Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2020

Hong Kong SAR PMI signals deepest economic slump on record amid coronavirus impact

- IHS Markit Hong Kong SAR whole economy PMI™ sinks to the lowest since survey started in July 1998

- PMI data signals the economy likely to remain stuck in recession in first quarter

- Record falls in both output and new orders

- Business confidence lowest on record

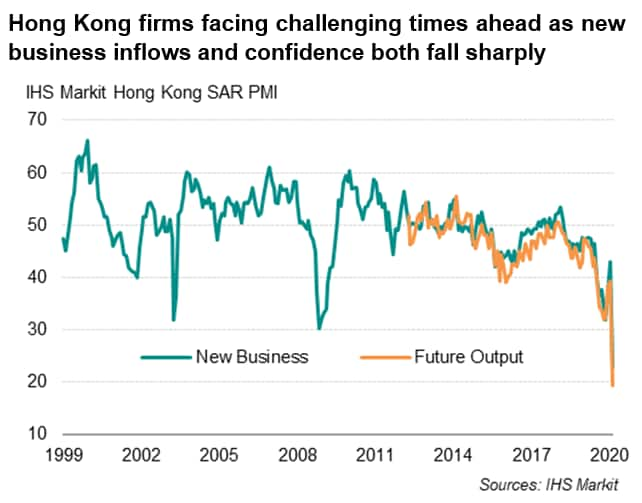

The latest PMI flashed red warning lights on the dire state of business conditions across Hong Kong SAR in February amid the coronavirus outbreak. The survey data set the scene for a deepening recession in the private sector economy during the first quarter. The coronavirus outbreak comes at a time when business confidence has already been badly affected by political protests and US-China trade war tensions, with expectations of the Covid-19 situation persisting in coming months to exacerbate the current downturn.

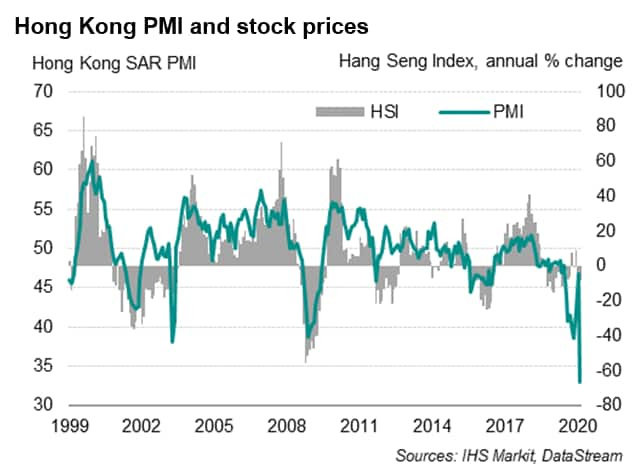

The headline index plunged to a level unprecedented since the survey started in July 1998, dragged down by both activity and demand falling at survey-record rates.

Biggest slump in survey history

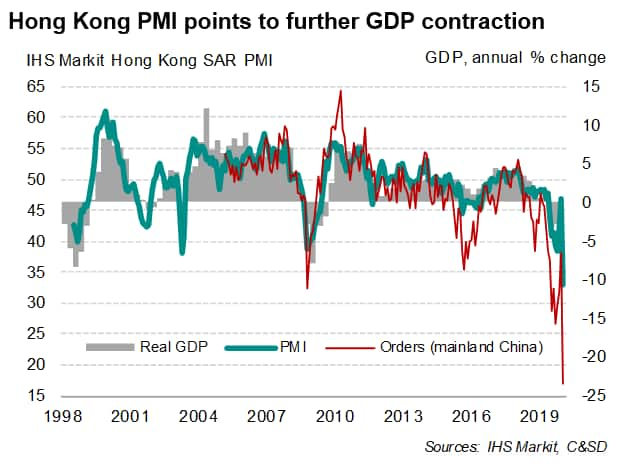

The IHS Markit Hong Kong PMI™ sank to 33.1 in February, down from 46.8 in January, signalling the steepest deterioration in private sector conditions since the survey started in 1998. Latest data are now broadly indicative of GDP contracting at an annual rate of nearly 5.0%, suggesting that Hong Kong could be heading into a steeper recession in the first half of the year.

Measures taken in response to the Covid-19 situation, and general fear of being infected, saw business activity and new sales sinking at a record pace. Notably, orders from mainland China for Hong Kong goods and services plunged by the greatest extent since data for this variable were first available in March 2005.

With demand sharply reduced and businesses facing increasing headwinds brought on by the Covid-19 situation, firms often struggle to remain in business. As such, purchasing activity and inventories were cut back further and at faster rates to save on operating expenses.

Firms also reduced staff numbers, with the rate of job shedding accelerating to the steepest for over 18 years.

The combination of lower purchasing and reduced headcounts contributed to the largest decline in overall input costs since the end of 2008.

Hong Kong private enterprises meanwhile turned to offering discounts to boost sluggish sales. Prices charged for Hong Kong's goods and services were reduced at a pace not seen since October 2001.

Unsurprisingly, the business mood became increasingly gloomy, suggesting firms do not expect any quick turnaround in the business situation. Confidence about the year-ahead outlook plummeted in the city to an all-time low, with a majority of firms anticipating lower future output amid expectations that the coronavirus situation will persist in coming months.

Policy stimulus

With the Hong Kong SAR economy shrinking 1.9% during 2019, the average PMI reading so far (39.9) for the first quarter of 2020 signals a deepening recession in the opening quarter of 2020.

Despite the recently announced expansionary budget and massive fiscal relief measures, which include HKD 120 billion worth of cash handouts, tax breaks and low-interest business loans, the severe disruptions from the virus outbreak are still expected to weigh heavily on economic activity. IHS Markit estimates the Hong Kong economy to shrink by an annual rate of 1.3% in 2020. That said, further GDP downgrades are possible should the situation continue to worsen in coming months.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-pmi-signals-deepest-economic-slump-on-record-amid-coronavirus-impact-mar20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-pmi-signals-deepest-economic-slump-on-record-amid-coronavirus-impact-mar20.html&text=Hong+Kong+SAR+PMI+signals+deepest+economic+slump+on+record+amid+coronavirus+impact+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-pmi-signals-deepest-economic-slump-on-record-amid-coronavirus-impact-mar20.html","enabled":true},{"name":"email","url":"?subject=Hong Kong SAR PMI signals deepest economic slump on record amid coronavirus impact | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-pmi-signals-deepest-economic-slump-on-record-amid-coronavirus-impact-mar20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hong+Kong+SAR+PMI+signals+deepest+economic+slump+on+record+amid+coronavirus+impact+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-pmi-signals-deepest-economic-slump-on-record-amid-coronavirus-impact-mar20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}