Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 10, 2019

IBORs, New Benchmarks Series – Case Study: SOFR and FRTB

One of the central concepts of FRTB and the Internal Model Approach (IMA) is that all risk factors are subject to a Modellable or Non-modellable requirement. Any Non-modellable risk factor results in a higher capital charge, incentivizing banks to optimize their risk factor definitions and secure access to as many Real Price Observations (RPOs) as possible.

A challenging part of this exercise stems from the IBOR transition that collides with the deployment of FRTB in many jurisdictions in terms of timelines.

In this case study, we looked at SOFR and leveraged IHS Markit FRTB Modellability Service by running its Risk Factor Utility at various points in time in the last couple of years.

As a reminder, the FRTB text stipulates that for a risk factor to be Modellable, the following conditions must be met:

Extract from Minimum capital requirements for market risk - Bank for International Settlements

"To pass the RFET, a risk factor that a bank uses in an internal model must meet either of the following criteria on a quarterly basis. Any real price that is observed for a transaction should be counted as an observation for all the risk factors for which it is representative.

(1) The bank must identify for the risk factor at least 24 real price observations per year (measured over the period used to calibrate the current ES model, with no more than one real price observation per day to be included in this count). Moreover, over the previous 12 months there must be no 90-day period in which fewer than four real price observations are identified for the risk factor (with no more than one real price observation per day to be included in this count). The above criteria must be monitored on a monthly basis; or

(2) The bank must identify for the risk factor at least 100 "real" price observations over the previous 12 months (with no more than one "real" price observation per day to be included in this count)."

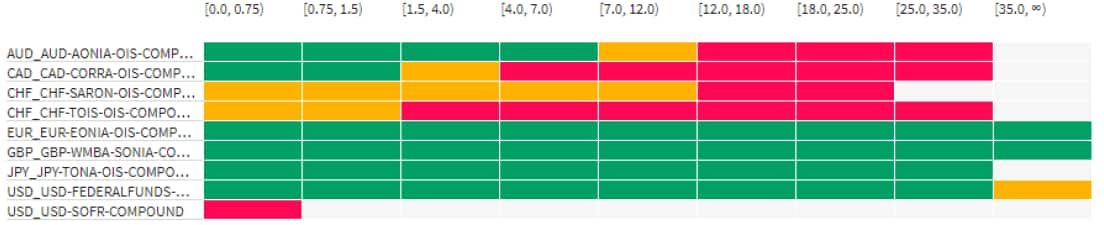

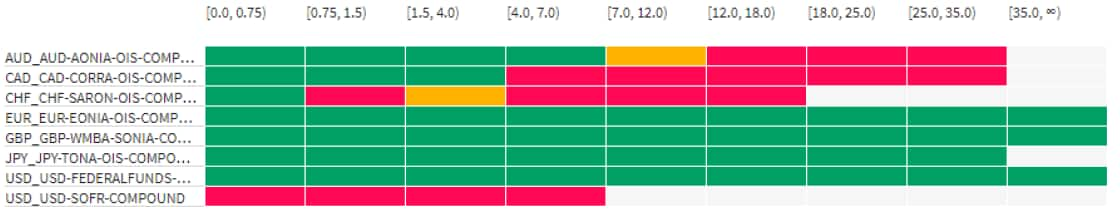

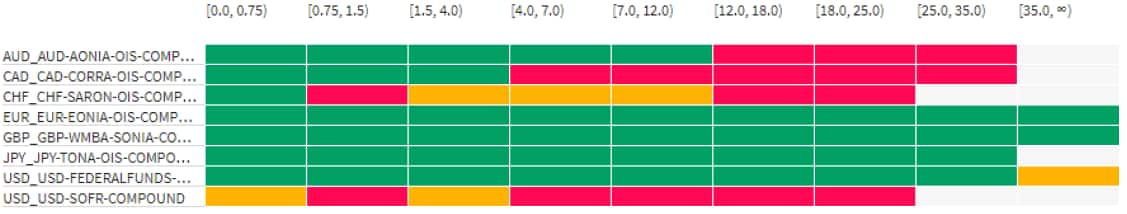

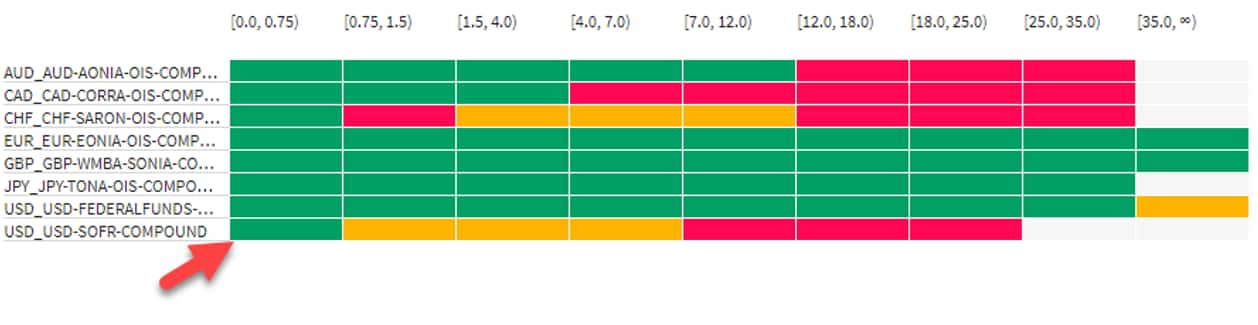

As shown in the heat maps below, the observability in USD-SOFR-COMPOUND improved steadily between Jun-18 and Jun-19 with a good number of RPOs gradually reported in longer dated buckets. However, until Jun-19 none of the risk buckets were Modellable.

This changed in Aug-19, and we can now officially report that SOFR turned Modellable for the shorter dated bucket (0 to 9 months)!

We are not out of the woods yet, but this is a step in the right direction, and we can only hope to see more green cells popping up in this heat map for our next update. Stay posted...!

30 June 2018

31 December 2018

30 June 2019

31 August 2019

![]()

Data for this exhibit based on MarkitSERV transaction population, as of 31 August 2019.

Related Reading

IBORs, new benchmarks series - Focus on SOFR

SOFR and alternative RFRs - Market update

SOFR and alternative RFRs - An introduction

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibors-new-benchmarks-series--case-study-sofr-and-frtb.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibors-new-benchmarks-series--case-study-sofr-and-frtb.html&text=IBORs%2c+New+Benchmarks+Series+%e2%80%93+Case+Study%3a+SOFR+and+FRTB+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibors-new-benchmarks-series--case-study-sofr-and-frtb.html","enabled":true},{"name":"email","url":"?subject=IBORs, New Benchmarks Series – Case Study: SOFR and FRTB | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibors-new-benchmarks-series--case-study-sofr-and-frtb.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=IBORs%2c+New+Benchmarks+Series+%e2%80%93+Case+Study%3a+SOFR+and+FRTB+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibors-new-benchmarks-series--case-study-sofr-and-frtb.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}