Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2026

Global PMI lifts higher at start of 2026 amid shifting regional growth trends

Global PMI surveys signalled a slight improvement in worldwide economic growth in January, having slowed to a six-month low in December. However, the pace of expansion remains subdued by historical standards, curbed in particular by low levels of business optimism in most major economies.

While the rate of global growth has shown only modest change in recent months, the pattern of growth has shown more evident signs of changing. A downshifting of growth in the US in recent months means Australia, the UK and Japan are now outperforming the US.

Europe is meanwhile bucking the ongoing trend of gloomy outlooks across both developed and emerging markets, hinting at a further shifting of global growth trends in the coming months in Europe's favour.

Global PMI rises but growth remains lower gear

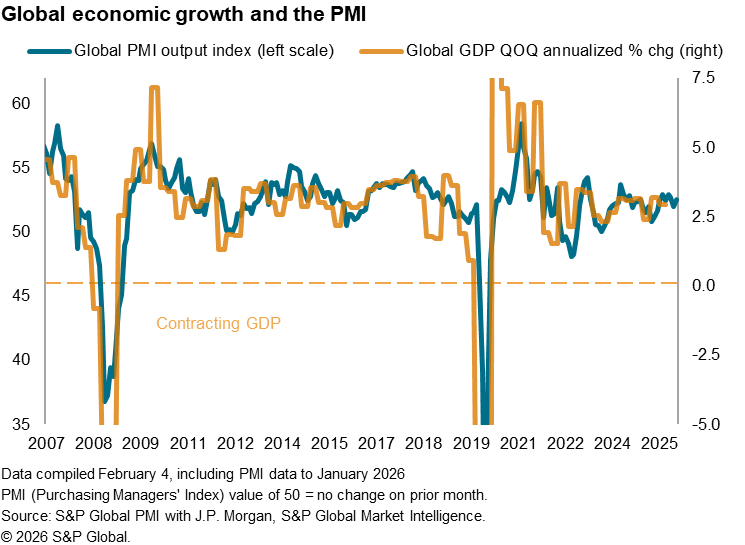

A further expansion of the global economy was indicated by S&P Global Market Intelligence's PMI surveys at the start of 2026. The J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, rose for the first time in three months, up from December's six-month low of 52.0 to 52.5 in January. Despite the rise, the latest reading was the second-lowest since last September.

Historical comparisons indicate that the latest PMI is broadly consistent with global GDP growing at an annualized rate of 2.6% at the start of 2026, similar to the pace signalled over the fourth quarter of 2025.

The survey data therefore suggest that global economic growth has shown resilience in the face of ongoing low levels of business confidence and elevated geopolitical uncertainty, but is running below its long-term trend rate. Annualized GDP growth averaged 3.2% in the decade prior to the pandemic.

Disappointment came from the forward-looking output expectations index, which showed business optimism about the coming year running well below its long run trend, dipping to a three-month low in January. Confidence was often shaken by the intensifying geopolitical uncertainty seen in the opening weeks of 2026.

Developed world growth led by Australia, the UK and Japan

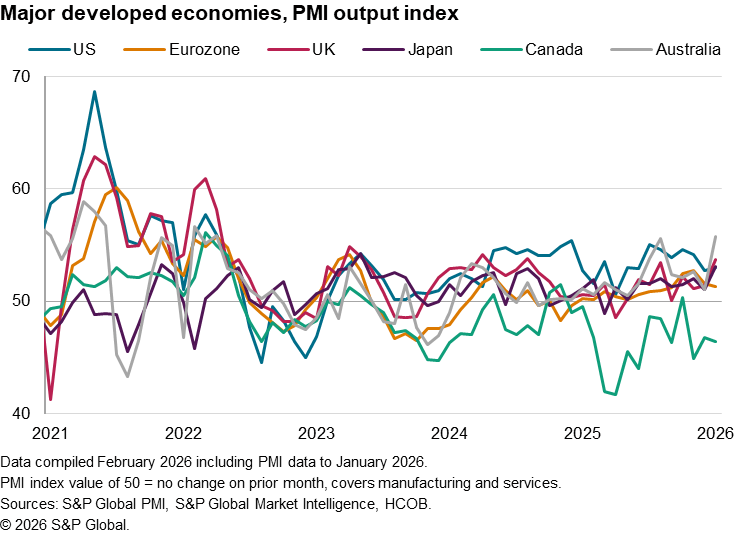

Although the overall pace of output expansion was little-changed in January, the composition of growth showed further signs of changing more markedly.

Having led the developed world expansion throughout the second half of last year, the US ceded the top spot in January. Growth across the developed economies was instead led by Australia, followed by the UK and Japan. Growth in these economies accelerated to the fastest rates since April 2022, August 2024 and May 2023 respectively. Growth also picked up, albeit more modestly, in the US, but was still the second-weakest seen over the past seven months.

Growth meanwhile slowed to only a modest pace in the eurozone - and to a four-month low - while Canada remained in contraction, where output has risen only once in the past 14 months.

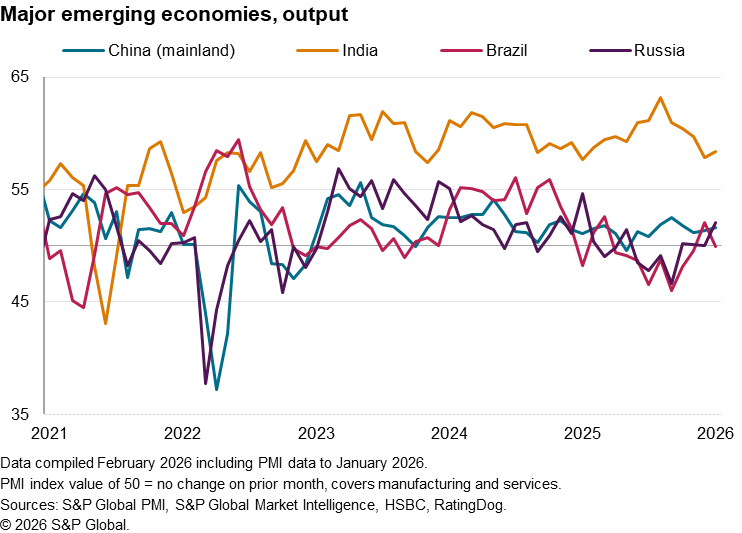

Emerging market growth gains momentum

Growth across the emerging markets edged higher, led once again by India but with mainland China and Russia both expanding at modest rates, helping offset a stalling of growth in Brazil. However, both Brazil and Russia have seen more promising signs of economic recovery after the low points seen for both economies back in September, and China's growth rate edged up to a three-month high.

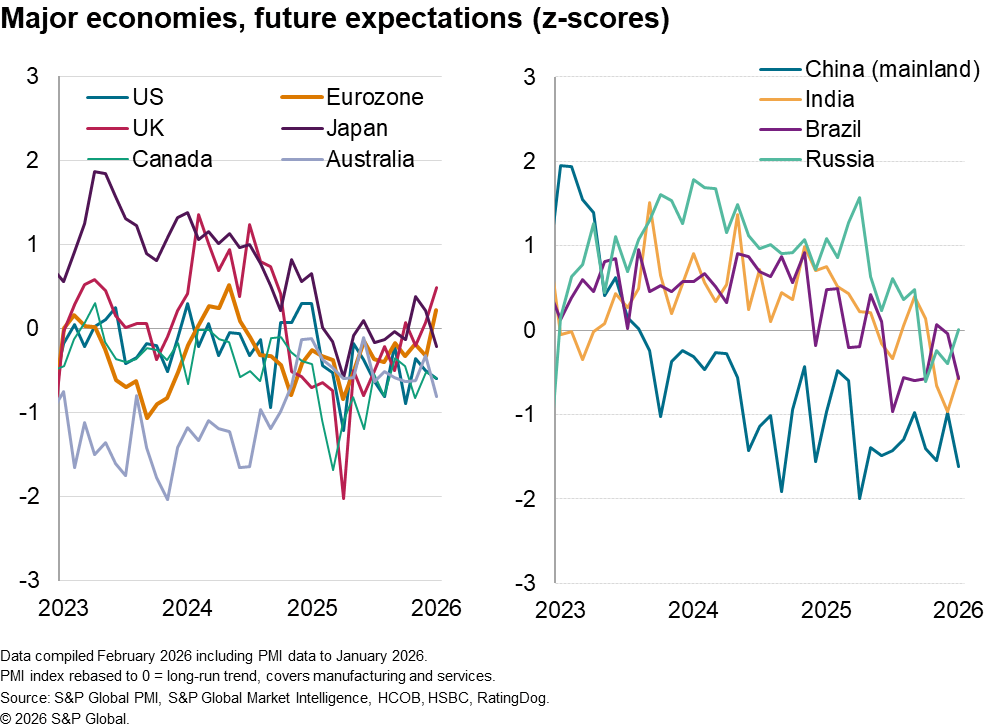

Europe bucks outlook gloom

In terms of business expectations about output in the year ahead, sentiment remains especially downbeat relative to its long-run average in mainland China and also remains below par in both India and Brazil, often reflecting concerns across emerging markets about the economic environment and international trade outlooks, particularly in the face of US tariff policy.

In the major developed markets, there was a notable divergence, with output expectations rising above long-run averages in both the UK and the eurozone, where sentiment struck 16- and 20-month highs respectively. In contrast, falling confidence in Australia and Japan hints that companies are not expecting January's robust performances to persist, and US confidence fell further below its long run average to point to a further potential cooling of its expansion in the coming months.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-lifts-higher-at-start-of-2026-feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-lifts-higher-at-start-of-2026-feb26.html&text=Global+PMI+lifts+higher+at+start+of+2026+amid+shifting+regional+growth+trends++++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-lifts-higher-at-start-of-2026-feb26.html","enabled":true},{"name":"email","url":"?subject=Global PMI lifts higher at start of 2026 amid shifting regional growth trends | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-lifts-higher-at-start-of-2026-feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+lifts+higher+at+start+of+2026+amid+shifting+regional+growth+trends++++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-lifts-higher-at-start-of-2026-feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}