharper downturn in goods new orders, attributed partly to a continued fall in export orders, underpinned the steeper fall in manufacturing production in Japan. Meanwhile, business optimism deteriorated among Japanese companies, which contributed to the slowest rise in staffing levels in two years.

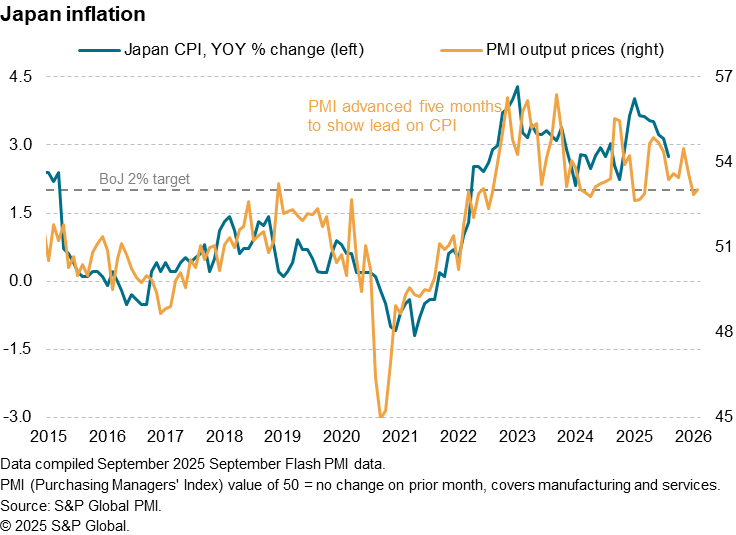

Amidst the slowdown in business activity growth, price pressures remained steep. Selling price inflation increased at a more pronounced pace in September, pointing to higher consumer price inflation in the coming months.

Altogether, the latest flash PMI data therefore continued to outline the dilemma facing the Bank of Japan, as softening business activity growth and rising prices pull the interest rate path in different directions, though we continue to see the likelihood for a December hike as the central banks seeks to gradually normalise policy from a period of ultra-low interest rates.

Japan's flash PMI slips to four-month low

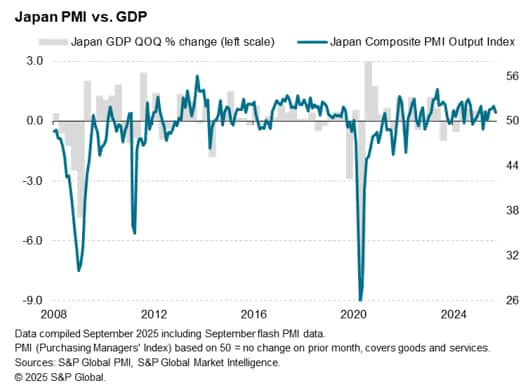

The S&P Global Flash Japan PMI Composite Output Index posted 51.1 in September, down from 52.0 in August. This marked the sixth consecutive month in which the headline reading remained above the 50.0 neutral mark to signal an expansion of business activity. That said, the latest reading reflected the slowest growth since May.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate at about 0.5% in September, which is just slightly higher than the 0.2% average seen over the past decade.

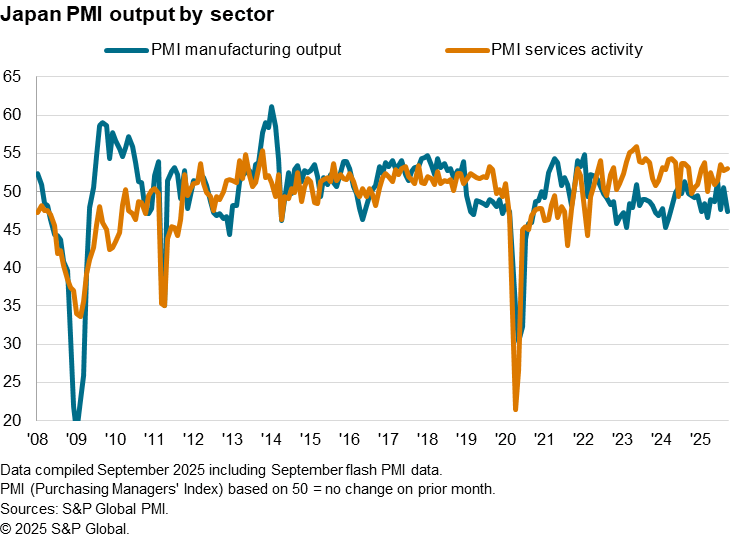

Solid service sector growth contrasts with accelerating manufacturing output contraction

Business activity growth was limited to the service sector for a third straight month in September, as the manufacturing downturn deepened.

The pace at which services activity expanded remained solid in the latest survey period despite easing slightly since August. This was as services new business rose at a pace that was little changed from the previous month on the back of rising client interest, according to comments from the flash survey contributors. The uptick in new business was limited to the domestic market, however, as services new export business shrank for a third successive month in September.

On the other hand, manufacturing production fell for a third straight month in September. Although modest, the rate at which manufacturing output declined was the sharpest in six months, attributed mainly to a steeper downturn in orders for new work. Anecdotal evidence from manufacturers pointed to the impact of US tariffs alongside cautious inventory policies, driving the fastest fall in new orders for goods since April. Meanwhile, new export orders for goods further declined in September, extending the sequence of contraction from March 2022.

Covering 10-19 September, the flash survey data collection period partially coincided with the announcement of new tariff reductions on imports from Japan to the US, which was later implemented on September 16. However, qualitative data from survey respondents showed little changes thus far, with subdued manufacturing sector business confidence further reflecting cautiousness among firms.

Diverging outlook trends

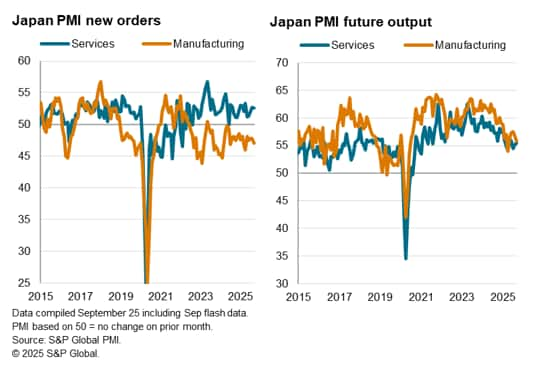

While the latest flash PMI data indicated slowing growth at the end of the third quarter, forward looking indicators hinted at potential divergence in sector performance in the months ahead.

Firstly, new orders data pointed to continued service sector demand growth in September, with the rate of expansion little changed from the solid pace in August. This contrasted with an acceleration in the manufacturing sector downturn as goods new orders fell at an above-average rate for the fifteenth month in a row.

Additionally, trends for the Future Output Index, which measures firms' outlook on growth in the next 12 months, further diverged in September. Falling for a second consecutive month, the level of optimism among manufacturers was at the lowest since April (when higher-than-expected US tariffs were first announced). In comparison, service sector business confidence climbed for the second month in a row, rising slightly above the long-run average in September, albeit running somewhat low by recent standards.

While expectations for growth to sustain amid business expansions plans helped boost service providers' confidence, the outlook for manufacturing production was clearly challenged by worries over the negative impact of US trade policy.

Although a lagging indicator, the changes in employment trend further reinforced the perception of a two-track economy in September. Service sector staffing levels returned to growth as businesses prioritised hiring in response to higher activity, while manufacturing headcounts fell for the first time in ten months partly due to the downturn in the goods producing sector.

Selling price inflation rises in September

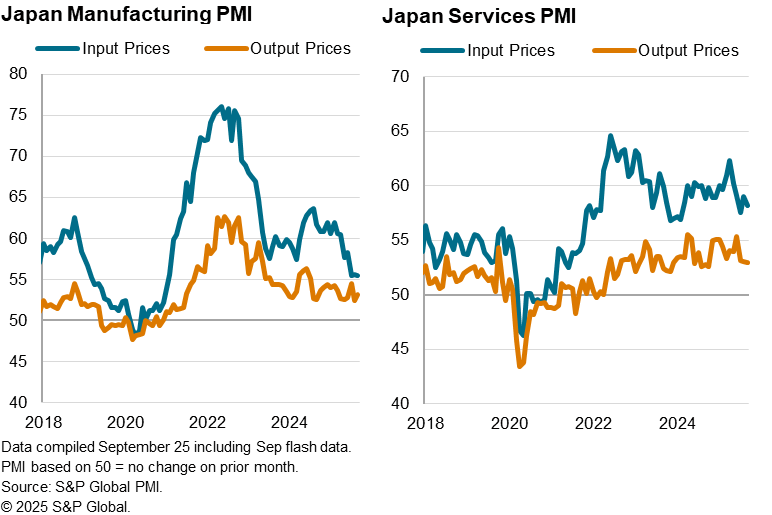

Adding to the worries over the subdued manufacturing sector performance was the persistence of elevated price pressures in Japan at the end of the third quarter.

Selling price inflation rose in September after having fallen to the lowest for nearly a year in August. This was attributed mainly to a quicker rise in manufacturing output prices, though services charges also continued to increase at a solid pace. Goods producers reported raising their selling prices to reflect another sharp increase in costs, marking a turn after margin pressures heightened in August. Overall, cost pressures stayed elevated, despite the rate of cost inflation easing slightly from August.

The latest increase in selling price inflation is therefore indicative of consumer price inflation remaining at around the 2.0% mark in the coming months, which continues to support our view for the Bank of Japan to conduct a policy rate hike in December. That said, the manufacturing downturn remains an area to monitor, with any deeper deteriorations potentially greater concerns from the Japanese central bank.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-growth-slows-in-september-Sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-growth-slows-in-september-Sep25.html&text=Japan%27s+business+activity+growth+slows+in+September+as+manufacturing+downturn+deepens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-growth-slows-in-september-Sep25.html","enabled":true},{"name":"email","url":"?subject=Japan's business activity growth slows in September as manufacturing downturn deepens | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-growth-slows-in-september-Sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+business+activity+growth+slows+in+September+as+manufacturing+downturn+deepens+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-business-activity-growth-slows-in-september-Sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}