Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 10, 2025

Global trade downturn persists into August

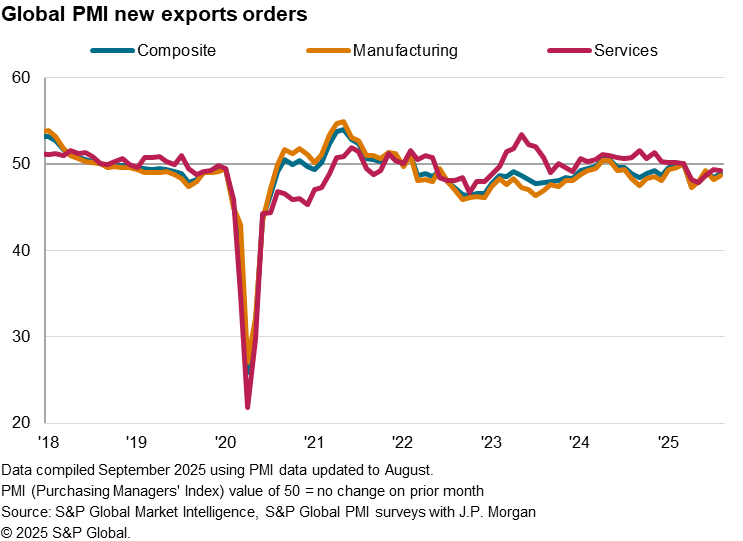

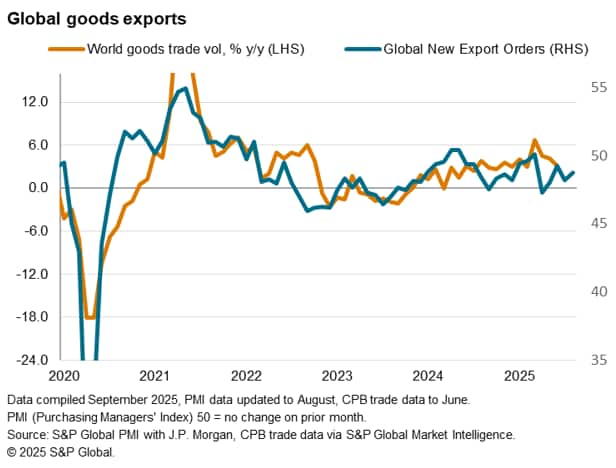

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade conditions continued to deteriorate midway through the third quarter of 2025.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 48.9 in August, up from 48.5 in July. This marked the fifth straight month in which the reading posted below the 50.0 neutral mark to signal an ongoing contraction of trade activity. That said, the rate of contraction softened from July and was only modest.

Manufacturing trade contraction eases in contrast to deepening services downturn

The downturn in export orders continued to be led by the manufacturing sector in August, albeit by only a small margin as the rate of contraction eased compared to July. This was as August's worldwide manufacturing survey revealed that production returned to growth following July's contraction. However, the production rise and easing of export decline was partly linked to the further front-running of potential tariffs, including ahead of widespread tariffs that were implemented during August. This was evident when observing the Stocks of Purchases Index in the US, which showed renewed accumulation of raw materials and semi-finished products in August. As cautioned since the second quarter, the intense stock-building in the US thus far could result in a payback later into 2025.

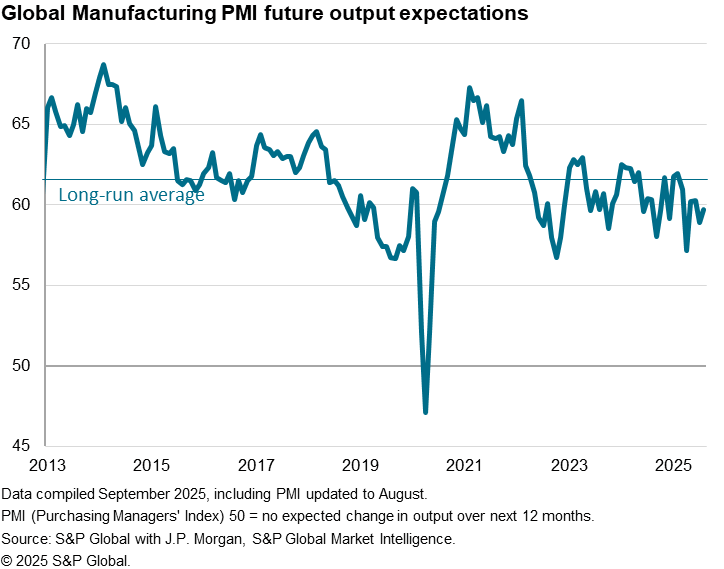

Manufacturers' confidence remained subdued by historical standards, adding to caution in interpreting August's improving trends in output and orders. The Future Output Index, which assesses business expectations of production trends in the next 12 month, remained at one of the lowest levels seen since the pandemic as goods producers cited concerns over the geopolitical landscape and the outlook for trade. That said, we acknowledge that the level of business confidence had picked up from April's low, reflecting a sense that peak uncertainty regarding US tariffs may perhaps be over.

Services exports meanwhile contracted for a fifth month in a row in August. The rate of contraction picked up slightly from July but remained very modest overall. Once again, the downturn in the exchange of services was underpinned by tariff-related uncertainty and input disruptions.

Detailed sector PMI revealed that export growth was again dominated by service-related sectors with the insurance, banking and transportation sectors in the lead. On the other hand, real estate, chemicals and forestry & paper products companies saw the sharpest downturn in export orders in August.

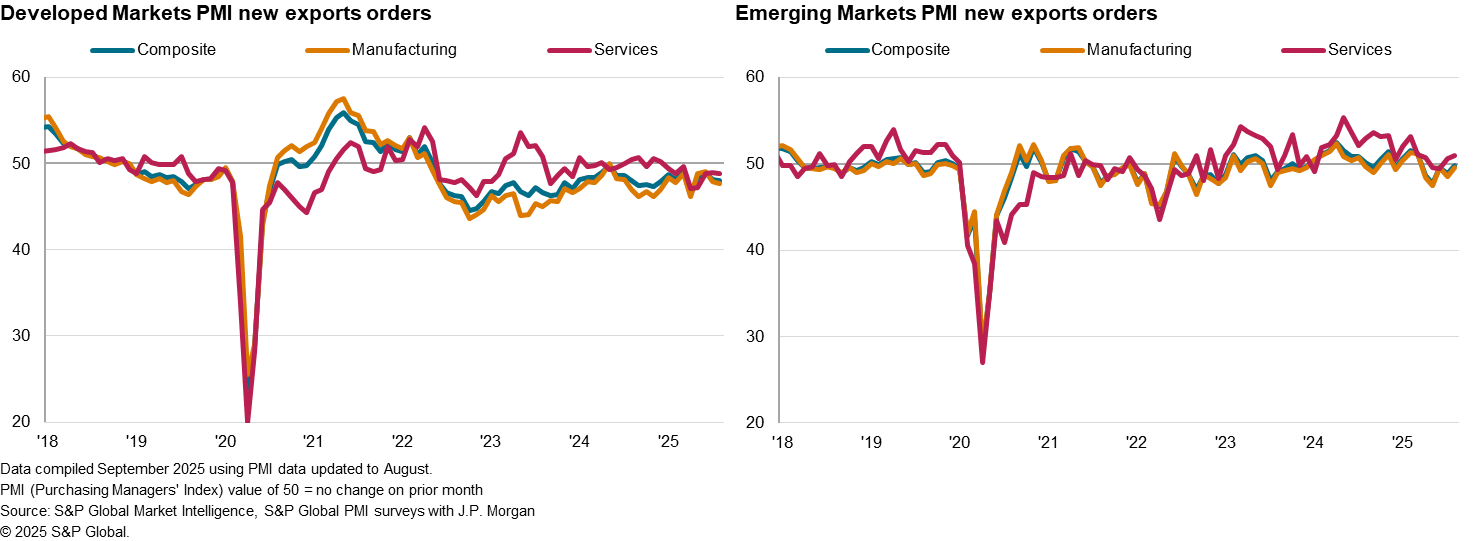

Trade contraction eases for emerging markets but deepens for developed economies

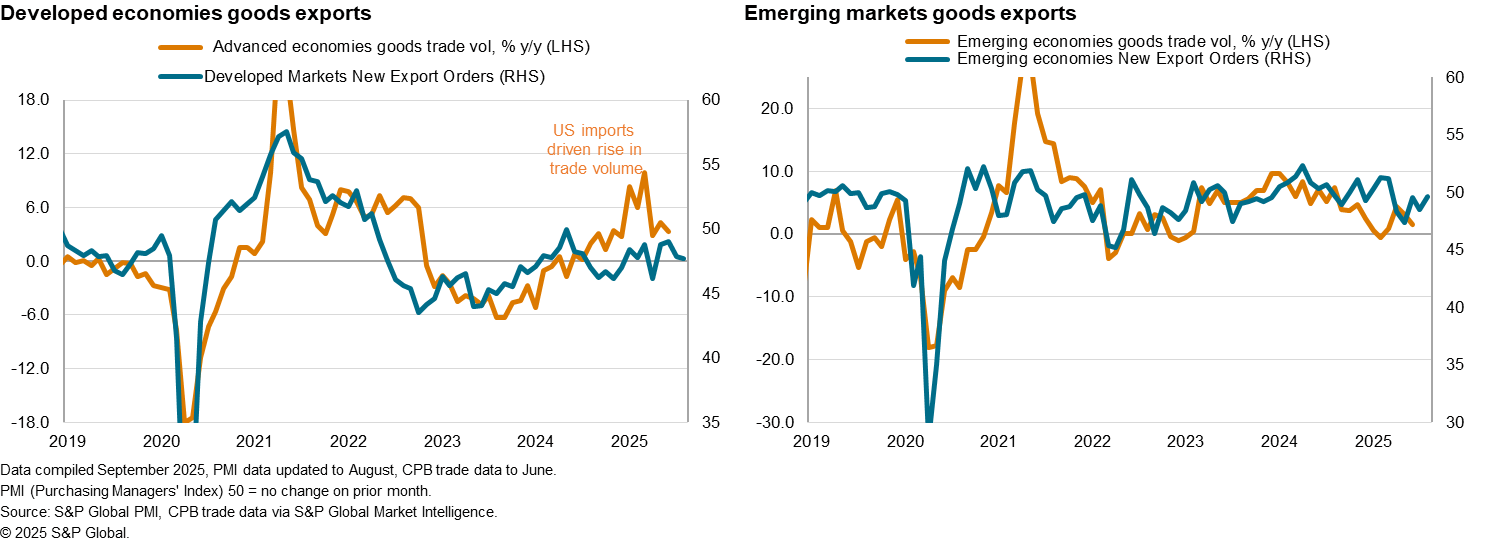

Regionally, the contraction in new export business remained broad-based in August. That said, diverging trends were observed as an easing trade contraction in emerging markets contrasted with a deepening of the trade downturn for developed markets.

Looking at developed markets (DM) as a whole, the pace at which export business declined accelerated across both the manufacturing and service sectors in August. Notably, DM manufacturing trade fell at a rate that was the sharpest since April, when widespread US tariffs were initially announced. The DM service sector recorded a modest reduction in export business, which nevertheless extends the sequence of contraction that commenced since the start of the year.

Meanwhile, export business across emerging markets (EM) fell for the fifth successive month but at the softest pace in the current sequence. This was attributed to a quicker expansion in EM services export business, though EM manufacturing export orders also fell at the softest pace in the current five-month sequence.

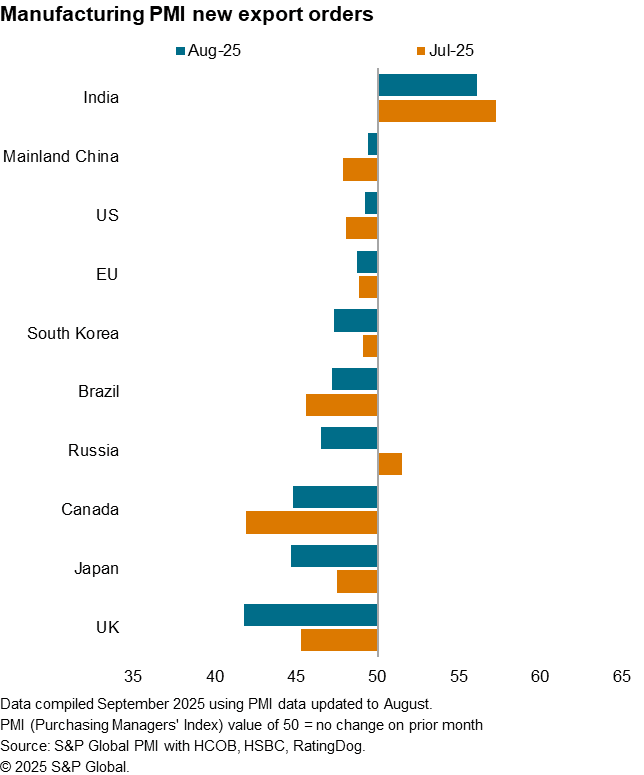

India remains only economy to record higher goods trade among the top 10

The number of top ten trading economies reporting higher goods exports dwindled to only one, India, in August. That said, even for India, the rate of expansion softened from July to the weakest in five months.

The UK meanwhile recorded the sharpest downturn in goods trade among the top 10 trading economies. The rate of UK trade contraction was steep and among the sharpest seen since the pandemic, reflecting global tariff uncertainties, ongoing administrative issues post-Brexit and rising competition. Goods trade was also heavily dampened by US tariffs in Japan and Canada, both of which reported marked reductions in new export orders in August. A sharp downturn in goods trade was also seen for Russia.

Meanwhile, more modest reductions in goods trade activity were seen in Brazil, South Korea and the EU, while marginal reductions were recorded in the US and mainland China. Given additional inventory building efforts in August, the rates at which export orders fell in both the US and mainland China were softer than in July.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-persists-into-august-sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-persists-into-august-sep25.html&text=Global+trade+downturn+persists+into+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-persists-into-august-sep25.html","enabled":true},{"name":"email","url":"?subject=Global trade downturn persists into August | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-persists-into-august-sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+downturn+persists+into+August+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-persists-into-august-sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}