Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 17, 2020

IHS Markit European GDP Nowcasts: Downside risks intensify for the eurozone

Summary: 17th February 2020

Our latest nowcast update highlights a notable rise in downside risks to growth for the euro area economy in the first quarter of the year, although the UK is on course to record a modest quarterly expansion as economic conditions pick up following a partial alleviation of uncertainty.

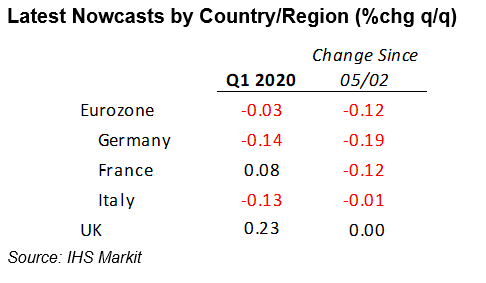

The euro area Q1 nowcast was revised down by over 0.1 percentage points to -0.03%q/q. The negative movement is primarily a result of poor industrial sector data, which has led the dynamic factor model to downwardly adjust its forecasts for manufacturing output in the first three months of the year. While January survey data suggest that the industrial downturn has most likely bottomed out, the surprisingly weak official outturn for December indicates that the production trend still carries notable downside risks, with coronavirus now adding to that.

The regional breakdown of the euro area shows a broad-based loss of momentum since our previous nowcast update. Much of the downward revision in the eurozone reflected weakness in Germany. Our model expects that German GDP will contract in the opening quarter, with the nowcast at -0.14%q/q, a 0.2 percentage point reduction since the previous estimate. As it stands, our dynamic factor model has pencilled in further month-on-month contractions in German industrial output, drawing from the trends across the consumer, intermediate and capital goods for December, which were all negative. The fact that all three segments contracted suggests that the manufacturing sector in Germany is not out of the woods just yet.

More euro area gloom is seen south of Germany as we maintain our call for technical recession in Italy. Official data released since our previous update has provided no reason to expect the trend to turn here. Our model projects Italian GDP to contract by -0.13%q/q.

France on the other hand looks set to record an expansion in GDP during the first quarter, particularly given that a payback from the negative inventory effects which pulled GDP into contraction during the final quarter of 2019 are likely to be reversed. Nevertheless, our nowcast model is providing an advanced signal that underlying conditions here have softened, catching up with the rest of the bloc. To that end, flash PMI data at the end of this week will crucially guide the model's judgement as to where economic momentum is moving here.

Finally, our UK GDP nowcasts for Q1 is unchanged at +0.23%q/q, a modest expansion and a pickup from the stagnant final quarter of 2019. Again, PMI data for February will help ascertain whether January's sharp rise in activity can be repeated.

Next Nowcast Update: February 21st 2020

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-downside-risks-intensify-for-the-eurozone-Feb2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-downside-risks-intensify-for-the-eurozone-Feb2020.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Downside+risks+intensify+for+the+eurozone+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-downside-risks-intensify-for-the-eurozone-Feb2020.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Downside risks intensify for the eurozone | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-downside-risks-intensify-for-the-eurozone-Feb2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Downside+risks+intensify+for+the+eurozone+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-downside-risks-intensify-for-the-eurozone-Feb2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}