Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2026

January flash PMIs show UK taking economic growth lead among major developed economies

Having led the developed world expansion over much of the past two years, US businesses have reported weaker demand growth and subdued confidence around the turn of the year, according to flash PMI data, in contrast to accelerating growth and rising confidence in the UK and Japan. While the eurozone's expansion remained subdued at the start of the year, it nevertheless saw a surge in business confidence about the year ahead, adding further to signs that the US's recent economic outperformance may be waning, in part linked by companies to higher prices.

Although the UK led in terms of output growth in January, it continued to report a worryingly high rate of job losses, in marked contrast to a jump in hiring in Japan.

UK growth outpaces G4 rivals as US expansion loses momentum

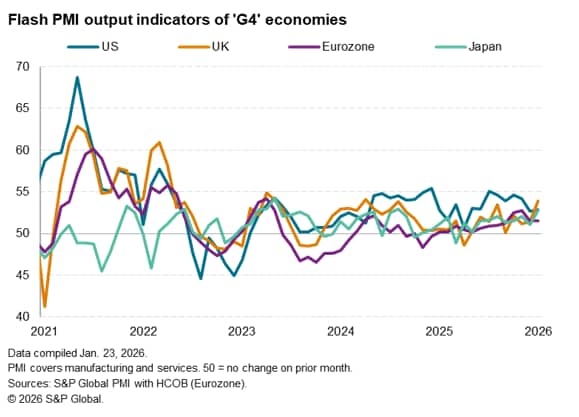

Measured across both goods and services, S&P Global's flash PMI data showed output rising in all four largest developed economies for a ninth successive month in January. The four economies collectively reported a slight acceleration of growth and an overall expansion of output for the twenty-sixth month.

However, whereas the US had recorded the strongest growth of the G4 over the final eight months of 2025, having dominated the G4 expansion over much of the past two years, the UK overtook the US at the start of 2026, leading the G4 growth rankings for the first time since April 2024.

While UK businesses reported a marked acceleration of output growth to the fastest since April 2024, US growth improved only marginally on the eight-month low recorded in December, representing a down-shifting of gear compared to the stronger rates of US expansion seen in prior months.

Growth also accelerated in Japan, reaching the highest since August 2024 and now matching the rate of expansion reported in the US in January.

Lagging the G4, the eurozone only reported modest growth, the rate of increase unchanged on December. The recent growth in the eurozone nevertheless represents it best spell since early 2023.

US firms report lower confidence

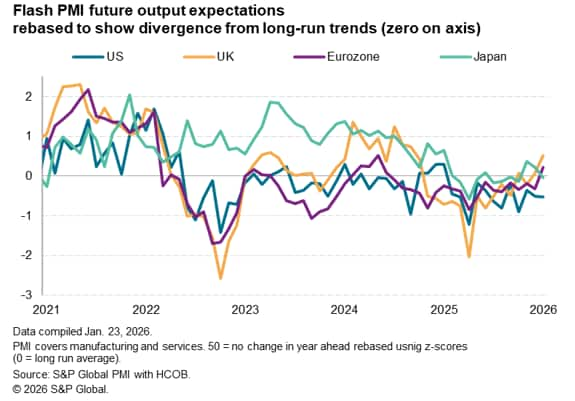

The flash PMI surveys also signalled some strong divergences in business confidence about the year ahead, hinting at an underperformance by the US in coming months.

Rebasing the PMI diffusion indices to reflect divergences from long-run trends, business expectations are now running at levels above long-run averages in both the UK and eurozone, reaching 16- and 20-month highs respectively. While confidence slipped to a three-month low in Japan, it was in line with both the long-run average and the average seen in 2025. In contrast, US business expectations sank further below the long-run average in January, dropping to its lowest since last October.

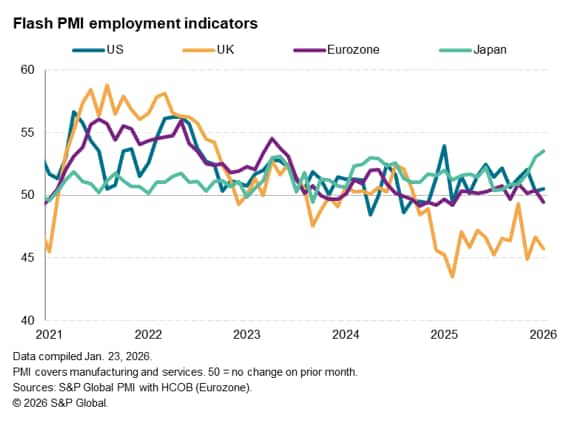

Steep UK job losses persist as Japan reports hiring spree

The slower output growth and relatively low optimism seen in the US translated into a second month of only marginal employment growth in January. Eurozone firms also remained wary of taking on staff, reporting a slight dip in payroll numbers. In contrast, Japanese firms reported a hiring spree which led to the sharpest rise in employment since April 2019.

The UK meanwhile continued to see especially steep job losses, as has been the case since late-2024, reflecting reports of the ongoing need to offset higher staffing costs associated with new government policies announced that year.

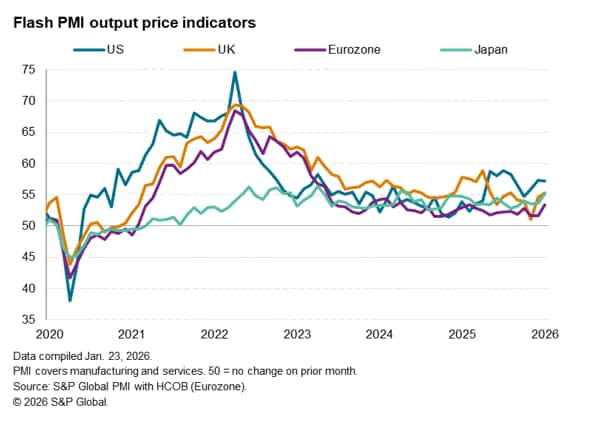

US reports further tariff-related price growth

The UK's higher staffing cost policy measures ensured input cost inflation in the UK continued to outpace that of the other G4 economies in January, though in terms of selling prices it was the US that once again reported the sharpest rate of increase. US firms have reported the highest price growth of the G4 economies since last May, following the announcement of US tariffs.

Firms in the US across both manufacturing and services continued to link high price growth to tariffs in January, and these high prices were in turn often blamed by US firms on the weakening of demand growth in recent months, helping to explain some of the slowdown in US business activity growth around the turn of the year.

That said, the flash PMIs are also picking up an increase in selling price inflation in Europe and Japan in January, suggesting global price pressures may be on the rise again.

Access the US, UK, Eurozone and Japan Flash PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-flash-pmis-show-uk-taking-economic-growth-lead-among-major-developed-economies-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-flash-pmis-show-uk-taking-economic-growth-lead-among-major-developed-economies-jan26.html&text=January+flash+PMIs+show+UK+taking+economic+growth+lead+among+major+developed+economies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-flash-pmis-show-uk-taking-economic-growth-lead-among-major-developed-economies-jan26.html","enabled":true},{"name":"email","url":"?subject=January flash PMIs show UK taking economic growth lead among major developed economies | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-flash-pmis-show-uk-taking-economic-growth-lead-among-major-developed-economies-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January+flash+PMIs+show+UK+taking+economic+growth+lead+among+major+developed+economies+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-flash-pmis-show-uk-taking-economic-growth-lead-among-major-developed-economies-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}