Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 19, 2019

Iron Ore Freight: IMO 2020 scrubber retrofits tighten supply, behind freight market surge

A sequential decline in August iron ore export volumes from Brazil is at odds with Capesize freight rates surging to a six-year high in recent weeks. Ship owners' actions with respect to IMO 2020 preparations is creating an artificial supply tightening and driving freight markets, in our view.

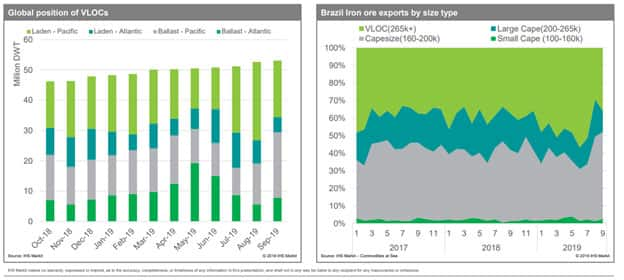

IHS Markit Commodities at Sea data shows Capesize demand benefitting amid an increasing number of Capesize departures from Brazil at the expense of VLOCs.

We observed 163 Capesize departures in August 2019 vs YTD average of 115, while VLOC departures dipped to 29 in August vs YTD average of 37.

Scrubber retrofitting activities in the Pacific have resulted in a shortage of VLOCs in the Atlantic which in our view explains the increased spot Capesize shipments in Brazil over the last two months (July-August 2019).

Moreover, with increased spot iron ore chartering out of Brazil, the tight tonnage in the Atlantic basin led to the Atlantic round-voyage rate reaching its highest level since January 2014 at $41,435/day. However, the Pacific round voyage rate from Australia to China experienced comparatively modest gains, reaching $34,108/day, as many vessels remain in the Pacific to prepare for the IMO 2020 regulation.

IHS Markit Freight Rate Forecast for Capesize is currently taking the following base case scenarios:

- Brazil will maximise iron ore exports for the rest of the year

- Capesize retrofitting activities continues with 3-4% of fleet offline

- The number of ballasters to the Atlantic will be limited as many shipowners prefer to stay in the Pacific to prepare for IMO 2020 regulations including scrubber retrofitting activities in Asia and bunker tanker cleaning and testing etc, which is expected to support freight rates with an inefficient fleet in the short-term

- Downside risk from China's coal import control, competition

from Panamax and recovery in supply remains

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-freight-imo-2020-scrubber-retrofits-tighten-supply.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-freight-imo-2020-scrubber-retrofits-tighten-supply.html&text=Iron+Ore+Freight%3a+IMO+2020+scrubber+retrofits+tighten+supply%2c+behind+freight+market+surge+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-freight-imo-2020-scrubber-retrofits-tighten-supply.html","enabled":true},{"name":"email","url":"?subject=Iron Ore Freight: IMO 2020 scrubber retrofits tighten supply, behind freight market surge | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-freight-imo-2020-scrubber-retrofits-tighten-supply.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Iron+Ore+Freight%3a+IMO+2020+scrubber+retrofits+tighten+supply%2c+behind+freight+market+surge+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-freight-imo-2020-scrubber-retrofits-tighten-supply.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}