Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2025

Global PMI growth driven by surging demand for financial services and technology

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - signalled a fourth successive month of accelerating business activity in August, with two industries in particular standing out as driving the latest expansion.

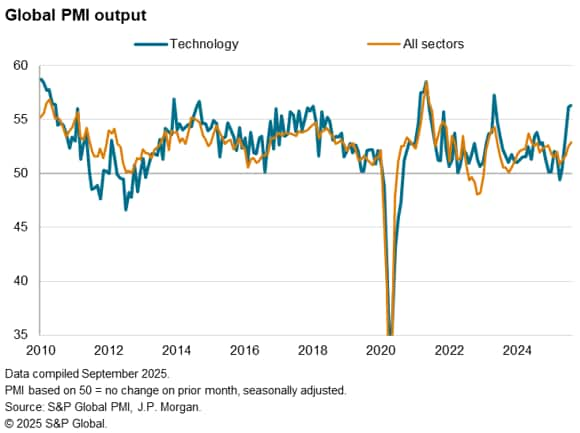

Financial services reported a rate of expansion not beaten over the past four years, while technology companies reported the largest jump in output for over two years. However, the tech boom was not matched by strong growth in other capex-bellwether sectors, suggesting that weak business confidence is retraining broader business investment spending.

Global PMI climbs to 14-month high

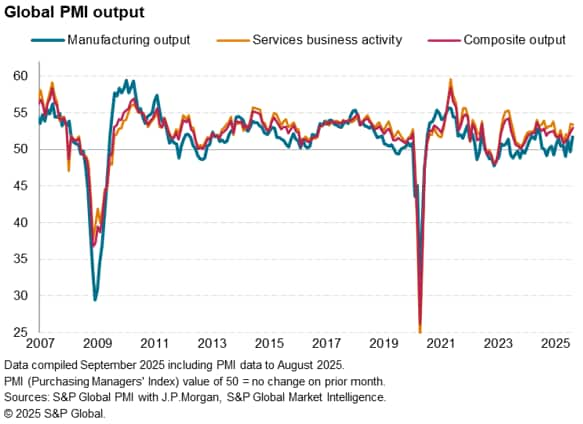

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity growth continued to recover from the low seen back in April, accelerating for a fourth successive month in August to register the fastest expansion since June of last year.

As seen throughout much of the post-COVID period, the global expansion continued to be led by the service sector, which grew at a slightly reduced - but still solid - pace. The past two months have seen the strongest back-to-back expansions of global services output seen so far this year. However, the upturn was also buoyed by a revival of manufacturing output, which more than made up for a marginal decline back in July. The August increase in factory output was the largest recorded for 14 months, and one of the best performances seen since the pandemic.

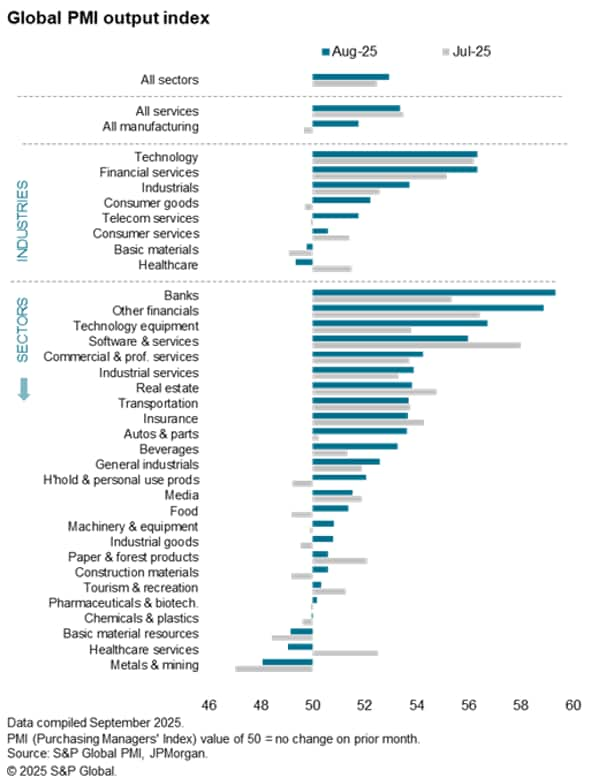

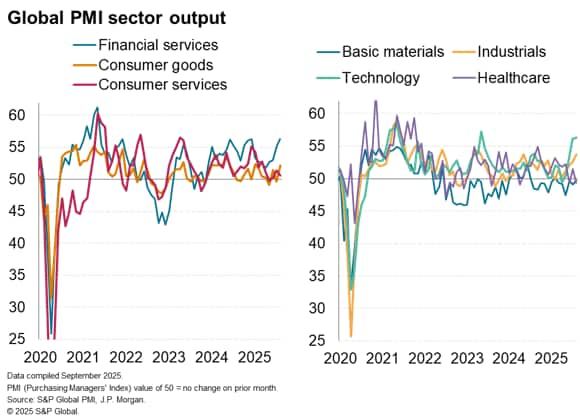

Digging deeper, it is clear that two industries provided a major impetus to global economic growth in August: financial services and technology. These were accompanied by a solid upturn in industrial services, plus a more modest upturn in consumer goods output. But basic materials and healthcare output both fell, and consumer services industries came close to stalling.

Financial services report growth at four-year high

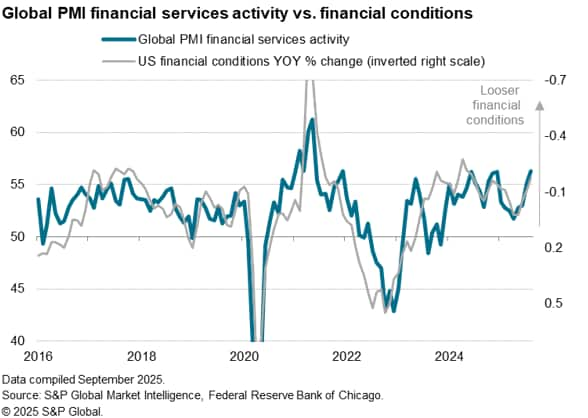

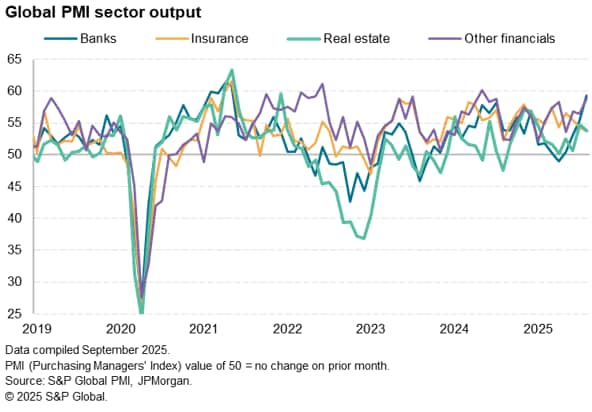

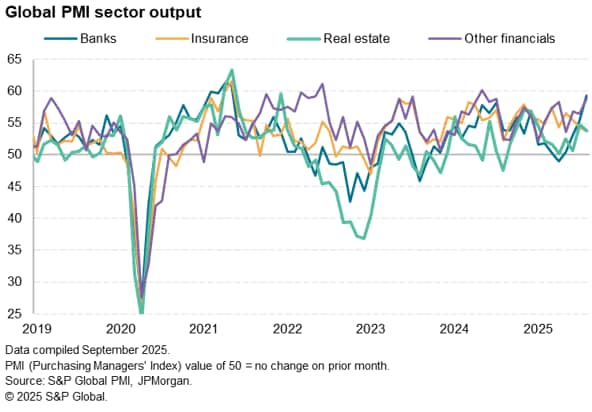

Financial services activity rose in August at a pace not beaten since May 2021. Rising demand for financial products was in turn widely linked to improved financial conditions, including lower borrowing costs in many economies as well as rising asset prices, notably including equity prices.

Especially strong financial services growth was recorded in the US, where the upturn was the steepest recorded so far this year (and one of the sharpest since the pandemic), though expansions were also seen in Europe and Asia.

Within financial services, banking reported the fastest growth, where activity showed the largest monthly jump since May 2021, followed by 'other financials' (which includes non-banking services such as investment funds, pension provides and financial advisers), where growth was the steepest for just over a year. These were in fact the two strongest growing of all 25-subsectors tracked by the global PMI in August.

While insurance and real estate reported reduced rates of expansions, both saw ongoing solid growth which was above the all-sector average in August.

Tech boom

Showing equal growth to the financial services sector in August was the technology sector, where companies reported the largest monthly rise in output since May 2023.

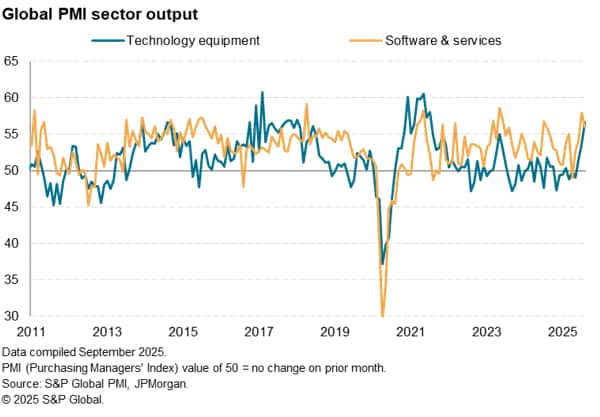

Within the technology sector, production of tech equipment led the expansion, recording the sharpest growth since July 2021 (during the pandemic surge in demand for tech goods). Although output of software & related IT services rose at a slower rate, July had seen one of the largest gains in the history of the survey.

No capex surge

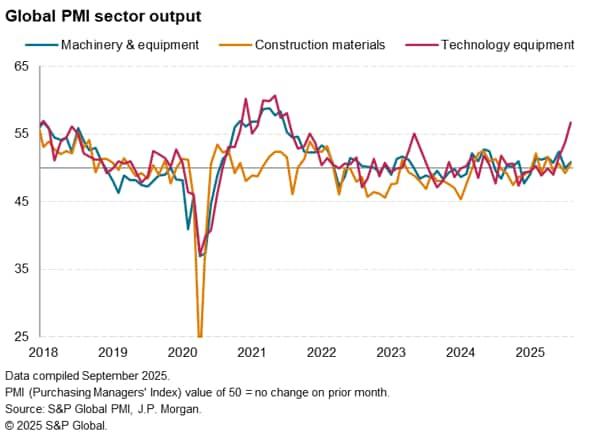

While the tech indicators from the PMI point to rising investment in IT, other investment-related indicators were less encouraging. Output of machinery and equipment rose only very modestly worldwide in August, as did output of construction materials, which collectively signal weak capex growth.

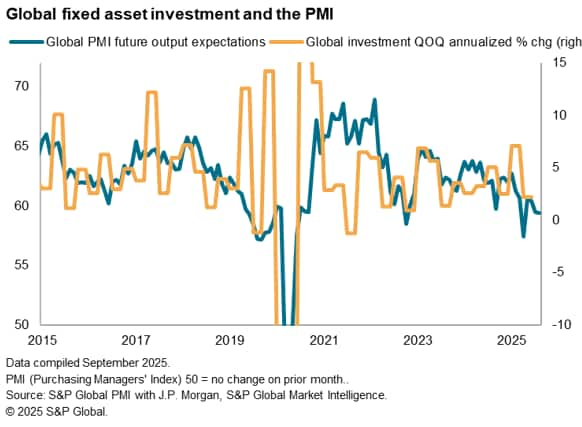

Such disappointing data on business investment spending outside of tech can be linked in part to low business optimism about prospects in the year ahead. Measured globally, business expectations are running at one of the lowest levels seen since the pandemic, according to August's PMI, albeit up from a recent low seen at the height of the US tariff uncertainty back in April.

Access the Global sector PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-growth-driven-by-surging-demand-for-financial-services-and-technology-sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-growth-driven-by-surging-demand-for-financial-services-and-technology-sep25.html&text=Global+PMI+growth+driven+by+surging+demand+for+financial+services+and+technology+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-growth-driven-by-surging-demand-for-financial-services-and-technology-sep25.html","enabled":true},{"name":"email","url":"?subject=Global PMI growth driven by surging demand for financial services and technology | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-growth-driven-by-surging-demand-for-financial-services-and-technology-sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+growth+driven+by+surging+demand+for+financial+services+and+technology+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-growth-driven-by-surging-demand-for-financial-services-and-technology-sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}