If yields continue to rise...

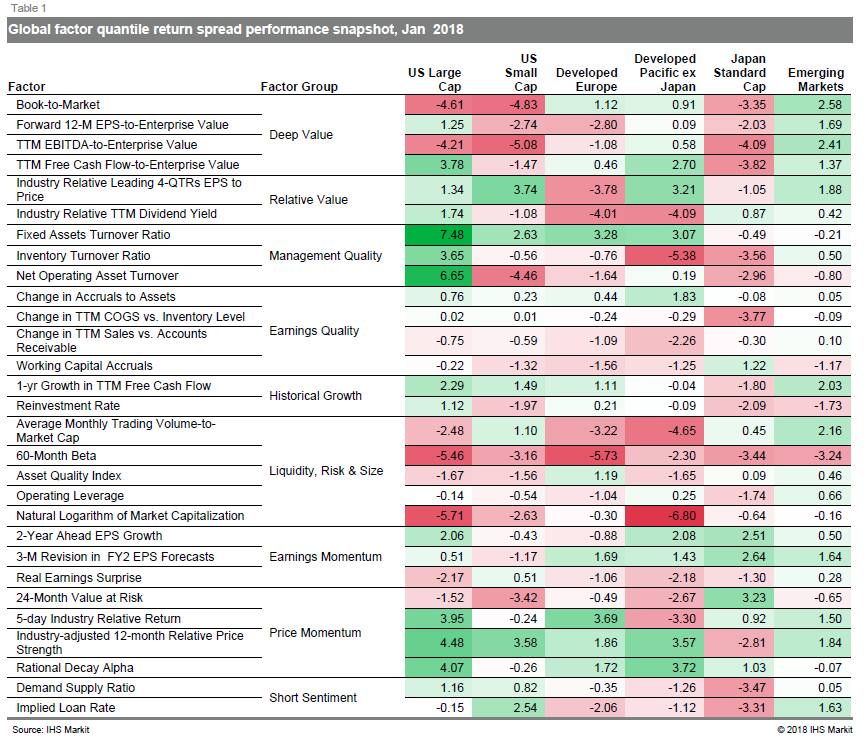

Following global stock markets’ best year since 2009 and starting off the year on a continued high level of hubris, investors are now reminded that stocks can go down. The markets ended the month with an attack on the reflation trade as investors contemplate the concept of a bond bear market, as put forth by Bill Gross and Ray Dalio in Davos. For most of January, markets celebrated global economic growth which reached a 40-month high, according to the J.P. Morgan Global Manufacturing & Services PMI™, and price momentum trades benefited across many regional markets (Table 1). However, markets were spooked at the end of the month as investors became more sensitive to the outlook of central bank policy and how quickly they will unwind stimulus, while, at the same time, several key developed markets saw 10-year government yields increase in January.

- US: Investors chased high momentum stocks (e.g., Industry-adjusted 12-month Relative Price Strength) at the expense of undervalued names (e.g., Book-to-Market) during the parabolic market run up in January

- Developed Europe: High beta stocks were highly rewarded, detracting from performance of factors such as 60-Month Beta

- Developed Pacific: Japanese markets differed from their regional developed market counterparts, continuing to bid up overvalued names as measured by TTM EBITDA-to-Enterprise Value

- Emerging markets: Key groups that were rewarded by investors for the month included undervalued stocks and high beta names

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.