Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 10, 2021

Global jobs growth reaches highest since 2007 as demand surges

Global PMI employment index hits highest for 14 years as companies step up hiring amid surging demand and optimism about the year ahead

Job gains led by the developed world, notably the US and UK

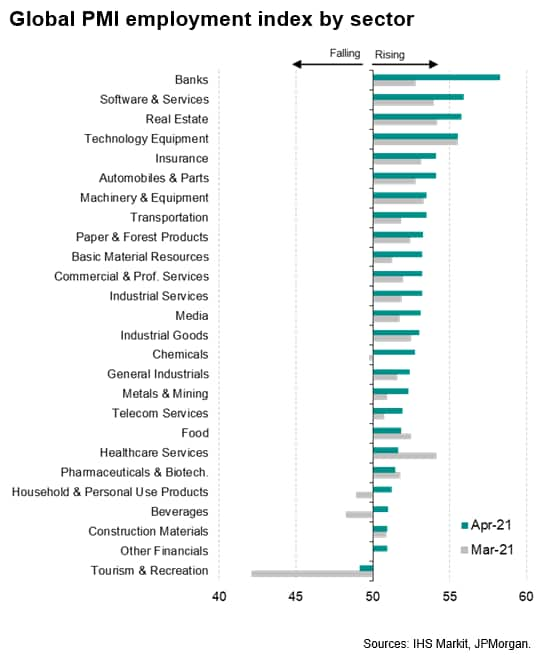

Banking reports fastest ever jobs growth, only tourism and recreation reports falling employment

Global business surveys indicated a marked upturn in hiring in April as companies boosted activity in line with resurgent demand for goods and services. As such, the data point to a substantial improvement in official labour market data in coming months.

Surging demand drives jobs boom

Global PMI data, compiled on behalf of JPMorgan by IHS Markit from its proprietary business surveys of over 28,000 companies in more than 40 countries, recorded the largest influx of new business into businesses since April 2010 at the start of the second quarter. Service providers reported the steepest increase in new orders since June 2014 while manufacturers reported the biggest gain since May 2010.

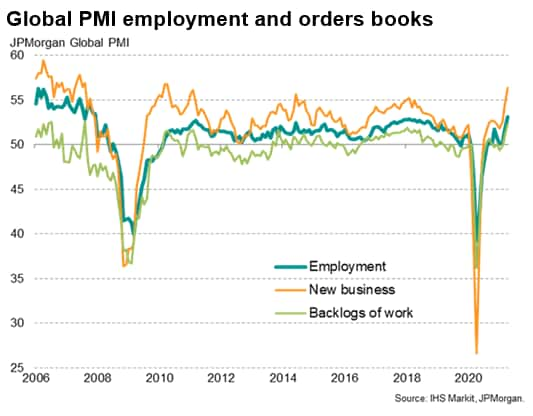

Companies often struggled to cope with these inflows of new orders, lacking the capacity to supply customers on time. Supply chains lengthened to an extent not previously seen in over two decades of survey history as demand exceeded supply. Consequently, backlogs of orders grew at a rate not seen since August 2007.

At the same time, companies' expectations for growth in the year ahead has been running at elevated levels in recent months as economies continue to reopen from coronavirus restrictions. Optimism is running at levels rarely exceeded over the past decade.

This combination of surging demand, rising backlogs of work and optimism about the year ahead encouraged firms to take on extra staff, with April seeing the largest monthly rise in global employment since December 2007.

Job gains led by the developed world

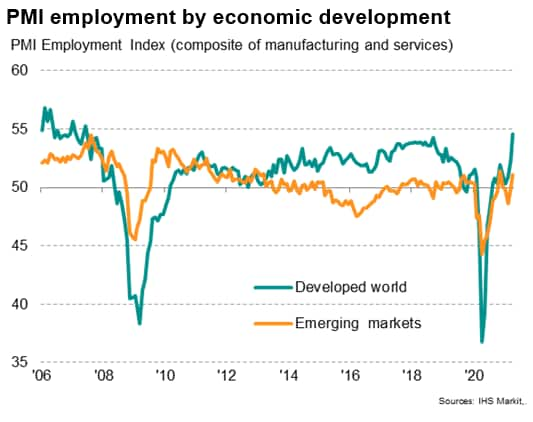

The upturn in employment was by no means universal, however, and heavily skewed towards the developed world.

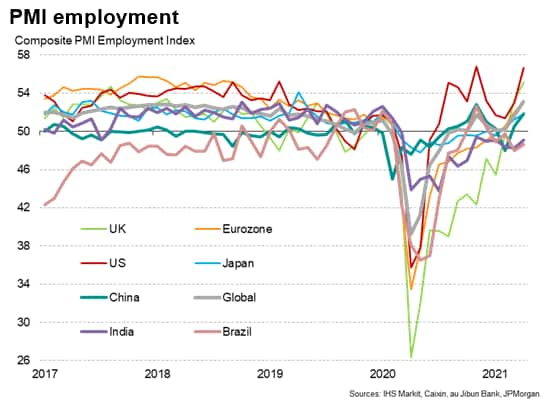

Among the major economies, the fastest rate of job creation was seen in the US, followed by the UK and eurozone, reflecting recent successes in controlling COVID-19 outbreaks and progress with vaccination programmes, especially in the US and UK.

In contrast, Brazil and India both reported lower employment levels during April, largely due to the further adverse economic impact from rising Covid case numbers and accompanying restrictions.

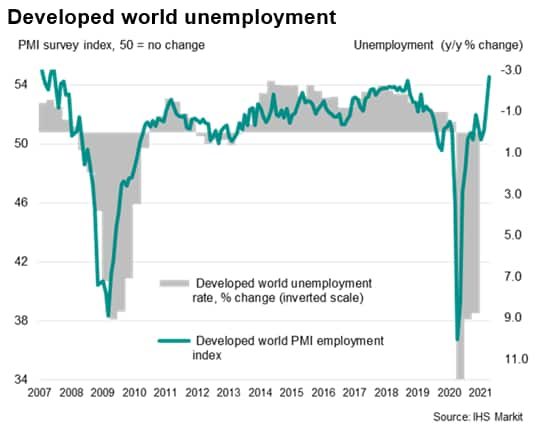

Certainly from a developed world perspective, the PMI numbers are encouraging. A strong correlation with historical labour market data suggests that the latest rise in the PMI survey employment index will soon translate into a marked fall in official unemployment (the PMI exhibits an 85% correlation with the annual change in unemployment, with the PMI acting with a lead of three months).

Sector data reveal banking as fastest growing job market

The worldwide job market improvement was driven by the service sector, which boosted payroll numbers to an extent not seen since 2007, though manufacturers also reported the largest payroll gain since February 2018.

Looking further into the sector detail, leading the upturn in April was the banking industry, which saw by far the largest monthly rise in employment ever recorded since comparable global data were available in 2009.

Only the tourism and recreation industry reported a decline in employment, and even here the monthly fall was smallest since the early days of the pandemic in February 2020.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-jobs-growth-reaches-highest-since-2007-as-demand-surges-May21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-jobs-growth-reaches-highest-since-2007-as-demand-surges-May21.html&text=Global+jobs+growth+reaches+highest+since+2007+as+demand+surges+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-jobs-growth-reaches-highest-since-2007-as-demand-surges-May21.html","enabled":true},{"name":"email","url":"?subject=Global jobs growth reaches highest since 2007 as demand surges | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-jobs-growth-reaches-highest-since-2007-as-demand-surges-May21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+jobs+growth+reaches+highest+since+2007+as+demand+surges+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-jobs-growth-reaches-highest-since-2007-as-demand-surges-May21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}