Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 06, 2024

Global trade shrinks in November amidst a reduction in goods export orders

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade continued to decline in the penultimate month of the year, weighed by an ongoing downturn in goods exports.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, rose to 49.2 in November, up from 48.9 in October. Posting below the 50.0 neutral mark for a sixth consecutive month, the latest reading signalled that trade conditions deteriorated again in the immediate aftermath of the US election. That said, the pace of decline eased to the softest since July with notable variations observed by region and sector, linked in part to the threat of tariffs from the incoming US administration.

Goods trade contraction eases while services export business growth accelerates

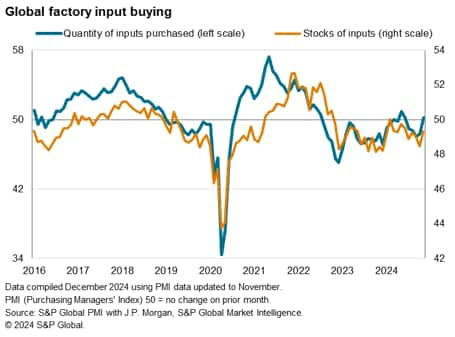

Manufacturing new export orders remained in contraction globally for a sixth straight month in November. That said, the pace at which manufacturing export orders fell was the softest since July and only modest, as the data from the latest manufacturing surveys revealed that global manufacturers may be at an inflection point, shifting from a period of inventory reduction to stockpiling.

As observed from the seasonally adjusted global PMI Quantity of Input Purchases Index, the amount of inputs bought by factories globally rose marginally in November for the first time in five months, while stocks of purchases fell at the least pronounced pace thus far in the second half of 2024. The data also revealed that the latest changes were partially driven by the threat of US tariffs, as one-in-four US manufacturers reported higher purchases in a bid to front-run the impact of tariffs by buying additional imported inputs. As such, we are seeing the first signs of the US tariff threat altering behaviour in 2024; an issue that may well remain a factor driving trade patterns in the coming months, especially with the final shape of US tariffs potentially taking months to form.

The latest fall in manufacturing export orders continued to correspond to global trade volumes falling approximately 2% in year-on-year terms midway through the fourth quarter of 2024.

Meanwhile services export business continued to expand globally in November and at an accelerated rate compared to October. Sector PMI data revealed that improvements in export demand were concentrated in services industries such as telecommunication, financials and consumer services, though industrials and technology firms also reported growth.

Across the detailed sectors, four of the top five sectors were services sectors, with beverages being the exception. On the other hand, reductions in export business were driven by goods producing sectors, led by forestry & paper products in November.

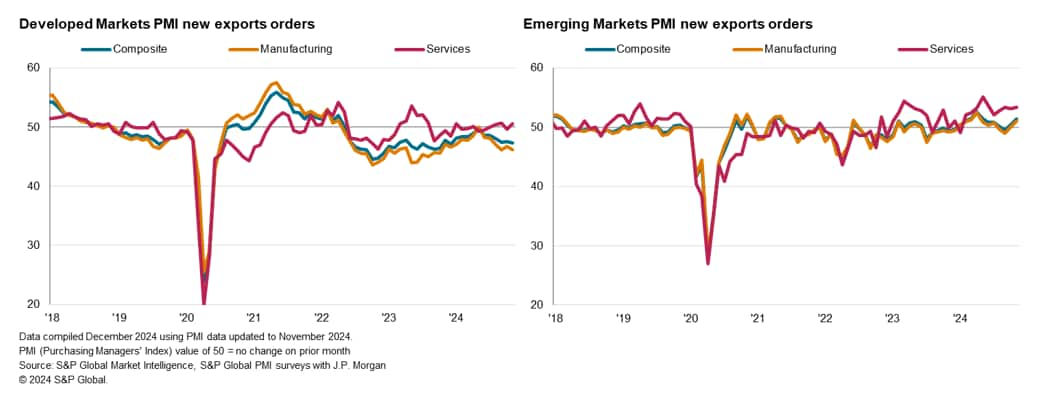

Downturn in export orders concentrated among developed economies

Variations in export performance by region were observed in November post the US election. While the overall rate of export contraction slowed globally, a divergence was noted with a quicker developed market export downturn contrasting with the fastest growth in export business among emerging markets in six months. Moreover, the expansion in export orders was broad-based for emerging markets, with the fastest expansion in services export business in six months joined by a renewed rise in goods export orders. The rate at which emerging market goods manufacturing export orders rose was also the fastest since April, with Asia being a key driver for the rise, seeing the fastest expansion since mid-2022.

In contrast, developed markets manufacturing export orders fell at the most pronounced pace in just over a year as part of a wider downturn in developed market manufacturing conditions. While services export business returned to growth in November for developed economies, the rate of expansion was only marginal.

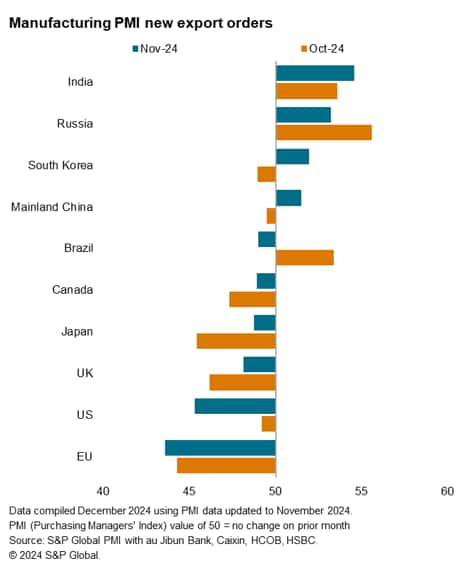

India reclaims top spot in goods export growth in November

Four of the top ten trading economies recorded higher goods export orders in November, up from three in October. India and Russia remained the top performers, but with India reclaiming the top spot as goods export orders growth accelerated to the fastest since July. The acceleration of India's export orders growth was a positive development as overall new orders growth slowed in the latest survey period. Meanwhile Russia saw the rate of export orders growth moderate from October but remain solid.

This was followed by South Korea and mainland China, both of which saw renewed expansions in goods export orders during November after brief declines in the prior months. The rise in mainland China's export orders was part of a broader acceleration in new orders growth, the latter having unfolded at the fastest pace since February 2023 amid reports of stockpiling post the US election.

Meanwhile Brazil concluded the seven-month growth streak with the first reduction in export orders since March. The rate of decline was modest, however, as were the rates of export loss for Canada and Japan. Quicker paces of decline were also observed for the UK and US, but it was the EU that saw the most pronounced downturn in goods exports among the top 10 trading economies. According to HCOB Eurozone Manufacturing PMI data, demand conditions broadly worsened for goods producers in the region, with political instability adding to structural issues facing many of the region's large manufacturing industries.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-shrinks-in-november-amidst-a-reduction-in-goods-export-orders-Dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-shrinks-in-november-amidst-a-reduction-in-goods-export-orders-Dec24.html&text=Global+trade+shrinks+in+November+amidst+a+reduction+in+goods+export+orders+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-shrinks-in-november-amidst-a-reduction-in-goods-export-orders-Dec24.html","enabled":true},{"name":"email","url":"?subject=Global trade shrinks in November amidst a reduction in goods export orders | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-shrinks-in-november-amidst-a-reduction-in-goods-export-orders-Dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+shrinks+in+November+amidst+a+reduction+in+goods+export+orders+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-shrinks-in-november-amidst-a-reduction-in-goods-export-orders-Dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}